-

The company is repositioning its secondary market sales of loans and servicing and implementing cost-cutting measures as the market normalizes.

November 4 -

But the Fed’s taper announcement has the industry planning for increases throughout 2022.

November 4 -

The partnership with Esusu, which the athlete’s venture capital firm invested in earlier this year, could help renters build credit histories, broadening their housing options, improving loan performance and incentivizing originations.

November 3 -

Applications related to Zillow Offers made up 70% of the mortgage lender's purchase business in the third quarter.

November 3 -

Purchases also dropped on a weekly basis, but still show signs of strong demand.

November 3 -

The transaction expands the investment management company’s portfolio of mortgage and real estate companies, which includes Selene, Deephaven and Progress Residential.

November 2 -

After closing its merger with Caliber, the company also hopes to pare down expenses by at least 10%.

November 2 -

But the number of prospects remains at the high end of its pre-pandemic range.

November 2 -

Values are predicted to increase by just a fraction of the rate they had in 2020, CoreLogic said.

November 2 -

The company, which was accused of cutting corners in originations by a former top executive, produced $32 billion in the third quarter and is guiding between $26 billion and $31 billion in the fourth.

November 1 -

When added to other staffing and acquisitions additions since year-end 2019, the mortgage services provider has more than tripled the company’s headcount.

November 1 -

Recent offerings come with lower age-eligibility requirements compared to traditional government-backed home equity conversion mortgages.

November 1 -

Rocket, already the nation's No. 1 lender, is looking to increase market share

October 29 -

If lenders build this technology, data suggests that borrowers will come walking out of the cornfields for it — but Congress needs to pass the SECURE Act first.

October 29 NotaryCam

NotaryCam -

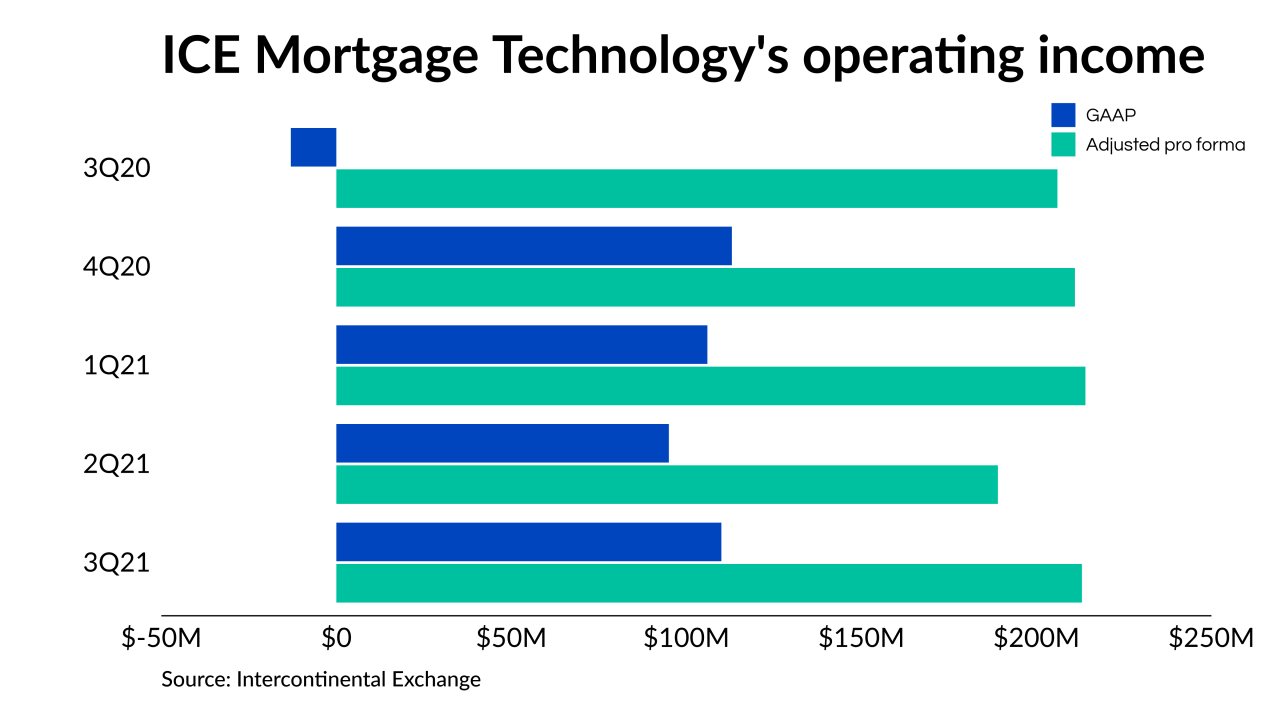

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

Application for loans to buy a home are a quarter more likely to contain misrepresentations than other loans in the market, CoreLogic said.

October 27 -

Purchases picked up, but refinances slowed for a fifth straight week, as rising interest rates took steam out of the market.

October 27 -

Rising debt-to-income ratios were behind almost a third of refinance rejections among those 65 and older, according to an analysis from the Urban Institute.

October 27 -

The MI Estimated Rate Quote application programming interface is built upon the JSON standard, used in server-to-mobile communications.

October 26 -

The average of 8% of total expenses that lenders put toward technology has a value, but it shows up more in broader organizational goals and productivity, the study found.

October 26