-

Xome, a company Washington Mutual successor WMIH Corp. obtained when it bought Nationstar, has appointed a new CEO who previously was part of Genesis Capital's C suite.

August 7 -

The administration’s recent report on fintech innovation discussed ways to adopt electronic promissory notes — or eNotes — and automated appraisals in federal mortgage programs.

August 6 -

Wire and other payments fraud affected a record number of businesses last year, and the FBI is warning in particular about real estate scams.

August 1 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

As the mortgage industry continues evolving digitally, MISMO is developing standards for business-to-consumer transactions on mobile devices, according to the Mortgage Bankers Association.

July 25 -

One of the biggest trade secrets cases in U.S. history took a bizarre turn, with the company that lost a $706 million jury verdict saying it uncovered "bombshell" evidence of fraud thanks to whistle blowers who used to work for the winning side.

July 24 -

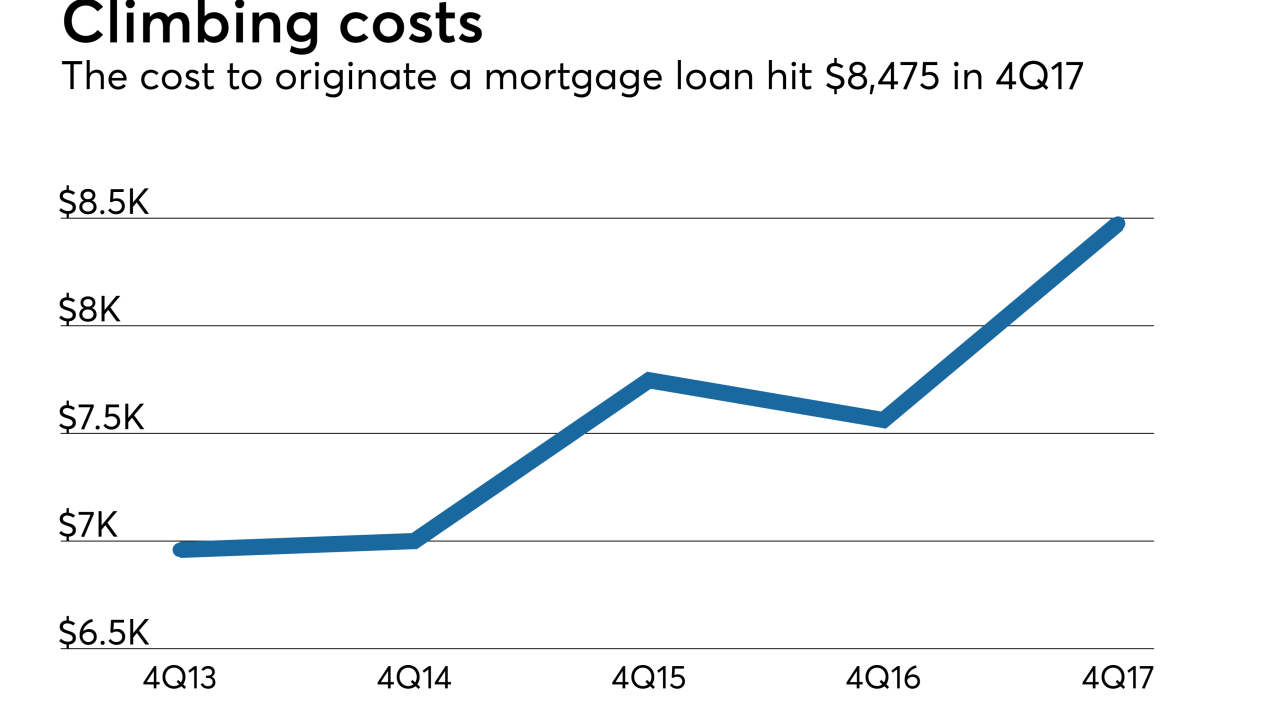

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

Other aggregators came to the bank's defense, while one CEO suggested Plaid's very public protest was unfounded.

July 17 -

United Wholesale Mortgage has set out to be an ally to mortgage brokers in unprecedented ways as CEO Mat Ishbia works to evolve the channel's transactional nature into a more relationship-driven dynamic.

July 13 -

When big banks bailed on brokers during the housing crisis, United Wholesale Mortgage doubled down. As third-party originations now make a comeback, the family-owned company is determined to chip away at retail lenders' dominance.

July 13 -

Freddie Mac will make automation it has been testing in conjunction with servicing-released cash sales available to the broader market next month.

July 3 -

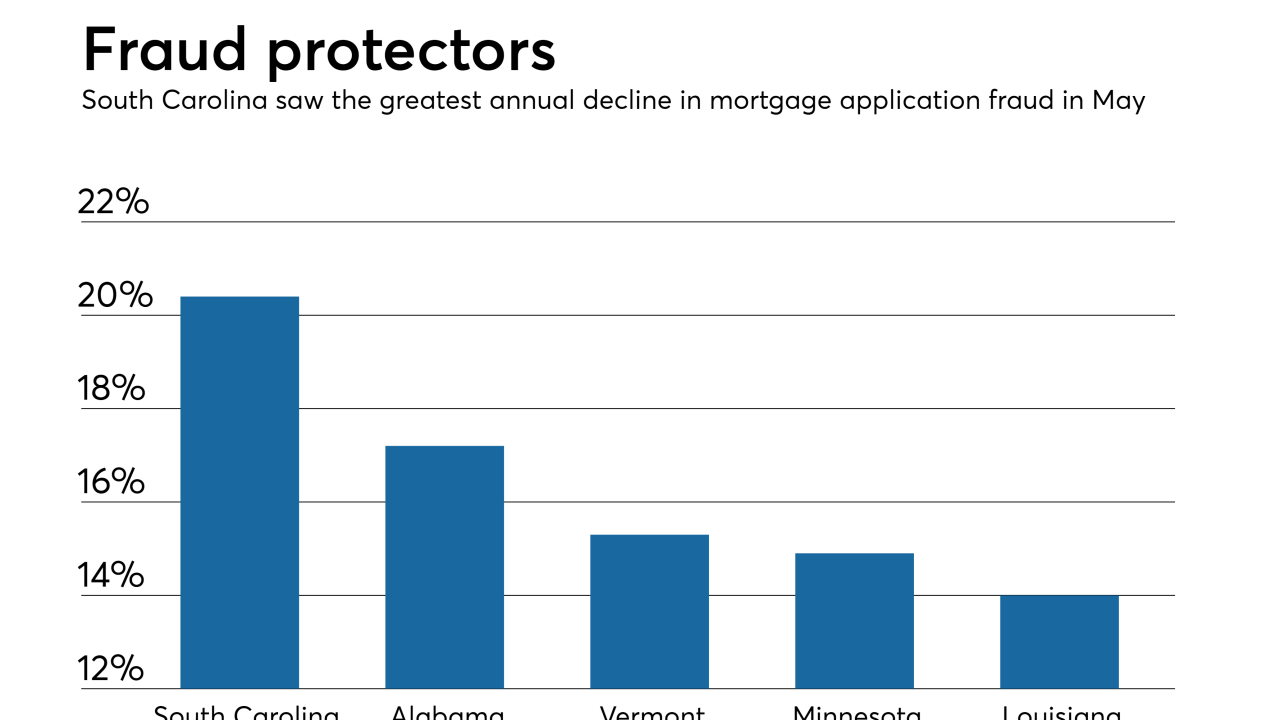

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

Most mortgage lenders and banks do not maintain a comprehensive vendor management strategy, exposing institutions to increased compliance risk, according to a recent survey.

June 26 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

Promontory MortgagePath fills management roles for bank relations, technology and outsourced services opportunities.

May 31 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23