-

Also: Rocket announces expansion and Ginnie Mae extends comment period on nonbank capital plan

August 13 -

Originations of loans to the self-employed and other outside-the-box borrowers had better margins than mainstream mortgages in the second quarter, but rebuilding after the niche market’s temporary disruption last year generated significant expenses.

August 13 -

But median prices still rose 17% year-over-year, the company found.

August 13 -

Second quarter open orders were 37% higher than one year prior, while closed orders grew by 43%.

August 13 -

While the company's mortgage originations saw a 46% annual drop in gain on sale margin, it anticipates that annual volumes will exceed 2020 levels.

August 13 -

The Department of Housing and Urban Development and Federal Housing Finance Agency, which supervises Fannie Mae and Freddie Mac, formed a pact to share information and coordinate investigations of potential fair-lending violations.

August 12 -

The companies are investing more in government-insured equity withdrawal products for borrowers ages 62 and up, which offer higher returns.

August 12 -

Shrinking gain-on-sale margins also ate into earnings, with growth expected to slow for the rest of 2021.

August 12 -

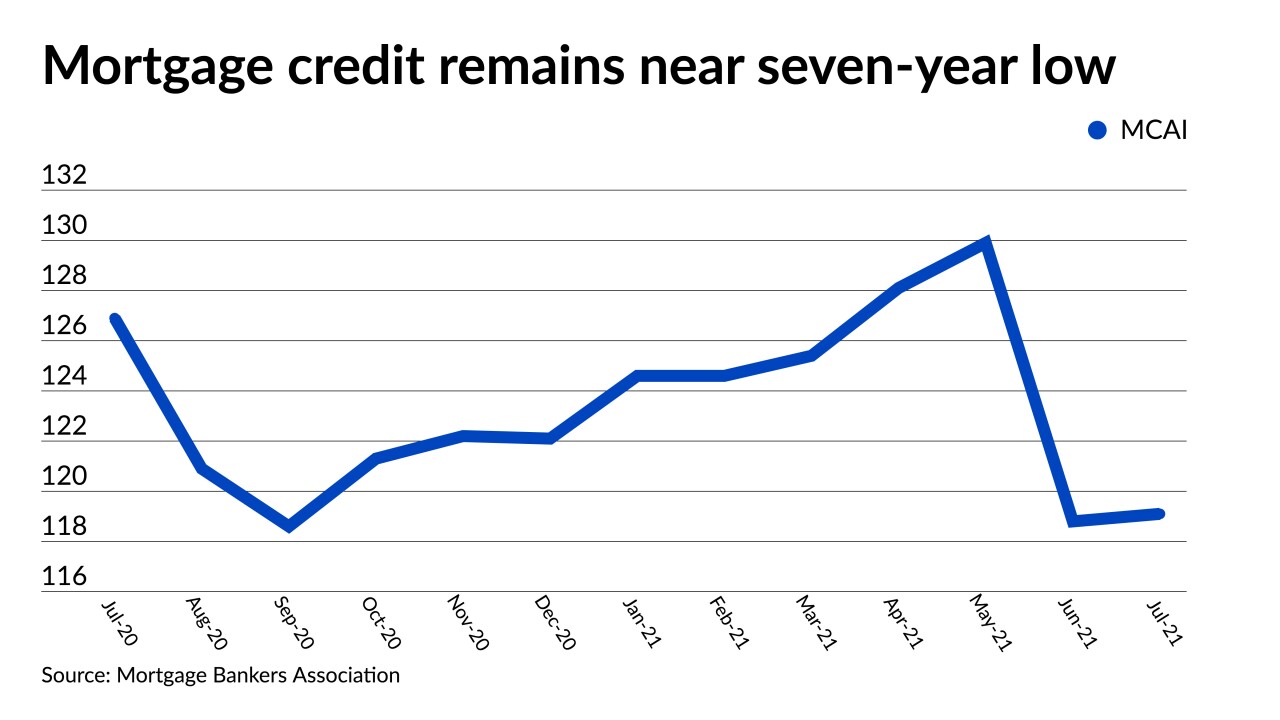

A jump in jumbo loan programs was countered by lenders dropping high loan-to-value conforming products.

August 12 -

The average was up from 2.77% last week and the highest since July 15, Freddie Mac said Thursday.

August 12 -

The median price of an existing single-family home jumped 23% from a year earlier to an all-time high of $357,900, the National Association of Realtors said in a report Thursday.

August 12 -

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10 -

Total investment property lending this year should be 31% above 2020's pandemic-affected activity.

August 10 -

Rocket Mortgage is offering $2,500 in lender credits to homebuyers purchasing a primary residence in Detroit, the mortgage giant of Rocket Companies Inc. said Monday.

August 10 -

An equal split of refinance and purchase rate locks occurred during July, helped by elimination of the adverse market fee, Black Knight said.

August 9 -

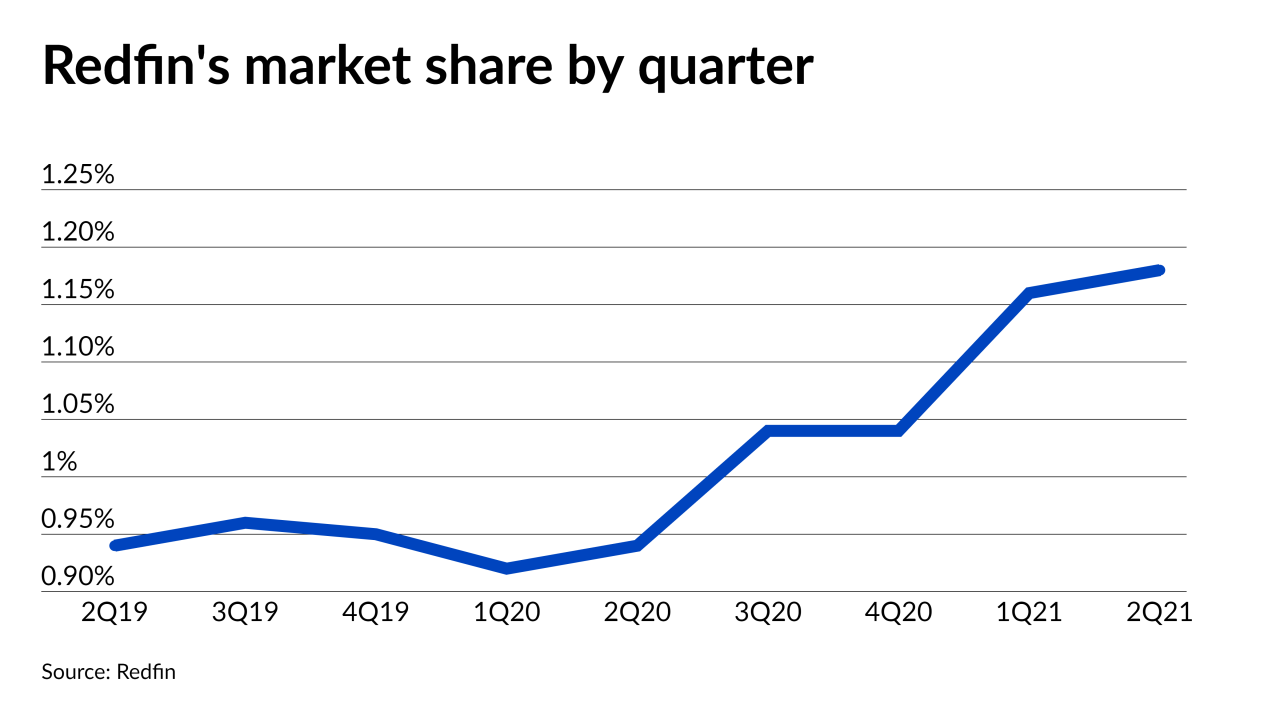

The real estate and mortgage company’s revenue beat estimates, but a deepening loss appears to have worried investors.

August 9 -

Also: Biden issues new eviction ban, CFPB clarifies rule on Juneteenth, Fannie Mae sets purchase mortgage acquisition record & more

August 6 -

Delinquency concerns continue to wane as the end of forbearances is not expected to lead to a massive wave of foreclosure activity.

August 6 -

Increased purchase lending and added pressure from Fannie Mae and Freddie Mac’s new loan limits should drive the likelihood of borrower misrepresentation.

August 6 -

The last-minute creation of the new federal holiday raised questions for lenders who must adhere to certain timelines regulated by the Consumer Financial Protection Bureau.

August 5