-

The government shutdown and Congress' inability to reauthorize the National Flood Insurance Program could delay some home sales and loan closings.

January 22 -

Here's a look at what happens at five federal agencies that support the mortgage industry during a government shutdown.

January 19 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11 -

Mortgage rates jumped across the board as investors sold some of their Treasury bond holdings, which led to higher yields, according to Freddie Mac.

January 11 -

CMG Financial is offering a new affinity marketing portal on its crowdfunding platform for down payments and positioning it as a way for employers to retain millennials.

January 10 -

There were fewer mortgage programs available to borrowers at the lower end of the credit spectrum in December, resulting in an overall decrease in credit availability.

January 9 -

Consumer credit scores are improving, but many qualified borrowers are still hesitant about buying a house. New tools are helping lenders better assess risk and show consumers with lower credit scores they can qualify for mortgages.

January 8 -

Mortgage rates dropped to start the year as the markets had little new news to react on during the holiday period.

January 4 -

The gap between the average credit score for homebuyers and other consumers has widened to its highest point in 12 years, and lenders don't know what, if anything, to do about it.

January 3 -

After surging earlier in the year, the number of mortgage loan application defects remained flat in November, a positive sign when it comes to fraud incidents going forward.

December 29 -

From consolidation to tech innovation, here's a look at some of the top challenges and trends that mortgage executives from lenders, servicers and vendors are focused on for 2018.

December 28 -

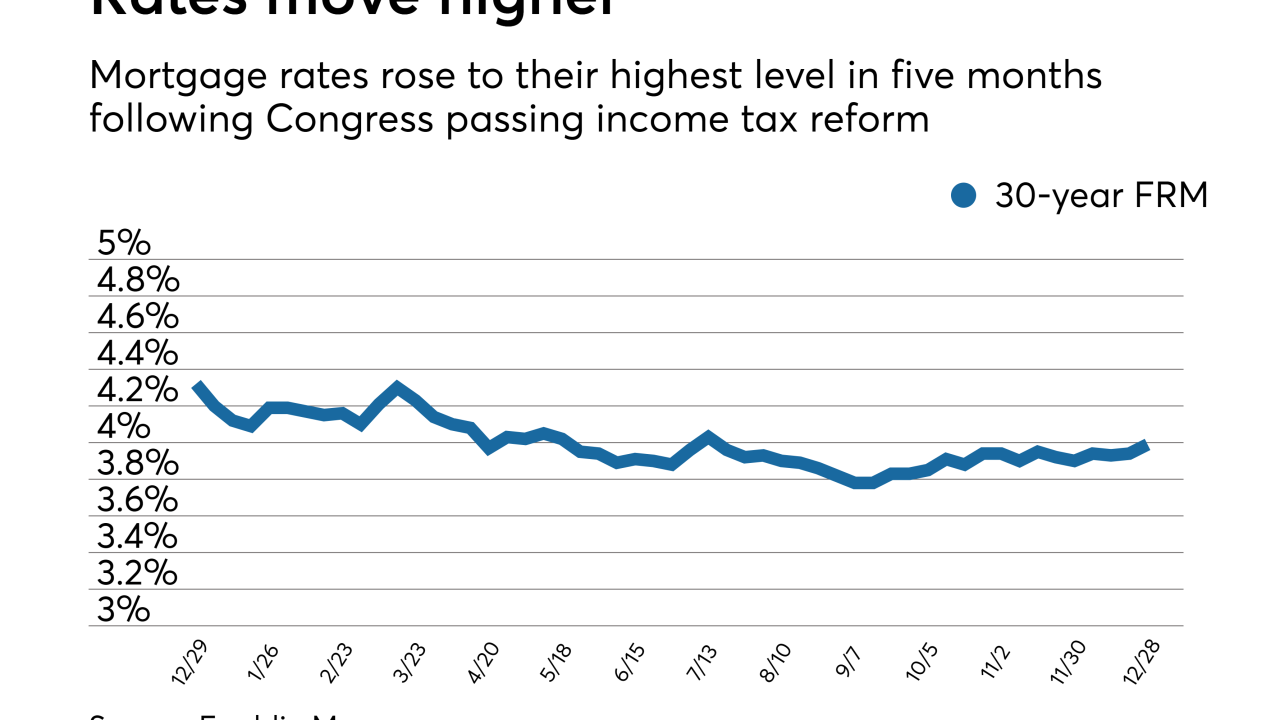

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

Billionaire Dan Gilbert's Quicken Loans Inc. outgrew almost every U.S. mortgage provider by unfurling technology like its online Rocket Mortgage platform faster than big banks.

December 28 -

Most housing finance companies are preparing to fight for a dwindling number of loans and operate on thinner margins.

December 26 -

Lending outside the qualified mortgage rule will likely become more prominent in 2018, as originators continue to struggle to replace lost refinance volume and their compliance and risk management processes become more robust.

December 26 -

Updated dynamic and interactive versions of Fannie Mae and Freddie Mac's redesigned Uniform Residential Loan Application are out.

December 20 -

Underwriting purchase loans is inherently more precarious for mortgage lenders and that contributed to the year-over-year increase in risk in new originations during the third quarter, CoreLogic said.

December 19 -

To succeed in an era of increasingly narrow margins and broad competition, mortgage lenders must be methodical about loan fulfillment and take a "less is more" approach to designing workflows.

December 18 cloudvirga

cloudvirga -

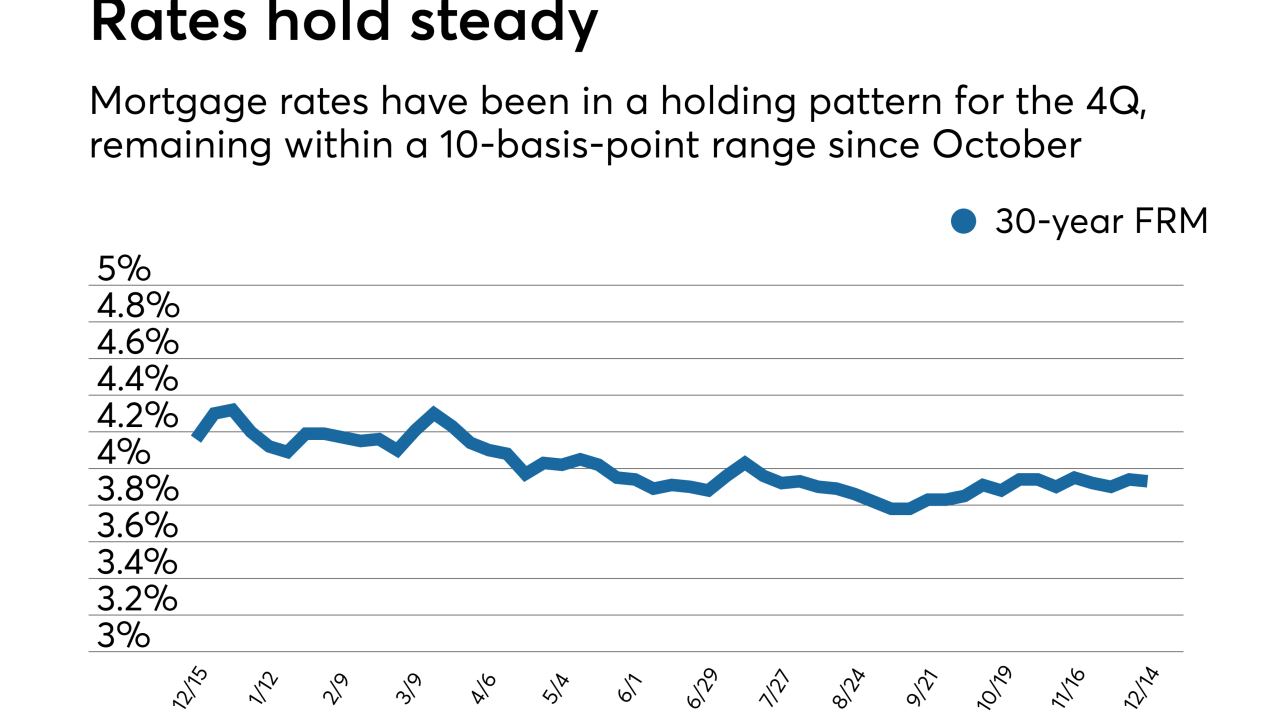

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14