-

Treasuries plunged following news of the omicron variant, but subsequently reversed course.

December 2 -

The news comes just a day after the company restructured its merger with Aurora Acquisition to put $750 million in cash on its balance sheet right away.

December 1 -

The agency must raise its upper and lower levels in tandem with the new conforming loan limits by law.

December 1 -

The new terms, which still value the New York-based mortgage lender at $6.9 billion, include a $750 billion convertible bridge note.

December 1 -

Purchase applications increased for the fourth consecutive week, with the average loan amount at its highest since February.

December 1 -

The increase that followed in the pandemic’s wake is subsiding, and migration patterns are shifting, according to Redfin.

November 30 -

Higher sales commissions helped to drive production costs to their second-highest level since the Mortgage Bankers Association started its survey in 2008.

November 30 -

Though unlikely to derail a hot housing market, another surge in COVID-19 cases could cloud the outlook for economic growth, analysts said.

November 29 -

With home improvement spending up, more mortgage bankers are building out teams to capture the market.

November 26 -

While most agree texting is essential, are more traditional methods, like direct mail, still necessary post-COVID?

November 24 -

The company also let go of staff in its Chicago-area office, with one account estimating "hundreds of employees" lost their jobs there.

November 24 -

Sales of new U.S. homes edged up in October, reflecting stabilizing demand even as builders face supply-chain disruptions and buyers grapple with rising prices.

November 24 -

Purchase and refinance numbers both came in higher, while average loan sizes also recorded an uptick.

November 24 -

But in November, home buyer demand reached its highest level since RedFin began compiling the data in 2017.

November 23 -

However, capacity issues, the suspension of the government-sponsored enterprise purchase caps and higher conforming limits all could affect activity, KBRA said.

November 22 -

Once the news of the delayed sale was announced, the mortgage wholesaler opened trading on Nov. 17 at $1.17 per share higher than its previous close.

November 19 -

The likelihood that inflation remains above the Fed's 2% target contributed to the government-sponsored agency’s decision to dial back its 2022 outlook.

November 18 -

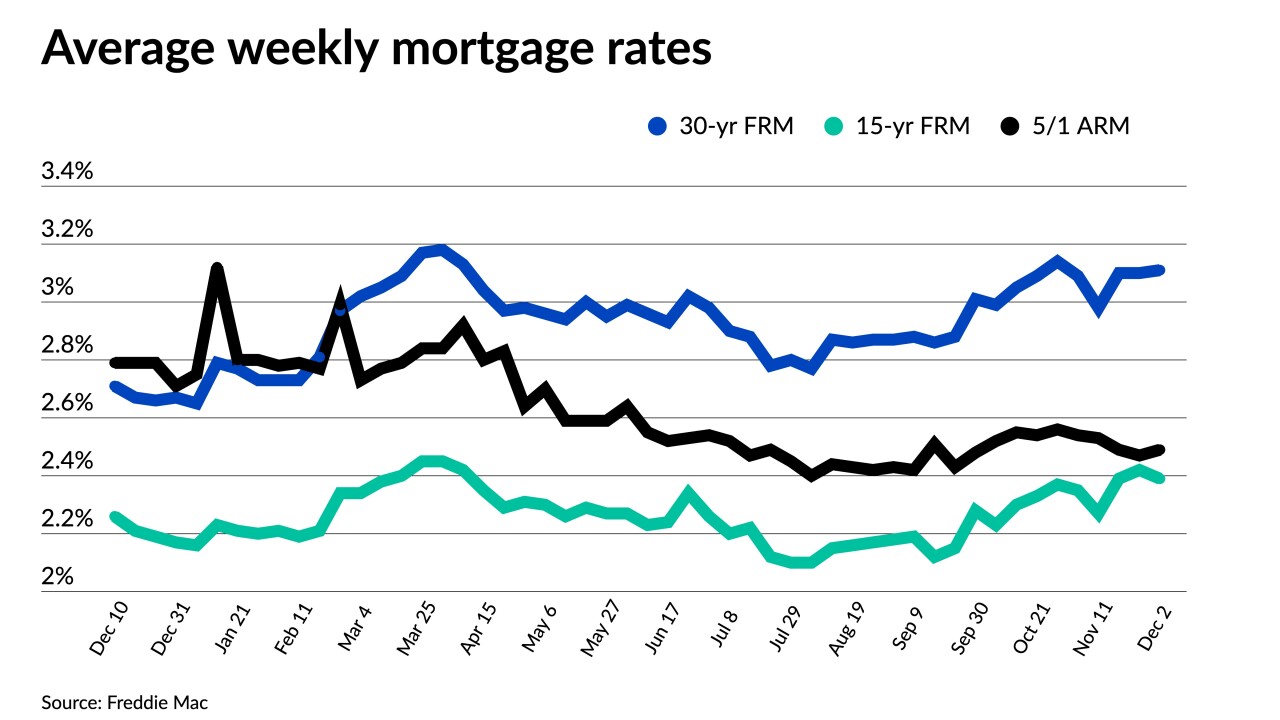

Fed moves, inflation and retail sales applied upward pressure, contributing to the increase.

November 18 -

Announcements from Paramount Residential Mortgage Group and LodeStar Software Solutions are early indications that the company’s aggressive investment in diversified business lines could pay off.

November 17 -

Borrowers who make at least a 10.01% down payment will not be required to obtain this form of credit enhancement, as these loans are not being sold to Fannie or Freddie.

November 17