-

Borrowers with loans secured by personal rather than real property made up 46% of manufactured housing borrowers in 2019 and of this group, only 5% used the loans to refinance.

June 1 -

Housing experts and advocates disagree on the biggest factor in advancing the Black homeownership rate — and that's part of the problem.

June 1 -

Also: Cloudvirga merges with Stewart Information Services, home price growth makes loans risky and rates dip again.

May 28 -

The increasing regulatory costs may give the Biden administration reason to encourage the rollback of some zoning restrictions that hamper construction.

May 28 -

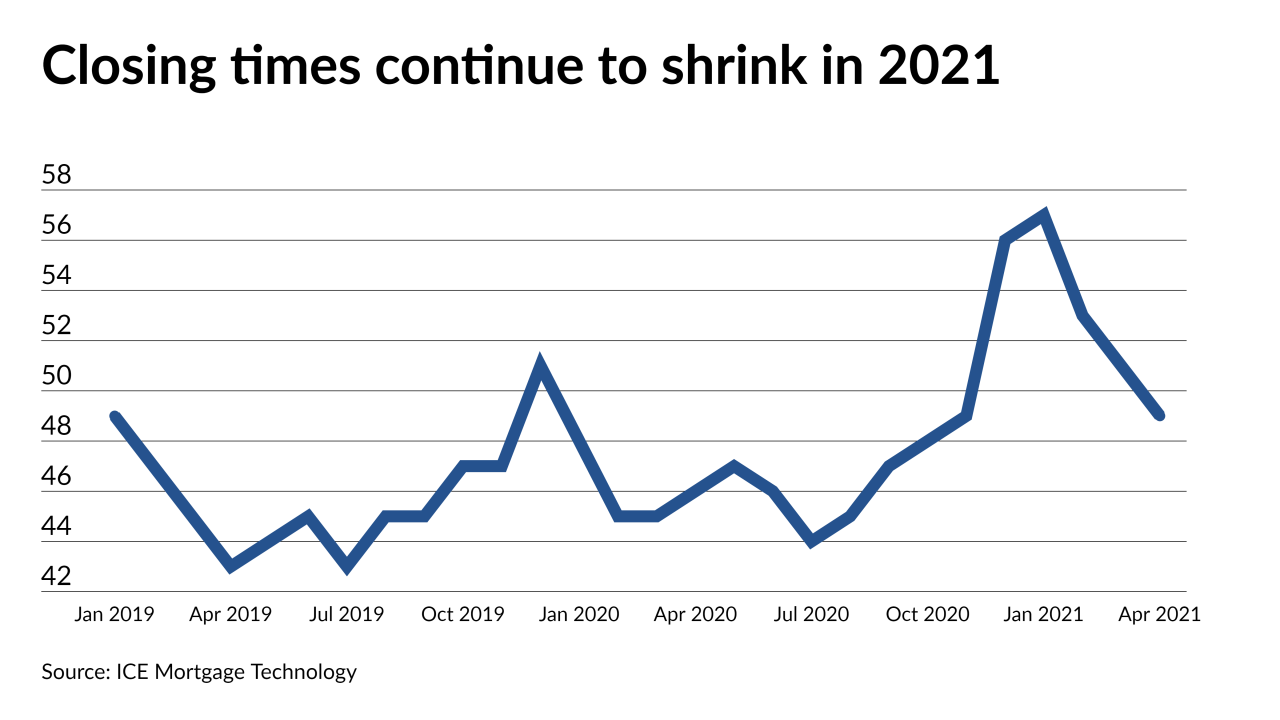

Average days to close dropped closer to pre-pandemic levels in April, according to ICE Mortgage Technology.

May 26 -

The company, on the cusp of going public via a merger, recently added Wells Fargo to its client roster.

May 26 -

While purchases increased, refinancing activity slowed considerably compared to its pace over the past month.

May 26 -

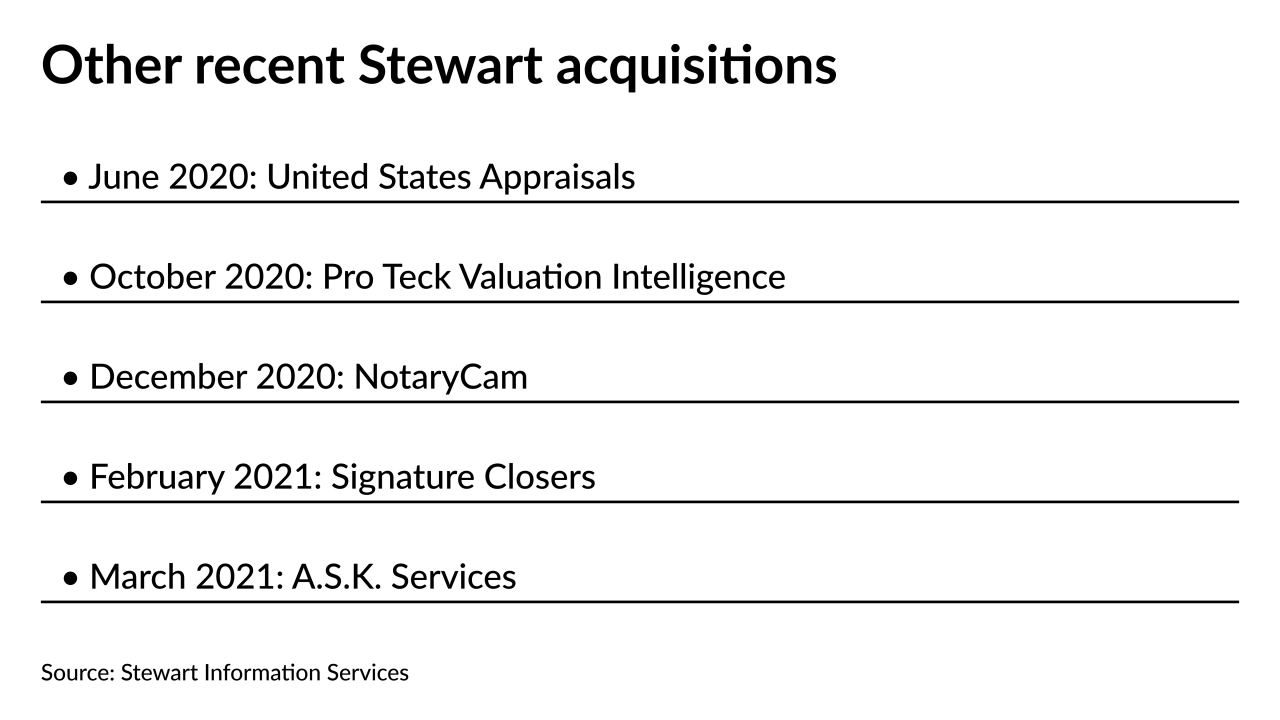

The deal adds to the burgeoning technology stack at the Houston-based title underwriter, which added NotaryCam in December.

May 25 -

Estimates suggest the government-sponsored enterprises did encourage increased lending to this demographic last year but ran into challenges related to the pandemic's impact and their own fluctuating business models.

May 25 - Home shortages spur record-breaking sales, Trump-era CRA rule paused and more of the week’s top news

Also: Delinquencies drop, rates rise and Senate debates flood insurance reform — again

May 21 -

The individuals allegedly defrauded Freddie Mac and CBRE Capital Markets by misrepresenting information used to refinance a small-balance loan.

May 20 -

Remote workers looking across the country for an inexpensive house have a wide net to cast, but a few important socioeconomic factors can narrow the search.

May 20 -

Groups active in low-income and rural housing expressed frustration that the post-pandemic resumption of long-term goal-setting didn’t do more to raise the bar.

May 19 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Mortgage lenders have much riding on a yearslong effort to overhaul a program that requires homeowners to hold policies in flood-prone areas. A congressional panel meeting to discuss the issue was once again split between lawmakers from storm-threatened states and those concerned about government costs.

May 18 -

With little transitional disruption, the bigger players on the non-agency side could gain a hefty share of non-owner-occupied mortgage volume as a result of Fannie Mae and Freddie Mac’s caps on such purchases, a KBRA analysis finds.

May 17 -

Mortgage activity fell across the board despite analysis that 14.5 million current qualified borrowers would benefit from a refinance, according to Black Knight.

May 17 -

Patience and vigilance are virtues when using certain social media for marketing, writes the CEO of Paragon Digital Marketing Group.

May 14 Paragon Digital Marketing Group

Paragon Digital Marketing Group -

The newly public company expects a 20% overall loss in adjusted earnings this year.

May 13