-

Foreclosure filings were reported on more than 360,000 properties in the United States last year, up 14% from 2025 and 3% from 2023, according to Attom.

January 15 -

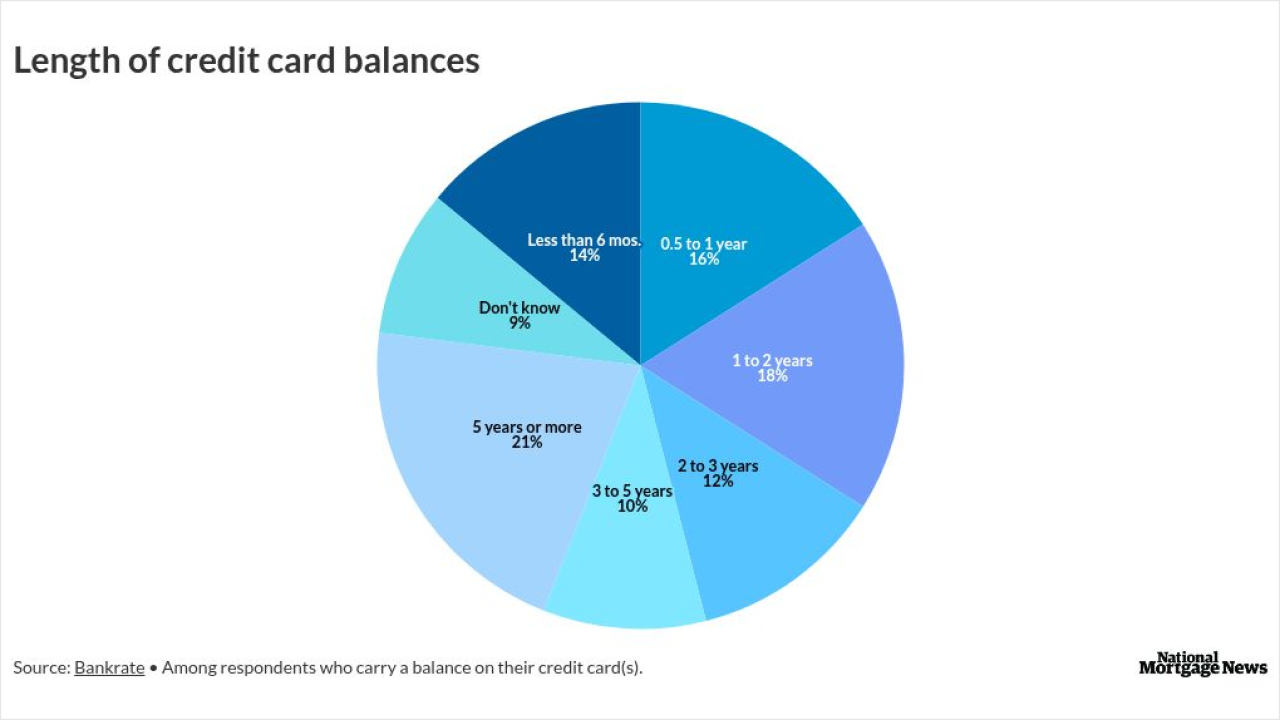

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

The Department of Housing and Urban Development is selling more due-and-payable HECMs on homes that are occupied while reviewing the loan program.

January 7 -

Wells Fargo, JPMorgan Chase, U.S. Bancorp and Citigroup will streamline borrower requests for an additional 90-day forbearance, allowing verbal applications.

January 6 -

Marshall is tasked with bringing Sagent's Dara servicing platform implementation up to scale, replacing Geno Paluso, who is vice chairman during the transition.

January 6 -

The impact of extreme weather remains top of mind for many, with a majority of homeowners citing it as a factor behind purchase or relocation considerations.

January 5 -

The Federal Home Loan Bank of Chicago will be offering more funding and higher per-member limits as part of its 2026 Community Advance program.

January 2 -

Fitch Ratings' outlooks for mortgage and title insurers this year are neutral, as housing deals with affordability challenges and a likely economic downturn.

January 2 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

December 30 -

As CFPB oversight recedes, servicers are turning to FHA, VA and state rules for guidance, with distressed loan compliance, redefaults and local registration risks rising in 2026.

December 30 -

Here are the most-read stories from National Mortgage News over the past year.

December 29 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

December 26 -

Mortgage lenders test crypto-backed mortgages as Fannie Mae and Freddie Mac review digital assets in underwriting, weighing risk, non-QM loans and access for nontraditional homebuyers.

December 26 -

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

December 24 -

The national mortgage delinquency rate jumped to 3.85% in November, up 15% month over month and 2.79% year over year, according to ICE Mortgage Technology.

December 23 -

The judge's order allows potentially thousands of consumers to join the lawsuit against the company, similar to other fights between borrowers and servicers.

December 22