-

Millennial homebuyers are increasingly using savings from their primary paychecks to put money down on a home, according to Redfin.

April 29 -

Toronto, Montreal and Vancouver have seen the biggest net inflow of millennials in 12 years, a key reason demand for housing is expected to remain strong, despite spiraling costs, according to Royal Bank of Canada.

April 26 -

Millennials act differently than prior generations, including moving to second-tier markets to buy a home, and that is the opening for community lenders to reach this market.

April 22 Nations Lending Corp.

Nations Lending Corp. -

Ally Financial took a stake in Better Mortgage, just the latest in the growing trend of banks investing in mortgage fintech companies to enhance their digital lending offerings.

April 18 -

A slim majority of younger consumers showed an interest in using a voice assistant like Alexa in the mortgage process, according to PriceWaterhouseCoopers.

April 10 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Despite earning less, the share of single female homebuyers who recently made a house purchase doubled that of single men, according to the National Association of Realtors.

April 3 -

Despite slowing home price growth, nearly 75% of millennials make financial concessions to afford housing compared to 40% of older generations, according to CoreLogic.

April 2 -

Canada's housing agency will spend up to C$1.25 billion ($943 million) over three years to take equity positions in homes bought by first-time buyers, part of a plan by Justin Trudeau's government to make housing more affordable for the youngest voters.

March 20 -

From the desert of the Southwest to all across Florida, here's a look at the 12 housing markets deemed best for first-time home purchasers.

March 20 -

Millennials make up the largest cohort of homebuyers, but a quarter of them don't even know their credit score, which could be a call for mortgage lenders to help them prepare to enter the housing market.

March 13 -

Millennial homebuyers took advantage of a winter lull in interest rates, using the opportunity to refinance their loans, according to Ellie Mae.

March 6 -

While millennials comprise the largest cohort of homebuyers, the aging baby boomer generation has created 7.86 million more homeowners and 2.82 million renters age 60 and older — growth rates higher than any other demographic.

March 4 -

The U.S. homeownership rate rose to the highest level since 2014, led by a growing share of buyers in their mid-30s and early 40s.

February 28 -

With its latest round of funding, the mortgage fintech company will continue to build its digital platform, with a goal of reducing the complexities and costs of home buying.

February 21 -

From the gateway to the West to just below the Mason-Dixon Line, here's a look at the 12 housing markets with the highest percentage of homes affordable to millennial purchasers with median incomes.

February 12 -

The share of home shoppers planning on buying a house within a year tanked in the fourth quarter, and those who are searching blame affordability struggles for their setbacks, according to the National Association of Home Builders.

February 8 -

Millennials are unfazed by the short supply of starter homes in a competitive market based on the rising share of December's purchase mortgages, according to Ellie Mae.

February 8 -

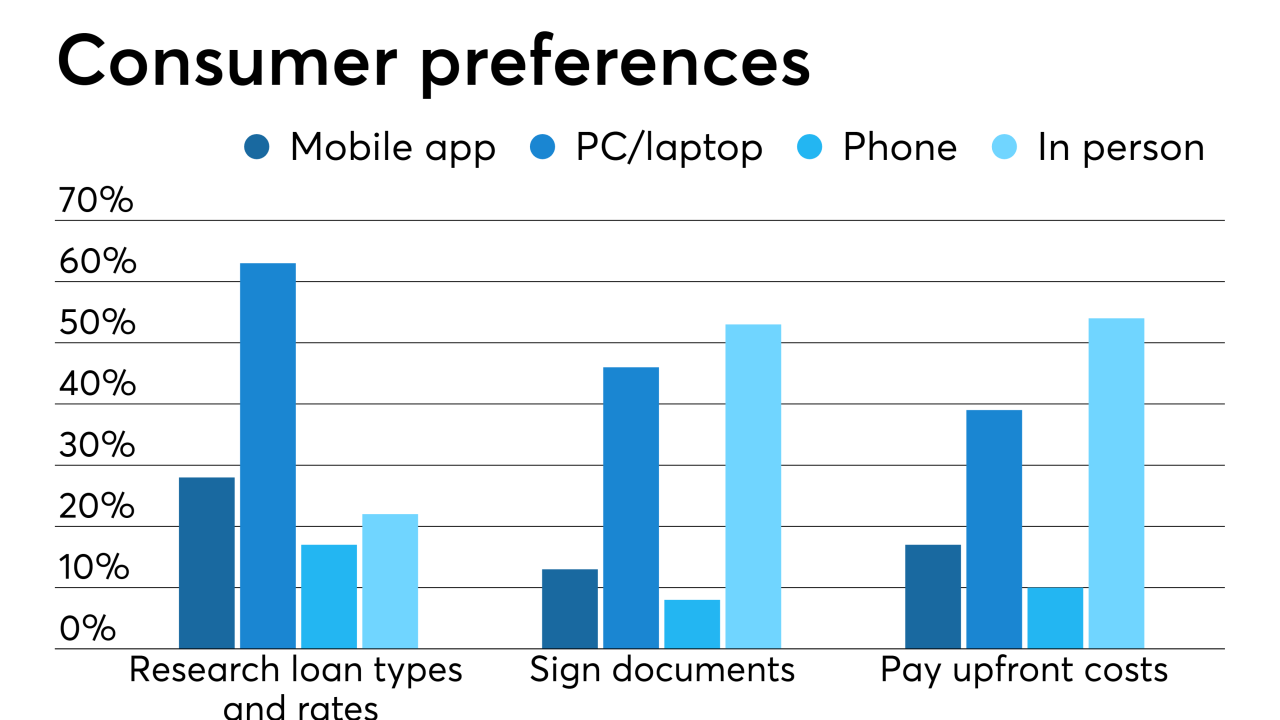

To bring millennials to the table, mortgage lenders must overcome misconceptions about the role technology plays in the way this generation buys homes.

February 6 Blend

Blend -

Bay Area adjacency without the exorbitant home prices make Sacramento, Calif., an attractive option for consumers, according to Redfin's migration report.

January 30