-

Covius Holdings plans to buy several businesses from Chronos Solutions that support mortgage servicing and origination processes, including three delivery platforms that will increase the breadth of its technology offerings.

June 4 -

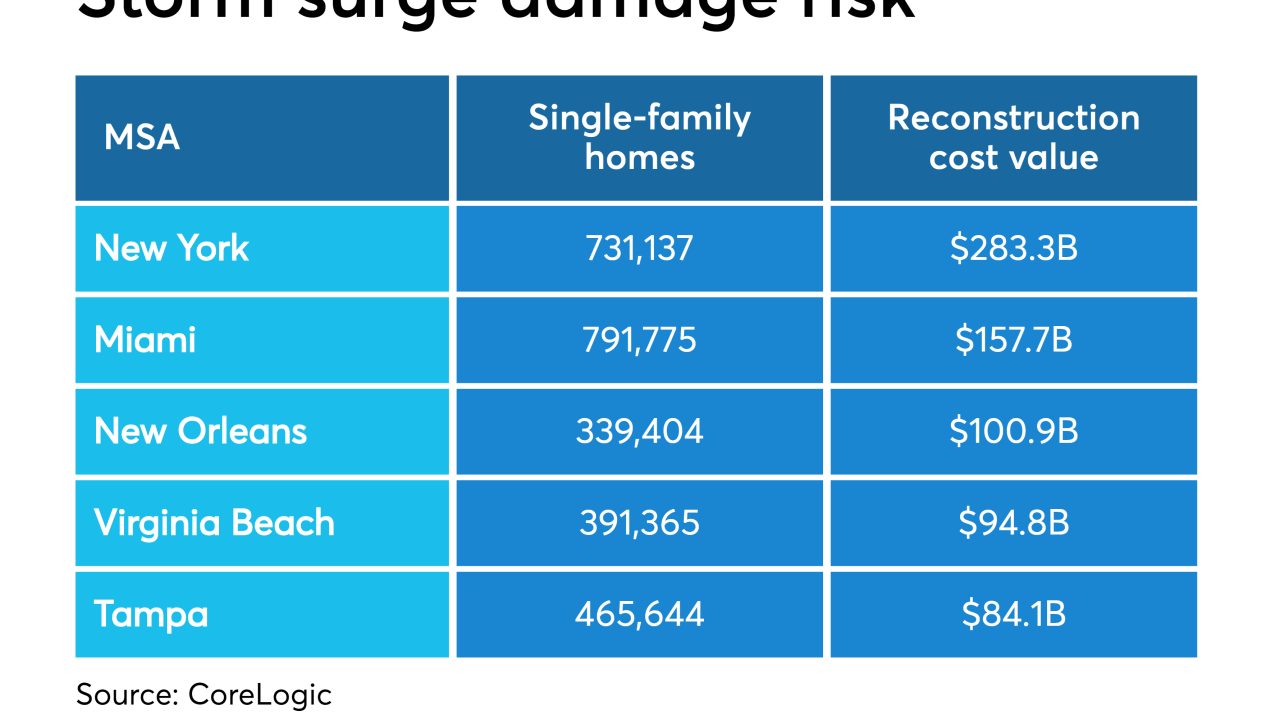

In the worst-case scenario, $1.8 trillion in reconstruction costs could result from coastal storms in 2019, even as hurricane experts predict a near-normal year for this season, according to CoreLogic.

June 3 -

Investors shouldn't overreact to the first-quarter shift in private mortgage insurer market share, said the CEO of the company that benefited most from the change.

May 31 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

First-time homebuyers face growing competition from out-of-state investors and corporate landlords looking to capitalize on Boise's increasing rents.

May 29 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

The distressed mortgage market continues to dry up, with delinquencies shriveling to a record low rate and foreclosure filings dropping annually for 10 consecutive months.

May 21 -

One of the hardest financial parts of buying a new home is coming up with the initial down payment on the mortgage loan.

May 20 -

The rise in home prices in North Texas has pushed home foreclosure rates to some of the lowest levels ever recorded.

May 20 -

Generation X is in its prime earning years, but the financial profiles of those renting are distinctly different from those who own a house, according to LendingTree.

May 20 -

Mortgage activity plunged before the start of the year, but subprime originations dropped the least, according to TransUnion. Despite dwindling volume, borrower delinquency rates hit historic lows in the first quarter.

May 16 -

Americans continued to take on debt in the first quarter, though new mortgage borrowing slowed to the weakest level since late 2014, according to a Federal Reserve Bank of New York report.

May 14 -

Strong levels of employment and continued economic expansion drove February's mortgage delinquencies and foreclosures to 20-year lows, according to CoreLogic.

May 14 -

Even though mortgage delinquencies increased on a quarter-to-quarter basis, strong overall metrics mitigate any concerns regarding future loan performance, according to the Mortgage Bankers Association.

May 14 -

As home price appreciation levels off, the amount of underwater loans rose in the first quarter while equity-rich properties continued adding value, according to Attom Data Solutions.

May 9 -

Payoffs of maturing office loans in securitizations may be delayed more often in the next few years if increasing inventory constrains occupancy and rent growth, according to Morningstar.

May 8 -

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29 -

Plenty of homeowners succumbed to foreclosure when the housing bubble burst, but the effects on Hispanic and black communities in particular were heightened, with many still suffering, according to Zillow.

April 25 -

Mortgage prepayments came gushing in at the start of the spring home buying season as delinquencies also improved, according to Black Knight.

April 23