-

Defaults on first-lien mortgages fell 5 basis points in May from the previous month, dropping to their lowest level in a year, according to the S&P/Experian Consumer Credit Default Index.

June 20 -

Fannie Mae chose three winning bidders for its 10th nonperforming loan sale, which consisted of 3,400 loans with an unpaid principal balance of $581 million.

June 9 -

The share of mortgaged properties underwater is inching down toward 6% but in certain areas like Las Vegas the percentage is more than twice as high, according to CoreLogic.

June 9 -

Fay Servicing will pay $1.15 million in borrower restitution and possible disgorgement to settle CFPB allegations that it engaged in so-called foreclosure dual tracking and failed to keep borrowers informed about loss mitigation efforts.

June 7 -

Lower credit scores for mortgages refinanced in the first quarter are likely to lead to increased defaults of these loans, said Black Knight Financial Services.

June 5 -

DLJ Mortgage Capital, a subsidiary of Credit Suisse, is securitizing $91 million of loans insured by the Federal Housing Administration that were once delinquent but are now making timely payments.

May 30 -

Maryland Gov. Larry Hogan has signed a bill that will expedite foreclosures of vacant and abandoned properties this fall.

May 26 -

The loan comes due next month for a marquee office building in Stamford, Conn., but recent developments raise questions about the payoff of the debt.

May 26 -

Mortgage delinquencies increased 13% in April from March, but the calendar and seasonality were the primary reasons for the spike, said Black Knight Financial Services.

May 24 -

Fidelity National Financial has acquired Hudson & Marshall, a real estate auction company, and in a related move its ServiceLink subsidiary introduced a foreclosure auction product.

May 23 -

Down payment standards should be relaxed to just 10% to spur homebuying among millennials, Bank of America CEO Brian Moynihan said this week.

May 19 -

Reverse mortgage lender Financial Freedom has agreed to pay $89 million to settle False Claims Act allegations involving unearned interest payments it received from the Federal Housing Administration.

May 17 -

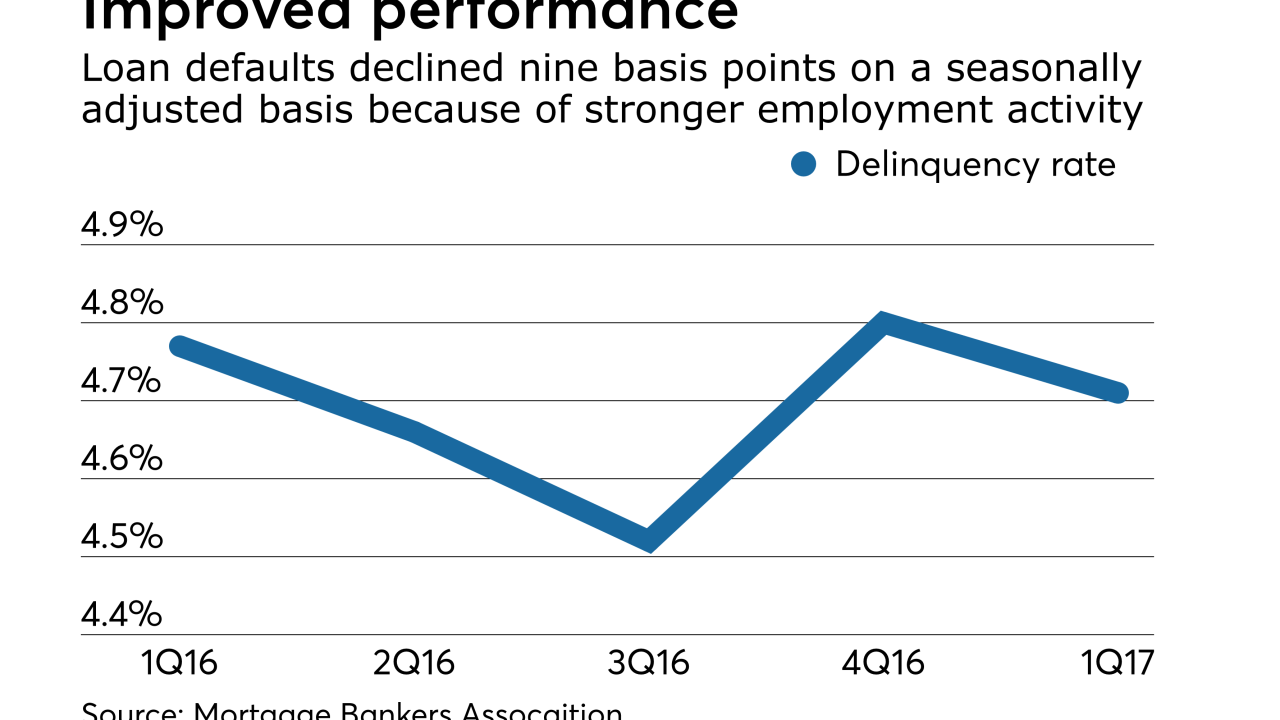

Lower defaults among government-guaranteed mortgage borrowers drove the overall delinquency rate down, the Mortgage Bankers Association said.

May 16 -

Foreclosure filings in April were at their lowest level since November 2005 at 77,049 properties, down 7% from March's 83,145 and 23% from April 2016.

May 11 -

The National Association of Realtors sent a letter to the Senate backing the temporary resumption of a tax break for homeowners with mortgage forgiveness.

May 11 -

The days of vacant, distressed homes covered in sheets of plywood appear numbered, as Fannie Mae and Freddie Mac move toward greater adoption of polycarbonate "clear boarding" to secure foreclosure properties.

May 9 -

U.S. securities regulators are investigating whether bonds backed by single-family rental homes and sold by Wall Street's biggest residential landlords used overvalued property assessments.

May 9 -

Fannie Mae said it expects to make a $2.8 billion dividend payment to the U.S. Treasury in June after reporting a first-quarter profit driven by a relatively stable mortgage market and a continued decline in delinquencies.

May 5 -

Seasonal factors contributed to an 89,000-unit increase in the number of seriously delinquent properties in the first quarter from the fourth quarter of 2016.

May 4 -

Late payments on loans securing commercial mortgage-backed securities rose in April as borrowers failed to make balloon payments on maturing loans.

May 3