-

Mortgage applications decreased 4.3% from one week earlier although concerns over the global economy resulted in falling interest rates, according to the Mortgage Bankers Association.

May 1 -

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

Provenance Blockchain, recently spun off from Mike Cagney's Figure Technologies, says it can help lenders trim 70% of mortgage settlement expenses through speedier processing and paperwork reduction.

April 26 -

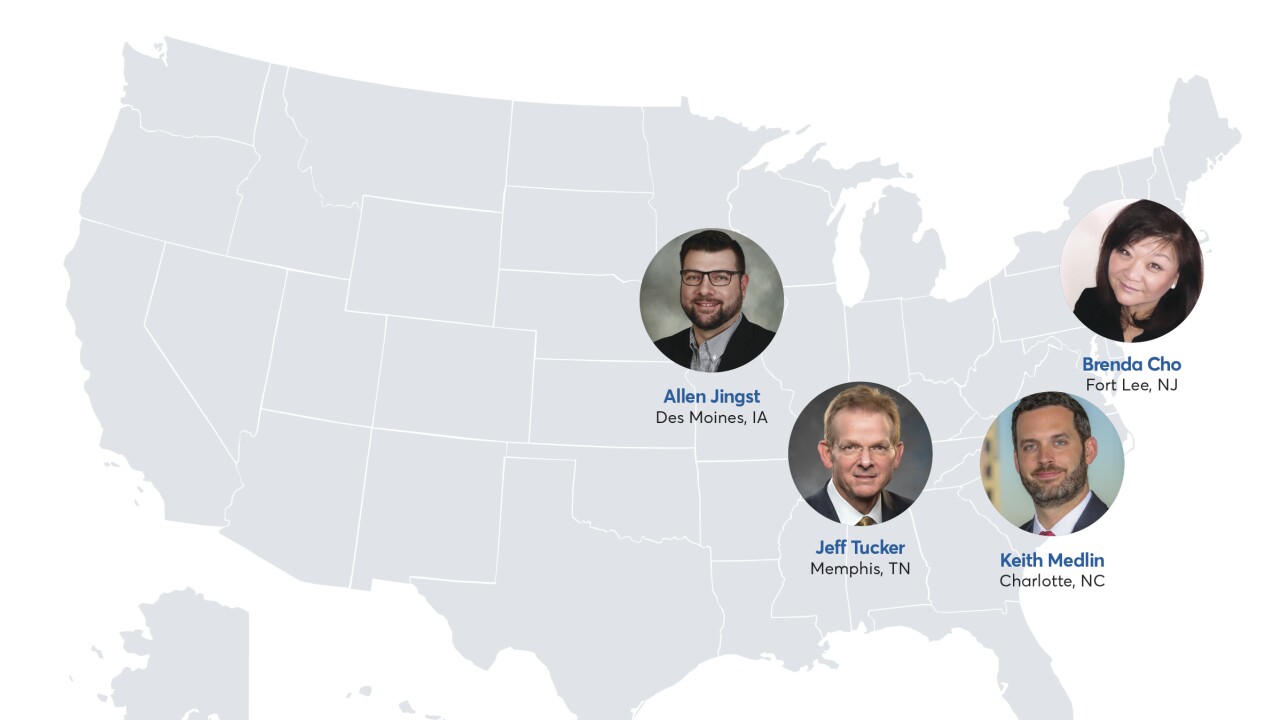

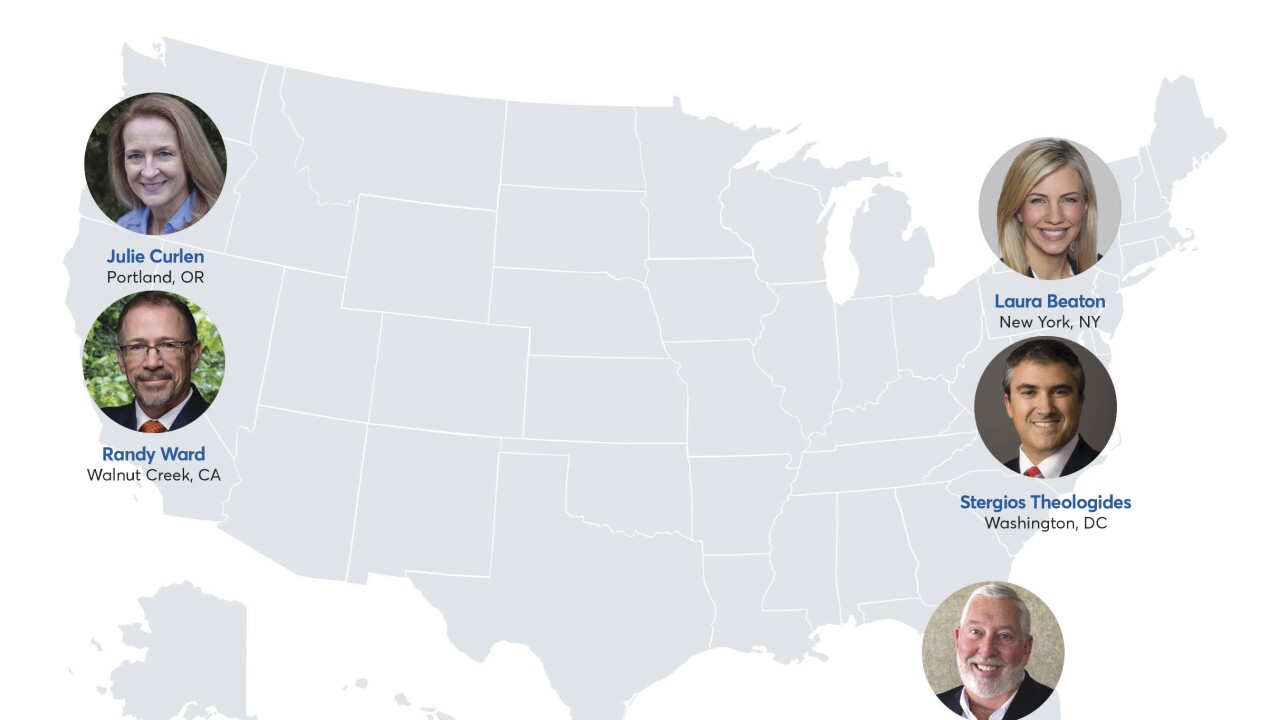

Mortgage industry hiring and new job appointments for the week ending April 26.

April 26 -

Quicken Loans parent company Rock Holdings is strengthening its investments in the Canadian market by acquiring a majority stake in Lendesk, a Vancouver-based mortgage fintech.

April 24 -

Customer-facing mortgage technology is not that big of a deal for Top Producers based in the South, even as a growing number of lenders are partnering with fintech firms to create a better user experience.

April 24 -

Purchase mortgage applications, which until now were unaffected by the recent rise in interest rates, fell by 4% on a seasonally adjusted basis from last week, according to the Mortgage Bankers Association.

April 24 -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23 -

Mortgage industry hiring and new job appointments for the week ending April 19.

April 19 -

Surging loan production expenses and low revenue killed profits in 2018 for loans originated by independent mortgage bankers and subsidiaries of chartered banks, according to the Mortgage Bankers Association.

April 17 -

Northeast mortgage originators relied heavily on referral relationships with attorneys and financial planners and less so with homebuilders last year, the Top Producers 2019 survey found.

April 17 -

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

April 17 -

Mortgage lenders have invested heavily in various digital tools that improve the consumer experience, but what they really need to focus on is artificial intelligence that will improve data quality.

April 16 LoanLogics

LoanLogics -

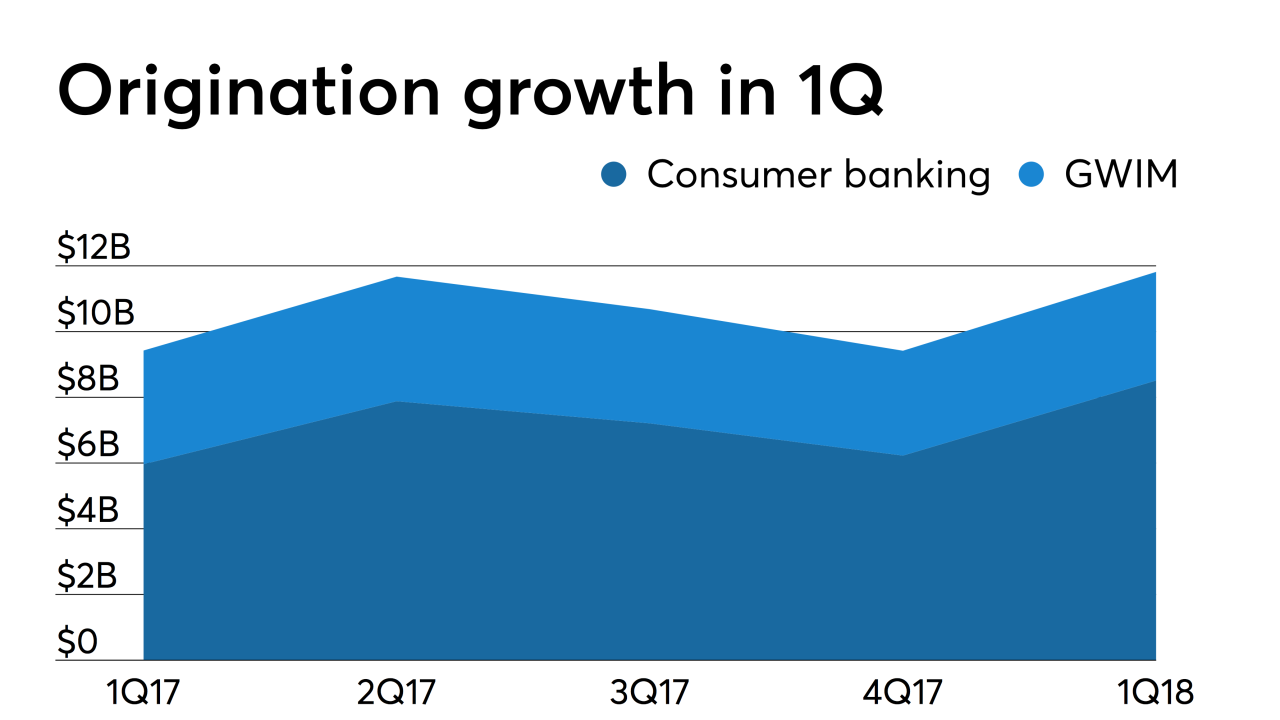

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

Citigroup's first quarter mortgage-related revenue increased compared with the fourth quarter — although down slightly from the same period last year — as its lending operations continued to contract.

April 15 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase could be an early sign of an improving industry.

April 12 -

Mortgage industry hiring and new job appointments for the week ending April 12.

April 12 -

Multifamily and commercial lenders had another banner year in 2018, when closed-loan originations rose 8% to a high of $574 billion.

April 11 -

Mortgage rates rose slightly for the second consecutive week, but should remain low for the foreseeable future, which will aid the purchase market, according to Freddie Mac.

April 11 -

The National Mortgage News 2019 Top Producers countdown takes a look at the top 50 loan officers by number of units originated.

April 10