-

Automating the mortgage process will force tighter margins, but drive higher volume, for lenders.

April 12 HouseCanary

HouseCanary -

The bank says its partnership with Lender Price will help streamline and simplify its home loan process.

April 12 -

While the mortgage industry heads in a digital direction, homebuyers are still expecting a more electronic experience during the mortgage process, which would also stand to benefit lenders.

April 11 -

Technology startup Eave is making a foray into Colorado's fast-moving, high-end mortgage lending market by offering software designed to quickly analyze jumbo borrowers' more complex incomes and assets.

April 9 -

Ranieri Solutions, a fintech investment firm in the mortgage space, has partnered with blockchain and smart contract company Symbiont to explore opportunities to implement blockchain technology in the mortgage industry.

April 6 -

While mobile applications have become increasingly present in the originations segment of the mortgage industry, they're now making their mark in the servicing space.

April 5 -

While the industry continues adopting digital mortgage methods, homebuyers expect to be able to apply for a mortgage and complete the application online, but still want human interaction, according to Ellie Mae.

March 20 -

Quicken Loans affiliate Amrock Inc. is appealing a jury verdict ordering it to pay $706.2 million to analytics company HouseCanary in a legal dispute over a software licensing agreement.

March 19 -

Hope LoanPort will receive funding and guidance to expand its loss mitigation platform for servicers, housing counselors and mortgage borrowers from the Finance of America Foundation, a nonprofit with ties to former Rep. Barney Frank.

March 13 -

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13 -

Financial data and analytics company FinLocker has gained the approval of a second patent supporting its digital vault functionality.

March 12 -

Today's mortgage broker is tech savvy, sophisticated and better equipped to thrive in a wholesale channel that's far more competitive than in the past.

March 8 -

The bank will spend an additional $1.4 billion on technology in 2018 to gain share and boost efficiency, executives said Tuesday. But they were peppered with questions about whether the big investment will yield a big financial return down the road.

February 27 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

Servicers continue to face data management challenges, particularly during loan onboarding and transfers. Blockchain technology may hold the key to resolving those issues.

February 16 -

Banco Santander joined existing investors JPMorgan and USAA as well as others in raising $25 million in secondary-round financing for Roostify, which seeks to build a paperless mortgage process.

February 15 -

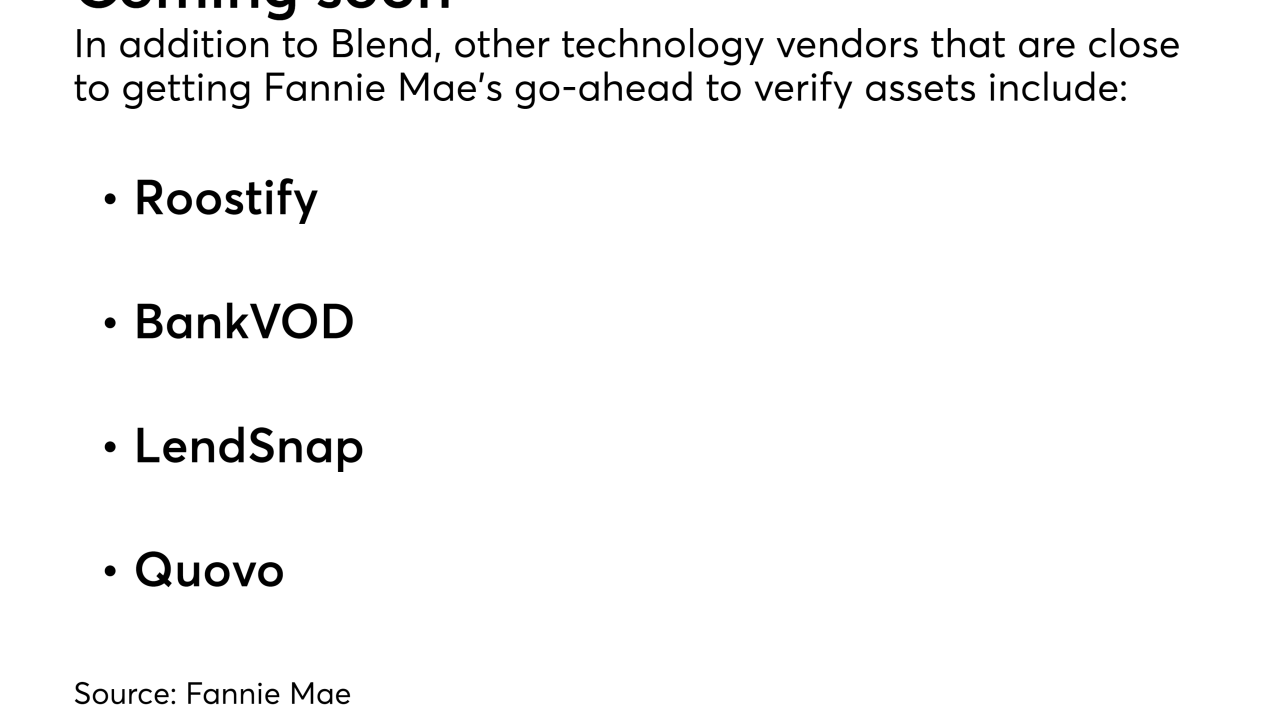

Fannie Mae is doing more to expand its list of Day 1 Certainty report suppliers, naming Blend as the first online point of sale system to directly offer asset validations.

February 13 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7