-

Foreclosure activity is down nationwide from a year ago, but certain local housing markets are telling a different story.

December 5 -

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5 -

Private mortgage insurers are moving away from traditional rate cards in favor of more granular risk-based pricing to make their products more competitive and efficient for lenders.

November 26 -

Fannie Mae completed 10 traditional and front-end credit risk insurance transactions during 2018, sharing $2.6 billion of risk, including $192 million in its final deal of the year.

November 15 -

Excellent credit quality and strong performance of post-housing-crisis originations resulted in a steep decline in foreclosure starts in September, according to Black Knight.

November 5 -

Housing policies are helping the number of vacant foreclosure homes drop, which could also mean homebuyers have been taking advantage of these properties as inventory continues to be constrained, according to Attom Data Solutions.

October 30 -

Growing home prices plus rising interest rates are putting a damper on mortgage lending, which pushes the market to seek out less qualified borrowers and increases the risk of fraud.

October 29 Mark Migdal & Hayden

Mark Migdal & Hayden -

After falling to its lowest level in over 12 years, servicers expected September's surge in delinquencies following the damage of Hurricane Florence, according to Black Knight.

October 24 -

Providing borrowers with an incentive to create financial reserves after closing is a better tool to prevent mortgage loan defaults than measures taken at underwriting, a JPMorgan Chase Institute study declared.

October 18 -

MGIC Investment Corp.'s quarterly earnings were again driven by better-than-expected loss development, and those favorable results should be seen in the other private mortgage insurers' results as well, an industry analyst said.

October 17 -

Nomura Holding America and affiliates agreed to pay a $480 million penalty to resolve U.S. claims that the bank misled investors in marketing and selling mortgage-backed securities tied to the 2008 financial crisis, according to the Justice Department.

October 16 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Natural disasters are now the leading driver of lenders' foreclosure risk, with last year's hurricanes causing a rise in third-quarter filings in affected markets, according to Attom Data Solutions.

October 11 -

The mortgage delinquency rate fell to a 12-year low, with declines expected to continue as the unemployment rate stays down, according to CoreLogic.

October 9 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

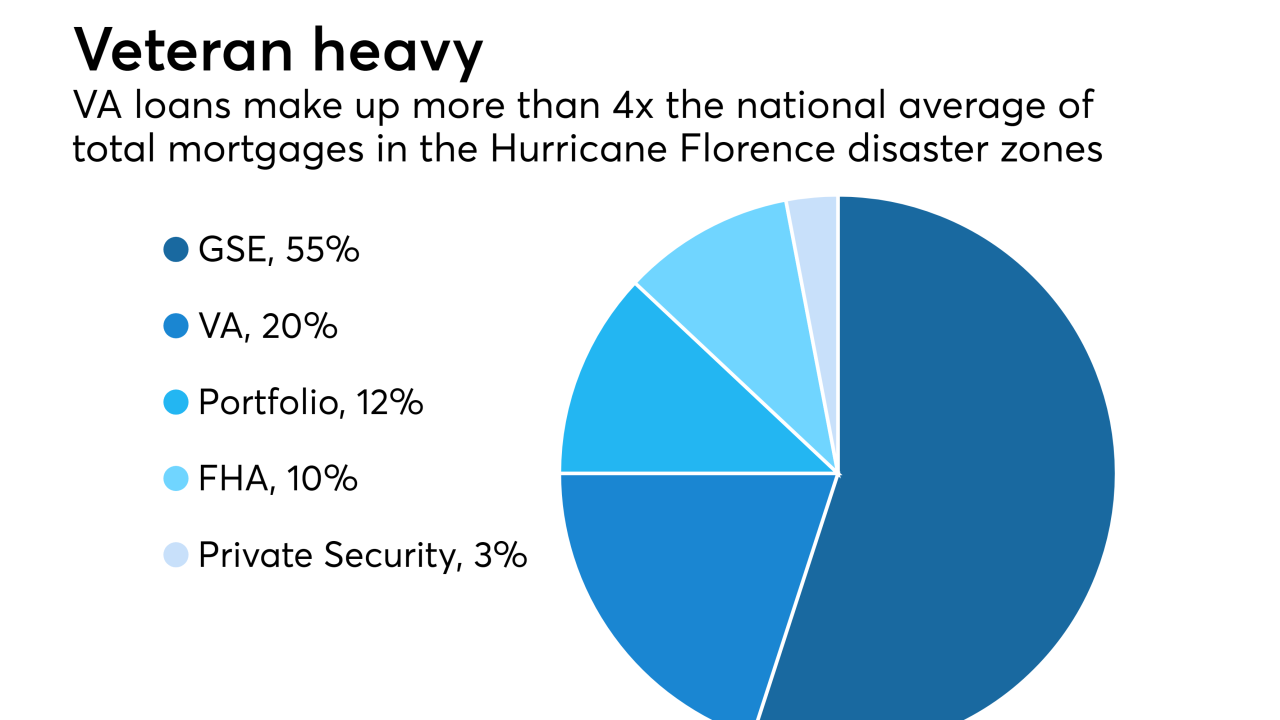

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

Foreclosure starts increased 9% in August compared with July, slightly higher than the historic norm between the two months, according to Attom Data Solutions.

September 27 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

Real estate crowdfund lender Sharestates introduced a new program to provide financing to investors to purchase nonperforming mortgage loans.

September 24 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24