-

Down payment standards should be relaxed to just 10% to spur homebuying among millennials, Bank of America CEO Brian Moynihan said this week.

May 19 -

Reverse mortgage lender Financial Freedom has agreed to pay $89 million to settle False Claims Act allegations involving unearned interest payments it received from the Federal Housing Administration.

May 17 -

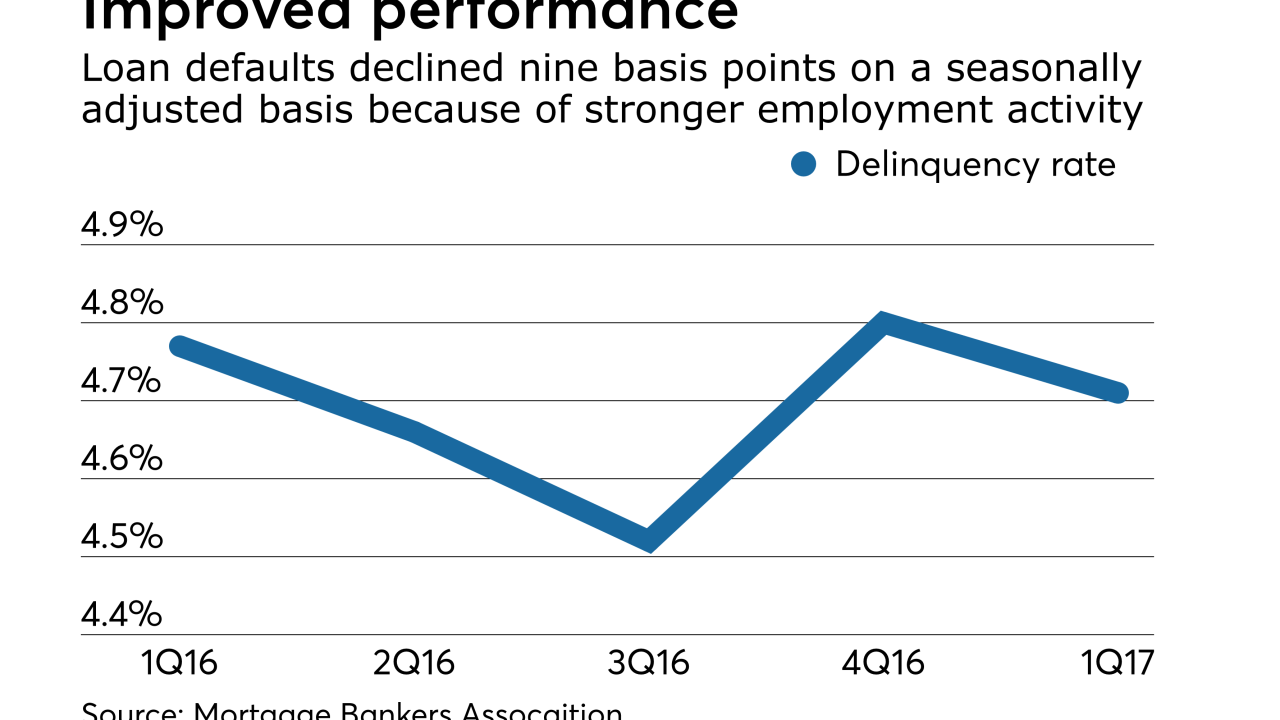

Lower defaults among government-guaranteed mortgage borrowers drove the overall delinquency rate down, the Mortgage Bankers Association said.

May 16 -

Foreclosure filings in April were at their lowest level since November 2005 at 77,049 properties, down 7% from March's 83,145 and 23% from April 2016.

May 11 -

The National Association of Realtors sent a letter to the Senate backing the temporary resumption of a tax break for homeowners with mortgage forgiveness.

May 11 -

The days of vacant, distressed homes covered in sheets of plywood appear numbered, as Fannie Mae and Freddie Mac move toward greater adoption of polycarbonate "clear boarding" to secure foreclosure properties.

May 9 -

U.S. securities regulators are investigating whether bonds backed by single-family rental homes and sold by Wall Street's biggest residential landlords used overvalued property assessments.

May 9 -

Fannie Mae said it expects to make a $2.8 billion dividend payment to the U.S. Treasury in June after reporting a first-quarter profit driven by a relatively stable mortgage market and a continued decline in delinquencies.

May 5 -

Seasonal factors contributed to an 89,000-unit increase in the number of seriously delinquent properties in the first quarter from the fourth quarter of 2016.

May 4 -

Late payments on loans securing commercial mortgage-backed securities rose in April as borrowers failed to make balloon payments on maturing loans.

May 3 -

Foreclosure activity continues to subside and most of the regulatory reforms created to protect distressed borrowers have been implemented. Yet mortgage servicers still haven't fully resolved the operational challenges facing their business.

April 28 -

Years after the worst of the housing crisis, states still dealing with high foreclosure activity are weighing laws to speed the process on vacant or abandoned properties.

April 28 -

National foreclosure activity is at an 11-year low, but some cities have yet to fully recover.

April 28 -

Bayview Asset Management is marketing another $183 million of bonds backed by reperforming mortgages acquired last year from CitiFinancial Credit Co.

April 28 -

Radian Group earned $76.5 million for the first quarter, up 16% from $66.2 million one year prior, helped by a 25% year-over-year rise in new insurance written.

April 27 -

Housing prices in the Near West Side, Logan Square and a handful of other popular areas north of downtown are now well above their pre-crash peaks, but most of the city and the suburbs are still clawing their way back from the depths of the devastating crash.

April 27 -

The struggling Pittsburgh Athletic Association in Oakland has paid $55,000 towards taxes it owes the county for the 7% drink tax, preventing a scheduled sheriff's sale Tuesday morning at the iconic Fifth Avenue social club.

April 25 -

Incenter Mortgage Advisors is brokering an $898 million alt-A bulk servicing rights portfolio for an undisclosed bank.

April 21 -

MGIC Investment Corp. had net income of $89.8 million for the first quarter, an increase of nearly 30% over the same period last year of $69.2 million.

April 20 -

DLJ Mortgage Capital Inc. was the winning bidder on all four pools in Fannie Mae's second reperforming loan sale.

April 13