-

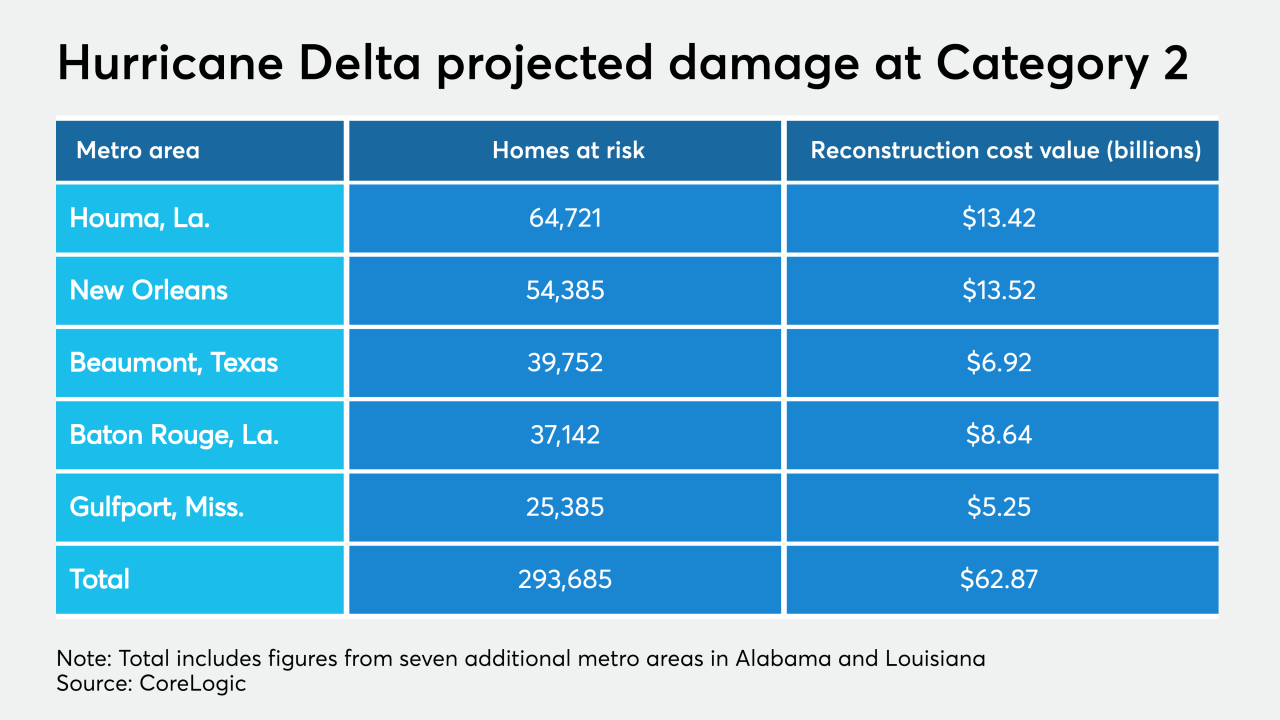

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

If the tally included loans with some form of payment relief, the rate would be close to 8%.

October 5 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

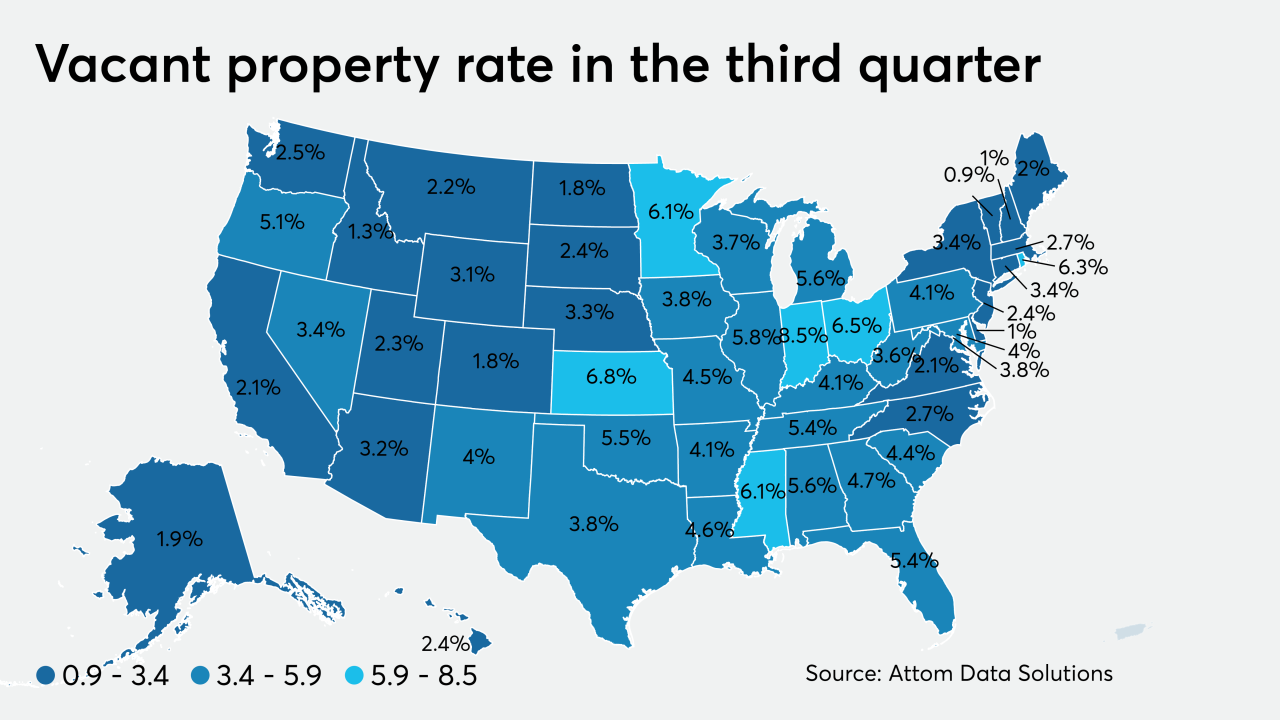

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

Late fees on loan payments and late-arriving documents tied to forbearance and loan forgiveness are just some examples of how delays caused by cutbacks at the U.S. Postal Service could affect lenders and their customers.

August 24 -

Travel restrictions have left hotels like Miami Beach's Fontainebleau struggling to repay their mortgage loans.

August 17 -

The city of Birmingham plans to set aside nearly $1 million in the 2021 budget to prop up the underperforming CrossPlex Village development in Five Points West, city officials said.

August 14 -

Late home payments increased in this community that hosts the Masters, according to a California-based real estate analytics firm.

August 13 -

Mortgage delinquency rates in May were even higher in some Texas markets.

August 12 -

Tenants at so-called Class C buildings paid 54% of total rents due in June by the middle of the month, according to a study by LeaseLock.

August 11 -

Ken Casey, a now-deceased Marin County, Calif., real estate developer, is being investigated by the Securities and Exchange Commission for fraud.

August 11 -

CUNA Mutual Group previously provided this service through a joint venture with PMI Mortgage Insurance but exited the business in 2014.

August 10 -

Rising equity levels lifted borrowers across the spectrum in the second quarter, according to Attom Data Solutions.

August 6 -

Insurance claims and claims expenses were 503% above 1Q and 1,075% over 2Q19.

August 6 -

The delinquent loan inventory more than doubled compared with the prior year.

August 5 -

The combined impact of coronavirus forbearance periods ending while low rates persist means large workloads for title insurers, appraisers and others.

July 31 -

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

July 30