-

Mortgage rates jumped across the board to their highest point this year as 10-year Treasury yields rose in the past week over economic headlines, according to Freddie Mac.

April 19 -

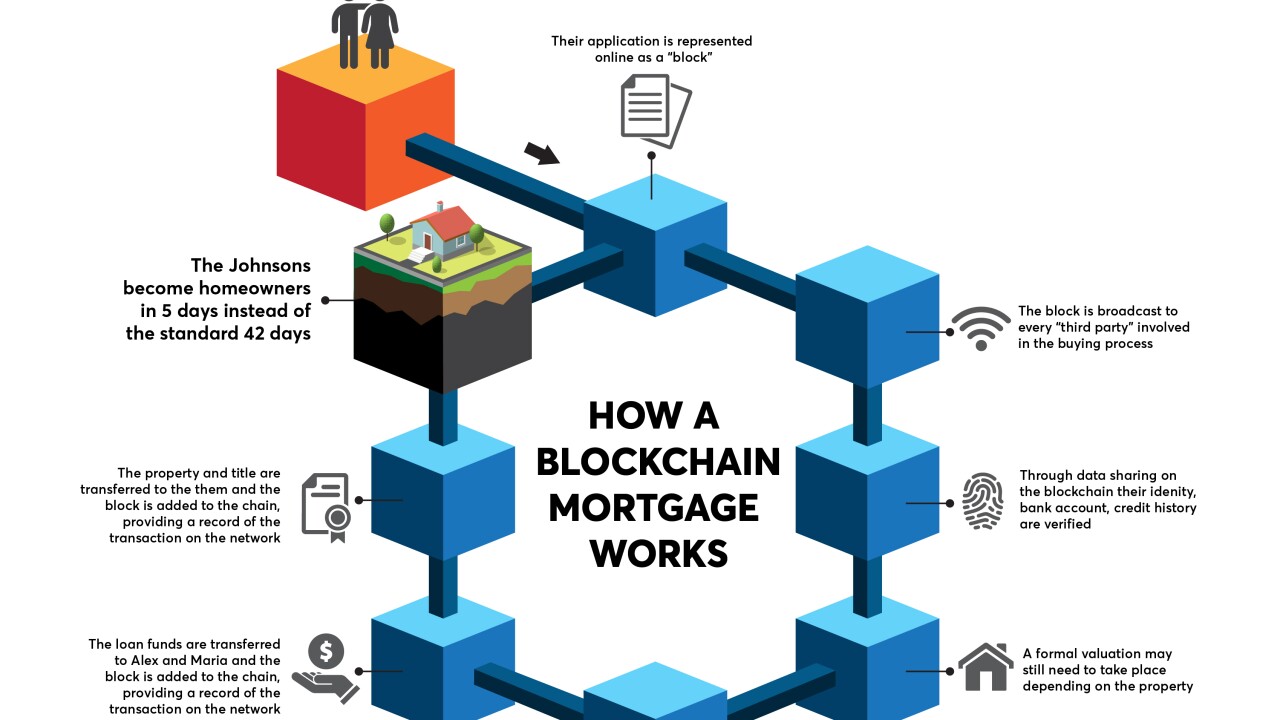

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

The Mortgage Bankers Association is calling for Ginnie Mae, states, the Internal Revenue Service and other government agencies to overcome remaining digital mortgage challenges.

April 16 -

Cloudvirga, in collaboration with Freddie Mac, has created the capability for loan officers to submit mortgage loan data to both government-sponsored enterprises' automated underwriting systems simultaneously with a single click.

April 12 -

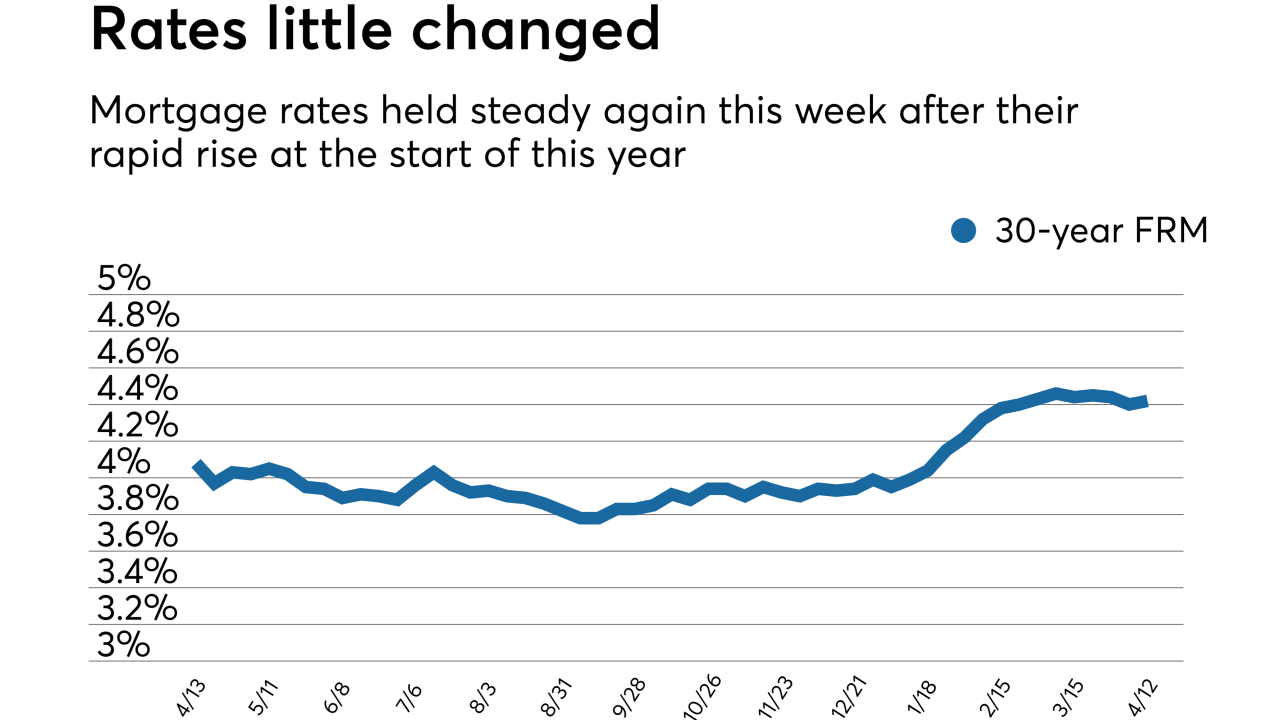

Mortgage rates increased a scant two basis points this past week, holding steady recently after their rapid rise at the start of this year, according to Freddie Mac.

April 12 -

The use of appraisal management companies does not result in higher quality property valuation reports, according to a working paper published by the Federal Housing Finance Agency.

April 11 -

Lennar Corp.'s home finance subsidiary with the help of Blend rolled out its own digital mortgage platform, as another small lender tries to keep up with Rocket Mortgage.

April 9 -

Technology startup Eave is making a foray into Colorado's fast-moving, high-end mortgage lending market by offering software designed to quickly analyze jumbo borrowers' more complex incomes and assets.

April 9 -

Mortgage rates dropped as the stock market downturn at the start of the week drove yields on the 10-year Treasury lower.

April 5 -

Mortgage credit availability tightened during March to its lowest level in over a year, adding another headwind to a market challenged by rising interest rates and a shortage of homes for sale.

April 5 -

Carrington Mortgage Services' decision to offer subprime mortgage loans was a natural progression from its decision four years ago to concentrate on borrowers with credit scores under 640.

April 3 -

Mortgage rates held largely steady for the week, dropping only 1 basis point, according to Freddie Mac.

March 29 -

Lenders should not get so desperate chasing volume by originating lower credit non-qualified mortgage products that they are inviting the next regulatory crackdown, said David Stevens, the Mortgage Bankers Association's CEO.

March 28 -

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

Mortgage rates posted a slight increase this week following the Federal Open Markets Committee's decision to boost short-term rates by 25 basis points, according to Freddie Mac.

March 22 -

Fidelity National Financial's proposed purchase of Stewart Information Services could solidify FNF's leading market share among title insurers if regulators don't balk at its scope.

March 19 -

Fannie Mae is about to roll out a new underwriting system that will address some concerns about layered risk that cropped up after it raised its maximum debt-to-income ratio.

March 16 -

Mortgage lenders are growing more pessimistic about their profitability, with the highest percentage ever seen in Fannie Mae's first-quarter industry sentiment survey expecting a decline in margins.

March 15 -

After increasing for nine consecutive weeks, mortgage rates dropped for the first time in 2018, according to Freddie Mac's Primary Mortgage Market Survey.

March 15