-

Consumer-permissioned access to bank or payroll information could be used to evaluate borrowers who still need relief after payment suspensions for pandemic-related hardships end.

June 16 -

The real estate technology company had a $498 million valuation, according to PitchBook, but it could get a sizable premium to that if it were to go public.

June 15 -

The long-time title and mortgage technology industry executive wants to reduce the number of public company boards he serves on.

June 14 -

There are plans to incorporate the code into the Encompass eClose product, which will allow for secure storage of digital mortgages and notes.

June 11 -

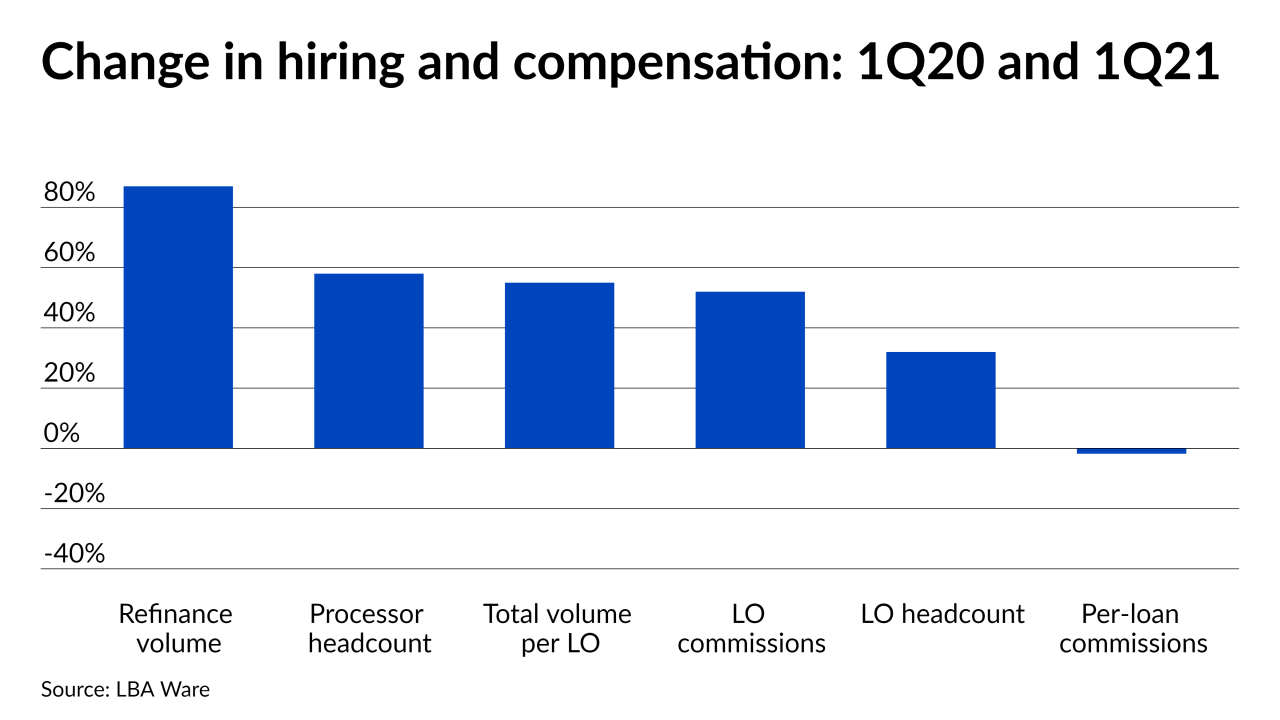

In the aftermath of 2020’s historic year of mortgage originations, lenders are concerned with keeping employees and insulating themselves from the negative effects of the boom and bust cycle, according to a survey from The Mortgage Collaborative.

June 8 -

The digital title insurance, closing, escrow, and recording services provider has now raised a total of $110 million in funding.

June 2 -

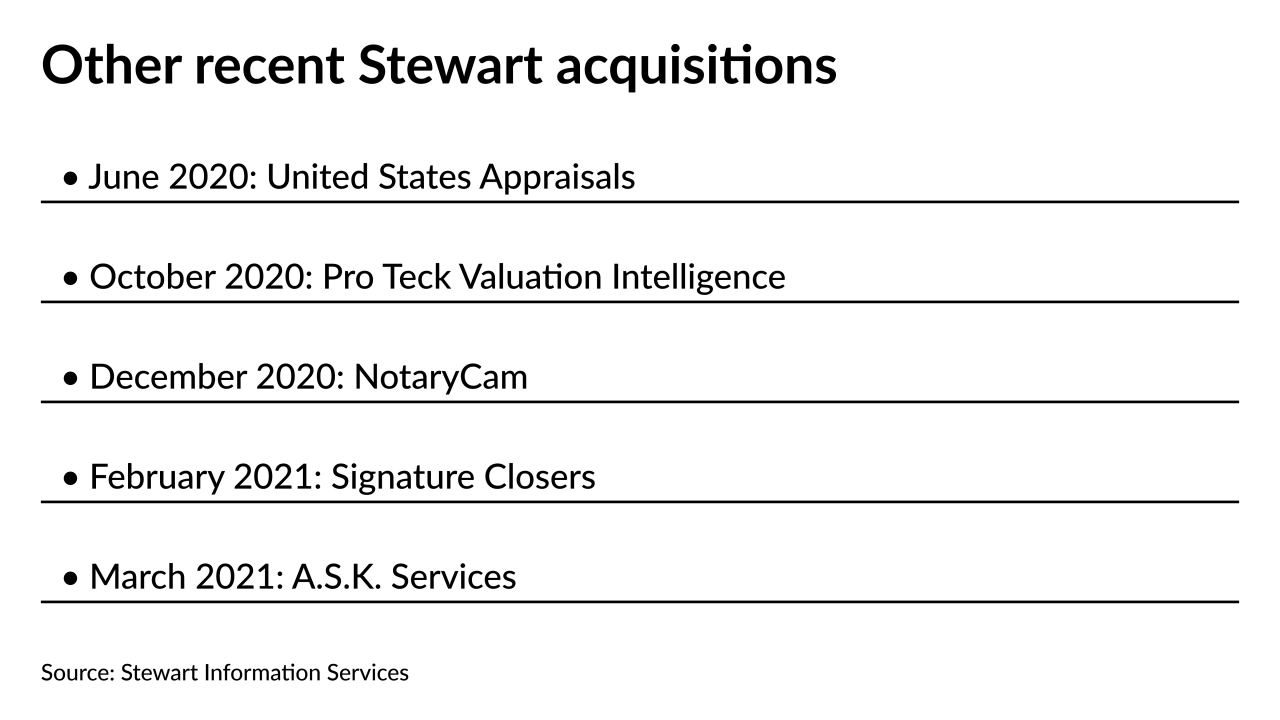

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

Rather than completing another equity raise, the five-year-old mortgage technology company went looking for a partner.

May 27 -

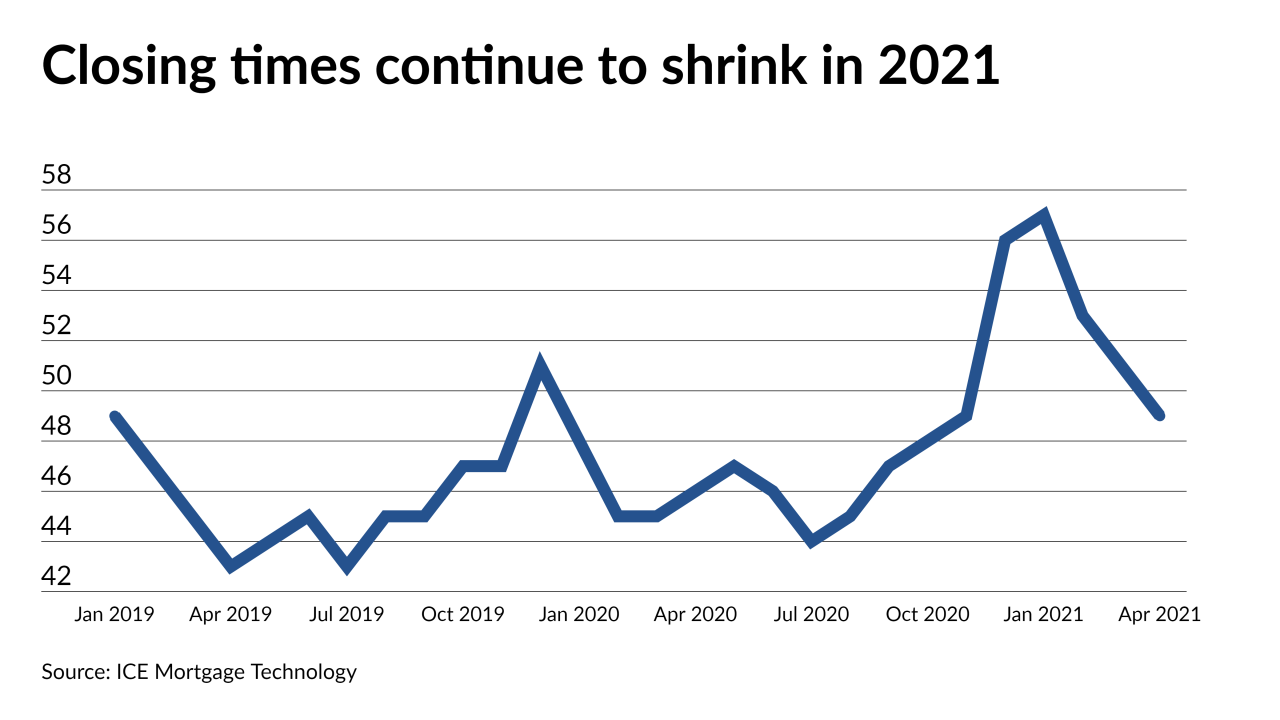

Average days to close dropped closer to pre-pandemic levels in April, according to ICE Mortgage Technology.

May 26 -

The cloud-based mortgage closing platform’s Series D round earned $150 million for the company.

May 25 -

The deal adds to the burgeoning technology stack at the Houston-based title underwriter, which added NotaryCam in December.

May 25 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

Also, per-loan compensation keeps dropping due to the persistence of refinancing in the mix but it could rise as the purchase share of the market increases.

May 5 -

There are only a handful of servicers who have unlocked the secret to achieving high retention rates, and they are performing over 3x better than the industry average of 18%. How are they doing it? It’s all about the data, writes the head of consumer finance at Jornaya.

May 5 Jornaya

Jornaya -

A total of 480,000 customers may have been affected by the duplicate drafts and so far it looks like far fewer than 1% of them incurred non-sufficient funds fees, Mr. Cooper said Tuesday.

April 28 -

The recent compression allays fears that lenders would have difficulty serving the needs of borrowers with time-sensitive purchase contracts during a peak season.

April 27 -

System updates, which may be a result of changes to the Preferred Stock Purchase Agreements, have Community Home Lenders Association members saying loans that were approved previously are getting rejected when put back through.

April 26 -

The incident points to a risk mortgage companies should be aware of as they shift to digital servicing strategies.

April 26 -

The mortgage real estate investment trust has been a first-mover regarding innovations in the private securitized market, and others tend to follow its lead.

April 19 -

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16