-

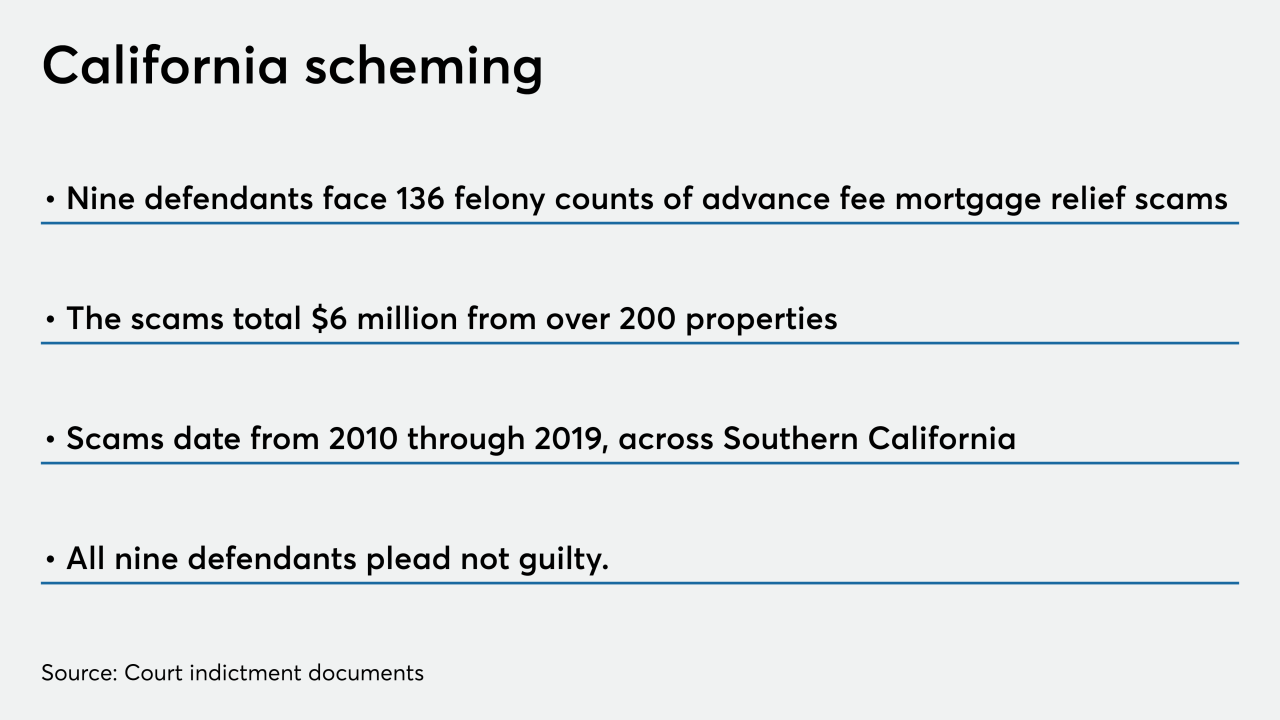

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

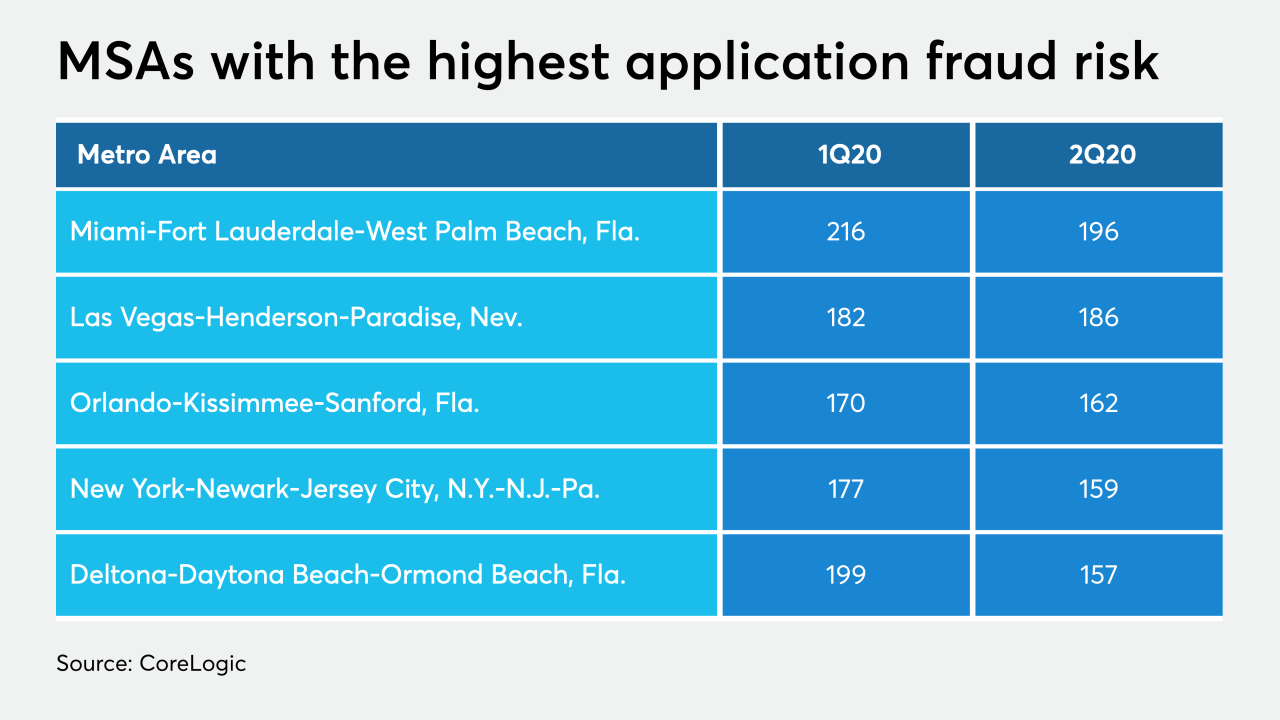

The third quarter’s higher share of purchase applications, which followed the refinance wave that crested in the second, caused a rise in mortgage application fraud risk, according to CoreLogic.

November 12 -

More than six months after the CARES Act became law, the two entities joined a host of industry organizations in launching the COVID Help for Home campaign to educate borrowers on the next steps in forbearance.

November 11 -

A Boulder, Colo., man was sentenced to five years in prison after using information obtained through legitimate transactions to create and sell almost $32 million of fraudulent loan packages to a bank.

November 11 -

Getting ahead of the next wave of mortgage fraud calls for rock-solid systems with several protective tools deployed at once. But that only goes so far without the proper employee preparation.

November 3 -

The scheme targeted distressed homeowners in the Filipino community, most of whom were nonnative English speakers, forcing some of them into bankruptcy and homelessness, according to law enforcement officials.

October 29 -

Mortgage application fraud risk dropped drastically from 2019 with the spike in refinances, but the fallout from the coronavirus means next year could come with more risk, according to CoreLogic.

October 28 -

Mortgage companies contended with an average of 1,316 fraud attempts per month in 2020, up from 1,280 in the previous year, according to the latest study by LexisNexis Risk Solutions.

October 16 -

Twelve people were charged in a scheme regarding the creation of 100 fraudulent mortgages in Georgia, according to the HUD inspector general.

September 24 -

Taylor, Bean & Whitaker's former chairman and CEO, Lee Farkas, led a $2.9 billion mortgage fraud scheme during the housing crash but was released early from prison due to susceptibility of COVID-19 transmission.

September 18 -

Lenders and vendors are starting to realize that there are both areas in which artificial intelligence can be used more broadly, and areas in which technology’s role should be limited.

September 16 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

A Quincy, Mass., real estate broker pleaded not guilty to nine charges, including money laundering and forgery, for what prosecutors say is the theft of $800,000 from deposit checks.

August 28 -

The proprietors of the Lorraine Hotel in downtown Toledo have received multi-year prison sentences from a federal judge for orchestrating a $3.9 million fraudulent real-estate investment scheme, while a third person received probation.

August 12 -

Ken Casey, a now-deceased Marin County, Calif., real estate developer, is being investigated by the Securities and Exchange Commission for fraud.

August 11 -

A Dallas developer has admitted to paying bribes to a former city councilwoman in exchange for her lobbying efforts and votes to provide $650,000 in taxpayer money for his Fair Park apartment project.

August 10 -

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 28 ACES Risk Management Corp.

ACES Risk Management Corp. -

CoreLogic said more refinancings and fewer investor purchase mortgages drove its index down to a level last reached in the third quarter of 2010.

July 24 -

First American's Loan Application Defect Index is higher on a month-to-month basis for the first time since February 2019.

June 29