-

Nomura Holding America and affiliates agreed to pay a $480 million penalty to resolve U.S. claims that the bank misled investors in marketing and selling mortgage-backed securities tied to the 2008 financial crisis, according to the Justice Department.

October 16 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Natural disasters are now the leading driver of lenders' foreclosure risk, with last year's hurricanes causing a rise in third-quarter filings in affected markets, according to Attom Data Solutions.

October 11 -

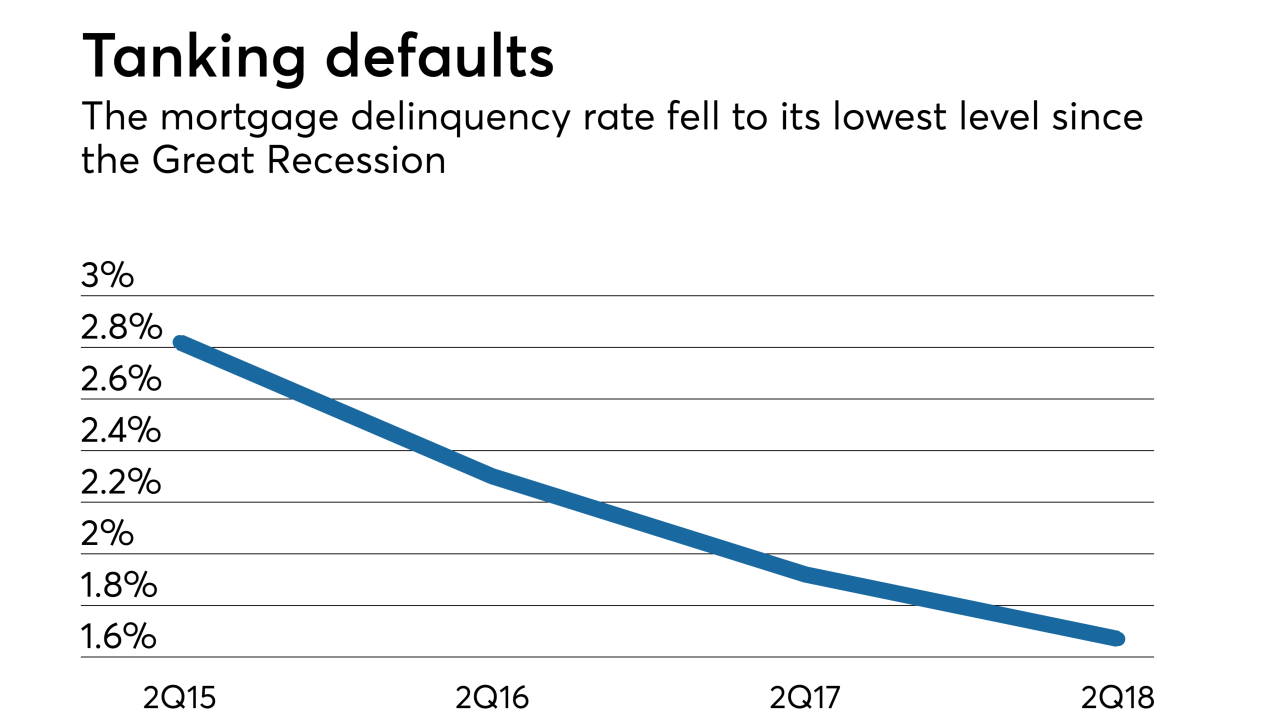

The mortgage delinquency rate fell to a 12-year low, with declines expected to continue as the unemployment rate stays down, according to CoreLogic.

October 9 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

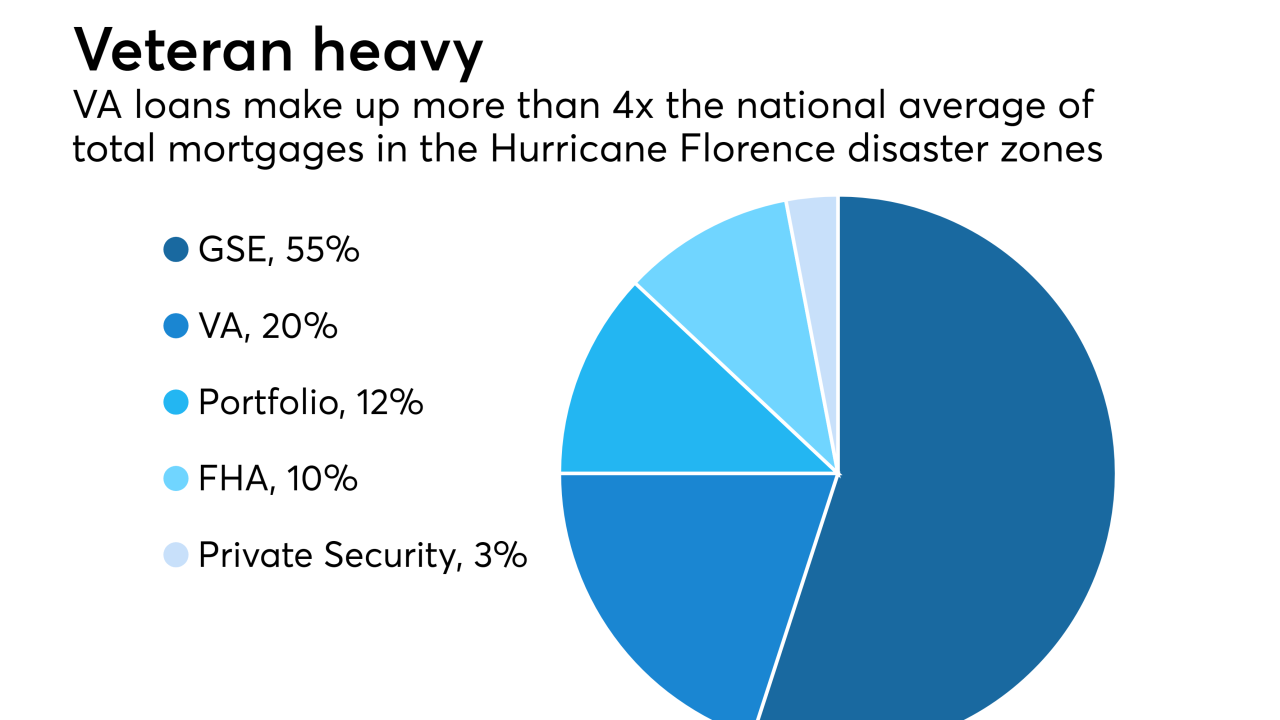

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

Foreclosure starts increased 9% in August compared with July, slightly higher than the historic norm between the two months, according to Attom Data Solutions.

September 27 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

Real estate crowdfund lender Sharestates introduced a new program to provide financing to investors to purchase nonperforming mortgage loans.

September 24 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

An AI-powered virtual assistant could be used in a variety of ways, including helping customers to prequalify for mortgages, easing compliance and detecting problems.

September 18 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

The number of Americans who are behind on their mortgage payments is the lowest in more than a decade.

September 12 -

The serious mortgage delinquency rate sank to its lowest June reading in 11 years, though recent natural disasters pose risk to loan performance in affected areas, according to CoreLogic.

September 11 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22 -

July's year-over-year increase in foreclosure starts for 44% of the nation's metro areas is a result of looser underwriting standards and a sign of future growth in defaults, said Attom Data Solutions.

August 21 -

Mortgage delinquency rates dropped on an annual basis, a sign of a strengthening economy, but could soon see a spike due to this year's wildfires, according to CoreLogic.

August 14 -

The risk of mortgage defaults reached its highest point since the second quarter of 2015 as lenders loosen credit, according to VantageScore.

August 10 -

The gap between equity-rich homeowners and mortgage borrowers who are seriously underwater narrowed in the second quarter, highlighting the uneven nature of the housing market's recovery since the Great Recession.

August 9