-

The executive order described state legislation on artificial intelligence as a cumbersome patchwork, and pledged to develop a national framework.

December 12 -

ETHZilla partnered with Zippy to bring manufactured home chattel loans on-chain as tokenized real-world assets.

December 11 -

The rent reporting platform says it's helped tenants raise their credit scores by double digits and unlocked $30 billion more in mortgage lending.

December 11 -

A former employee cited a ransomware gang's claim in October that it stole 20 terabytes of sensitive customer information from the industry vendor.

December 10 -

New rules means sellers and servicers will need to have plans demonstrating proper oversight of their artificial intelligence and machine learning practices.

December 9 -

BTIG is waiting with "baited breath" for Fannie Mae and Freddie Mac to relist their common stocks, but if spreads widen, it could derail it from happening.

December 5 -

Bank of America was the leader in this study, with Rocket as the only nonbank mortgage lender which got a score higher than the industry average.

December 4 -

The wholesale lender fell victim to a data incursion two years ago in a months-long period marked by several high-profile cybersecurity incidents.

December 4 -

Ringcentral claims the direct-to-consumer lender breached a 2021 contract for telephone services to help facilitate up to 1.3 million calls a day.

December 2 -

Perceived risk among lenders may result from a struggle to fully understand what the technology can and won't do as advocates tout its efficiency and speed.

November 28 -

Equities move through a stack of intermediaries, from custodians and clearing firms to brokers. Figure's blockchain structure aims to cut out third parties.

November 19 -

The multi-year, $100 million agreement will allow users to take financial actions without leaving the ChatGPT app.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

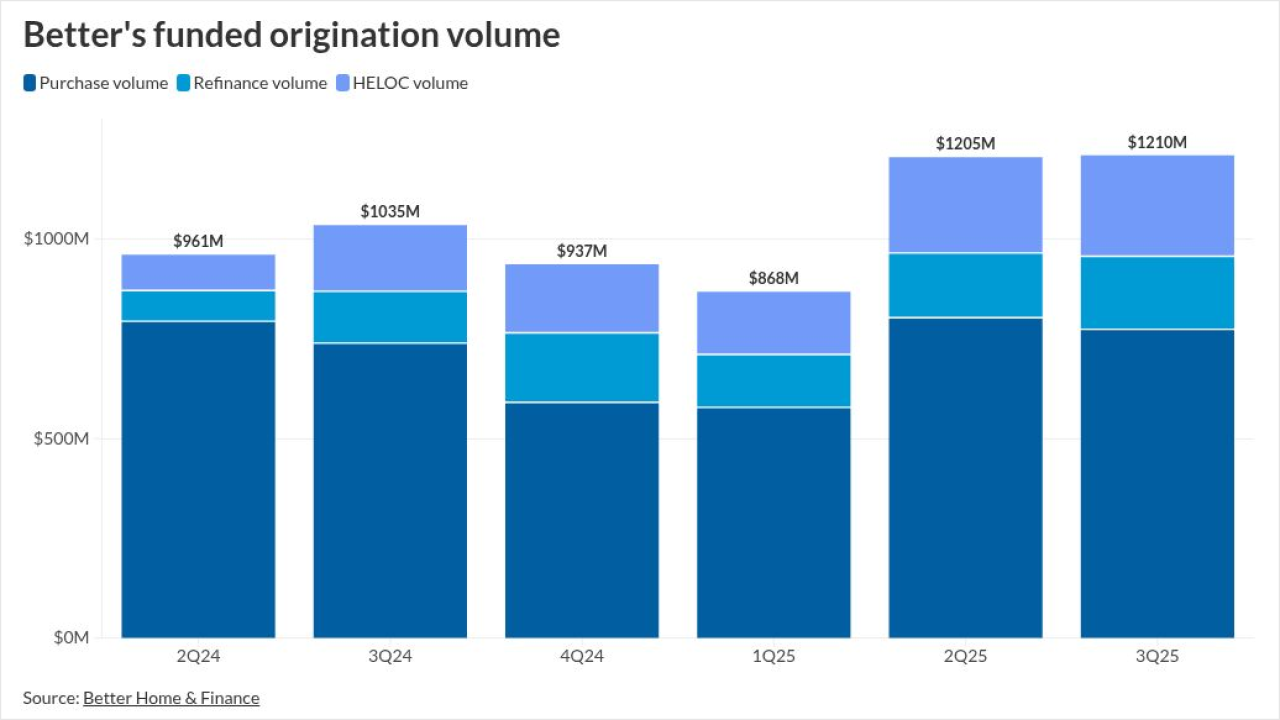

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

While Rocket increased 15 points, it slipped to 11th overall as other mortgage lenders had higher customer service score growth, J.D, Power said.

November 12 -

More profitable companies are weighing deals because they're bullish on their leverage or are simply eying today's big price tags, the expert said.

November 11 -

The FHFA director hinted at a partnership in the works and doubled down on criticism of homebuilders and the Fed chair in a housing conference interview.

November 7 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

Built launched Draw Agent Tuesday, which can process thousands of construction loan draws monthly.

November 5 -

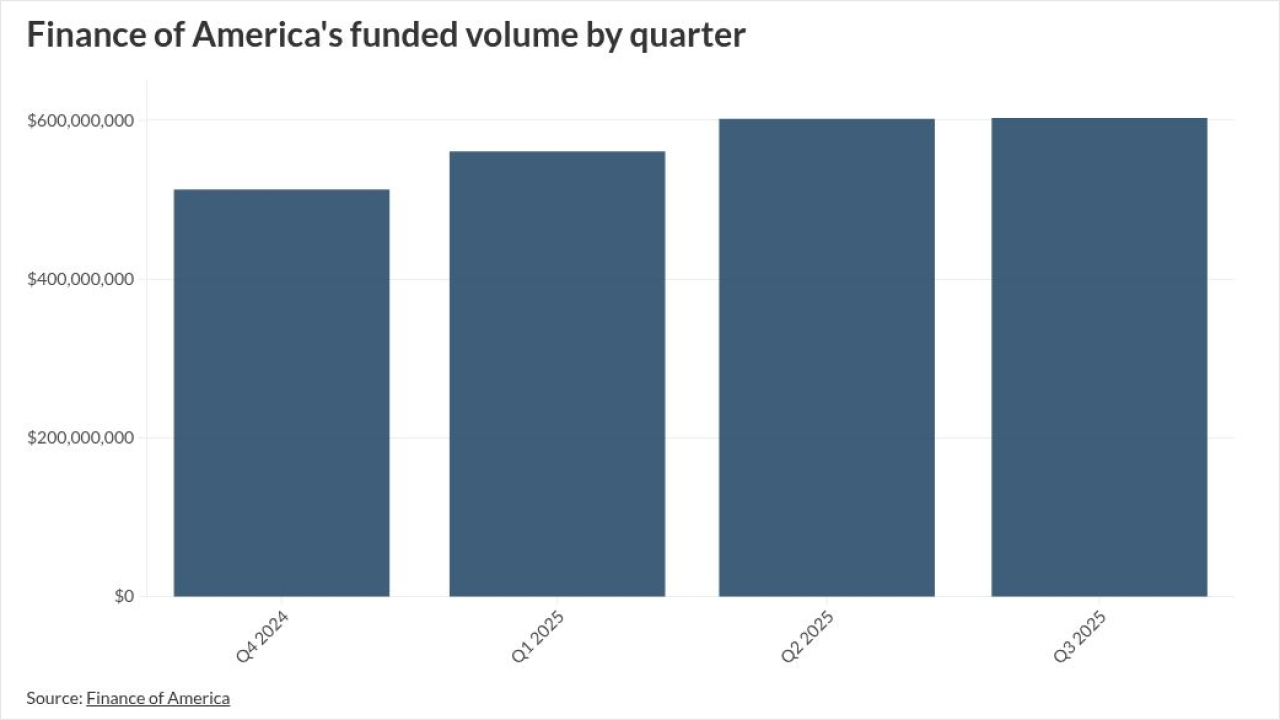

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4