-

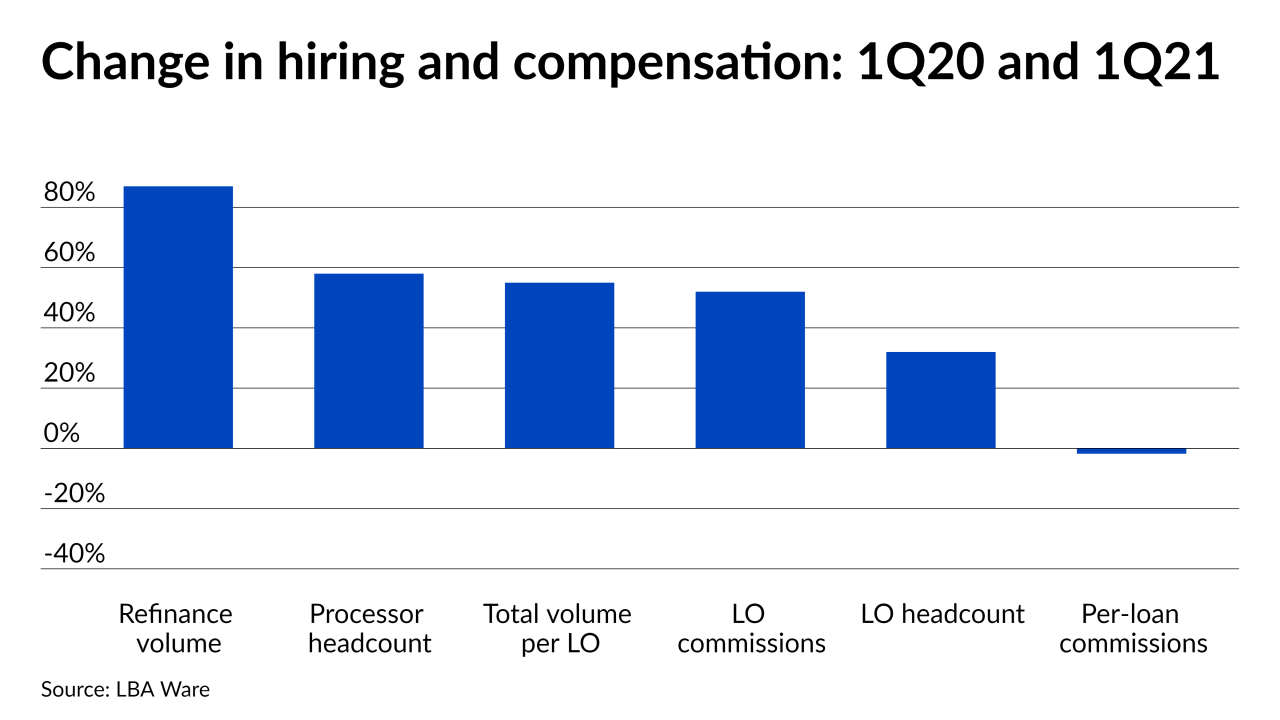

In the aftermath of 2020’s historic year of mortgage originations, lenders are concerned with keeping employees and insulating themselves from the negative effects of the boom and bust cycle, according to a survey from The Mortgage Collaborative.

June 8 -

The digital title insurance, closing, escrow, and recording services provider has now raised a total of $110 million in funding.

June 2 -

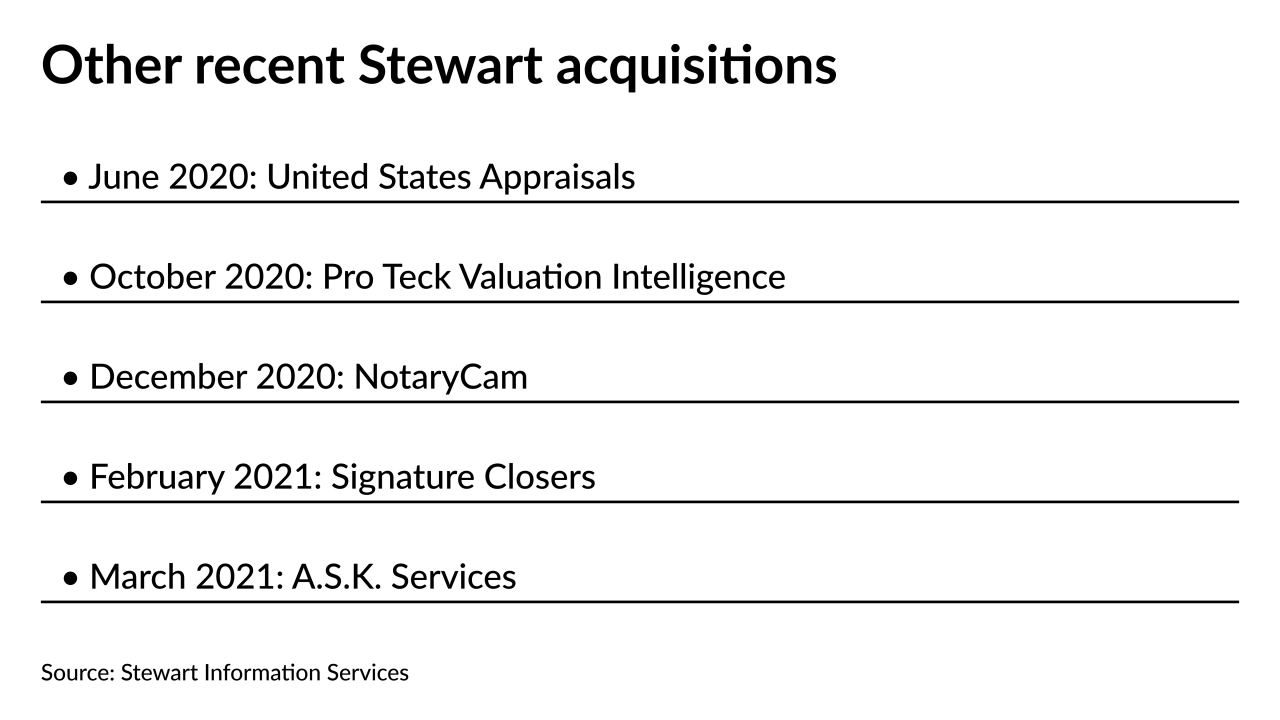

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

Rather than completing another equity raise, the five-year-old mortgage technology company went looking for a partner.

May 27 -

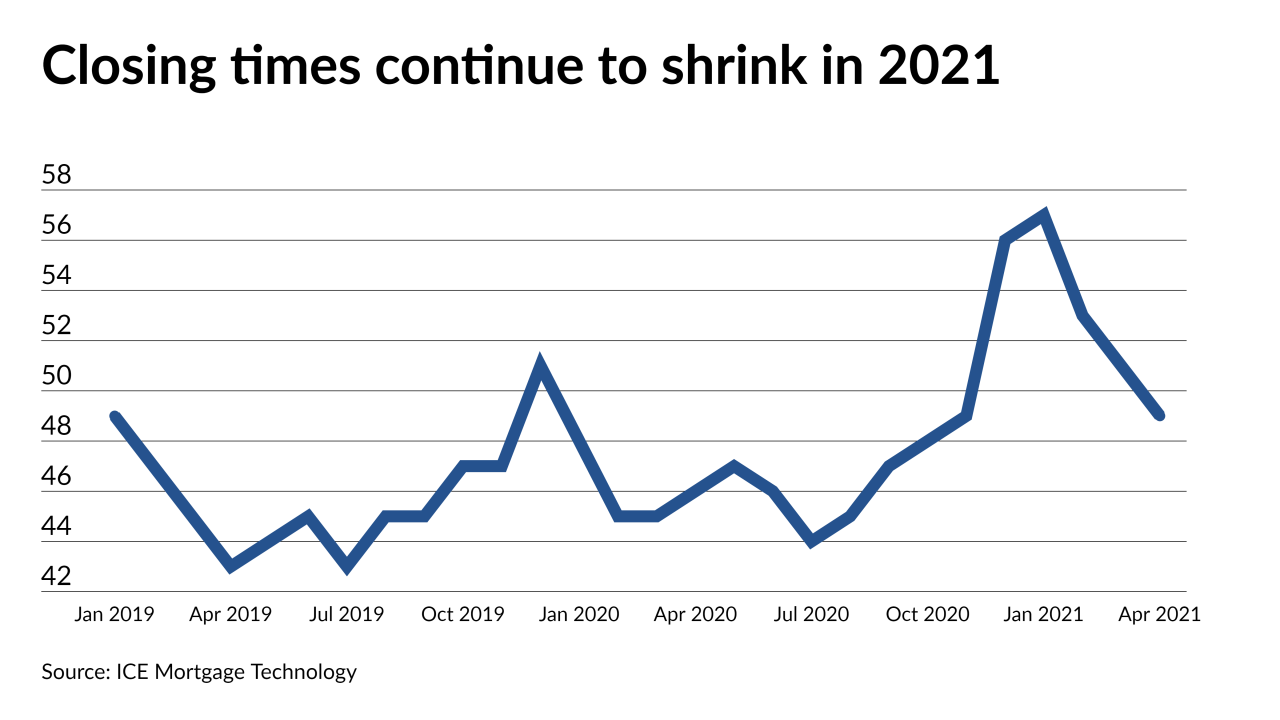

Average days to close dropped closer to pre-pandemic levels in April, according to ICE Mortgage Technology.

May 26 -

The cloud-based mortgage closing platform’s Series D round earned $150 million for the company.

May 25 -

The deal adds to the burgeoning technology stack at the Houston-based title underwriter, which added NotaryCam in December.

May 25 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

Also, per-loan compensation keeps dropping due to the persistence of refinancing in the mix but it could rise as the purchase share of the market increases.

May 5 -

There are only a handful of servicers who have unlocked the secret to achieving high retention rates, and they are performing over 3x better than the industry average of 18%. How are they doing it? It’s all about the data, writes the head of consumer finance at Jornaya.

May 5 Jornaya

Jornaya