-

Lenders and vendors are starting to realize that there are both areas in which artificial intelligence can be used more broadly, and areas in which technology’s role should be limited.

September 16 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

A Quincy, Mass., real estate broker pleaded not guilty to nine charges, including money laundering and forgery, for what prosecutors say is the theft of $800,000 from deposit checks.

August 28 -

The proprietors of the Lorraine Hotel in downtown Toledo have received multi-year prison sentences from a federal judge for orchestrating a $3.9 million fraudulent real-estate investment scheme, while a third person received probation.

August 12 -

Ken Casey, a now-deceased Marin County, Calif., real estate developer, is being investigated by the Securities and Exchange Commission for fraud.

August 11 -

A Dallas developer has admitted to paying bribes to a former city councilwoman in exchange for her lobbying efforts and votes to provide $650,000 in taxpayer money for his Fair Park apartment project.

August 10 -

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 28 ACES Risk Management Corp.

ACES Risk Management Corp. -

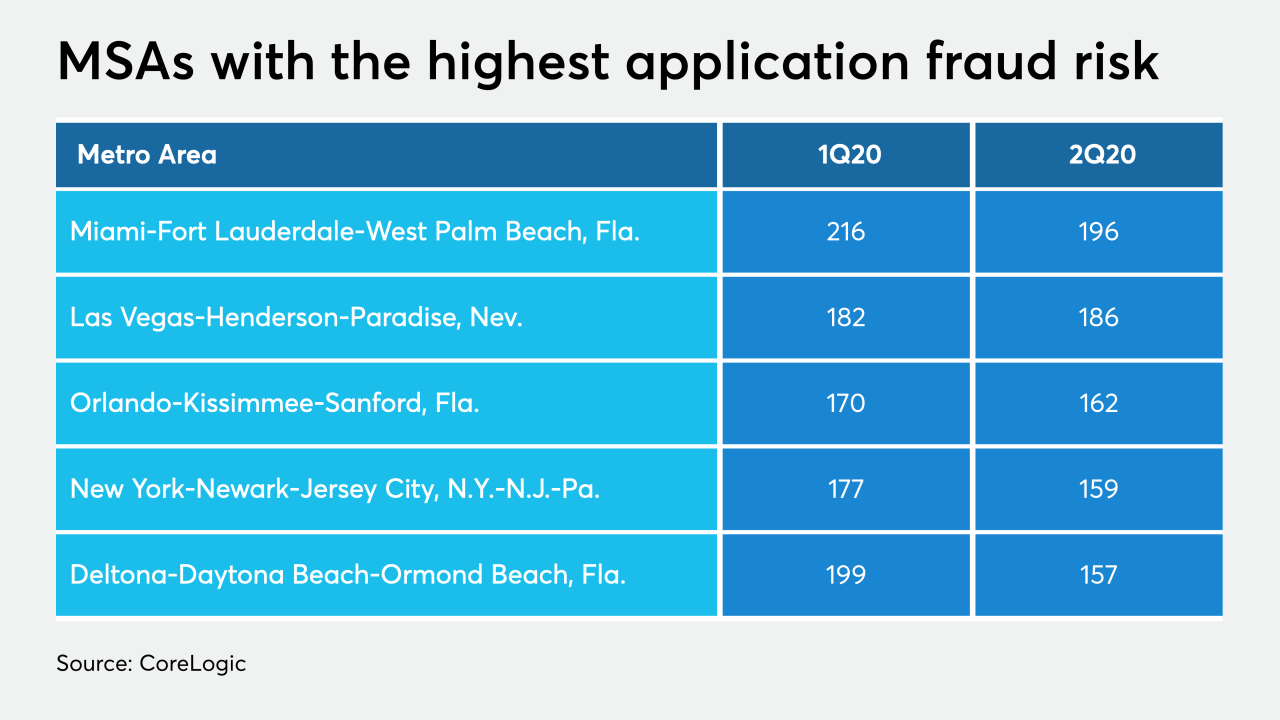

CoreLogic said more refinancings and fewer investor purchase mortgages drove its index down to a level last reached in the third quarter of 2010.

July 24 -

First American's Loan Application Defect Index is higher on a month-to-month basis for the first time since February 2019.

June 29 -

An Idaho court has ruled against a Treasure Valley resident for his role in a Ponzi scheme that bilked millions from real estate investors.

June 19 -

A federal grand jury indicted Ronald J. McCord, 69, of Oklahoma City, on charges of defrauding two banks, Fannie Mae, and others of millions of dollars, money laundering, and making a false statement to a financial institution, said Timothy J. Downing, U.S. attorney for the Western District of Oklahoma.

June 9 -

From what it takes to accommodate remote notarization to figuring out how to process an influx of forbearance requests through limited communication channels, here are five takeaways from coronavirus-related work restrictions.

May 13 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

A Rapid City, S.D., real estate agent must serve more than a year in prison and pay $124,645 in restitution after pleading guilty to tax evasion.

April 29 -

Fidelity National Financial, the nation's largest title insurance underwriter, added a new digital title insurance opening package to its WireSafe homebuyer and seller program.

March 2 -

Mortgage loan application defect risk is at the lowest point since First American started tracking this data, strictly as a function of the shift to a refinance market.

February 28 -

The pursuit of a dream home became a nightmare for apartment hunters who were scammed out of tens of thousands of dollars by an agent pushing a phony affordable housing scheme in Brooklyn, N.Y., authorities said.

February 19 -

Mary Doenlen couldn't tell a judge why she stole over $130,000 from her employer. She wasn't in financial straits. She has a daughter, a husband and a sickly father to tend to.

February 6 -

The prevention of wire fraud and cybercrime being perpetrated against the mortgage business is the latest passion for Regina Lowrie, longtime industry executive and the first woman to head up the Mortgage Bankers Association.

February 3