-

Radian Group reported third-quarter net income of $65 million after taking $57.8 million in pretax charges — $12 million of which is related to the Clayton Holdings restructuring.

October 26 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

Legalizing the recreational use of marijuana has created jobs in Colorado, bringing people into the state and putting stress on its residential purchase and rental markets.

October 24 -

The forecast for total originations of home equity lines of credit over the next five years is almost twice as high as the five-year total through 2017.

October 24 -

Fannie Mae is staging more pilot projects with lenders and vendors, including one that consolidates submissions of different types of loan data potentially eligible for immediate representation and warranty relief.

October 23 -

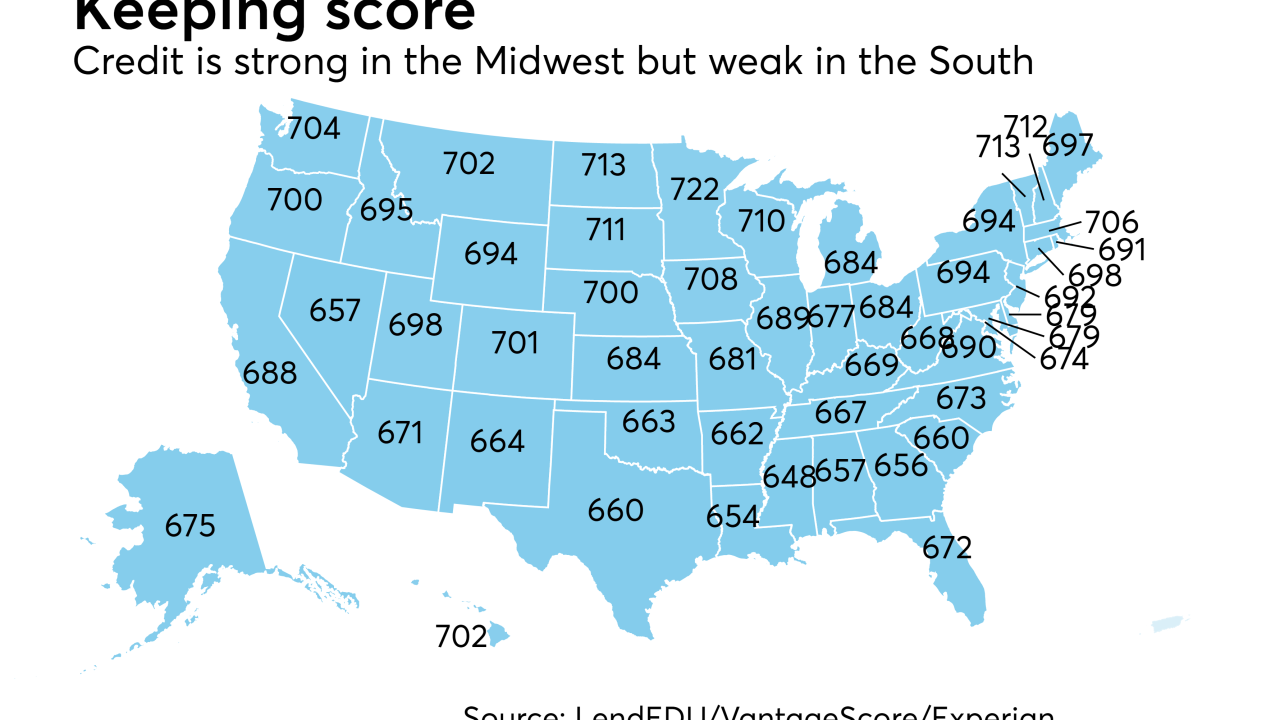

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Cannabis businesses are legal in 29 states, but compliance questions on the federal level are keeping mortgage lenders from making loans to the industry's workers.

October 23 -

Fannie Mae is authorizing additional suppliers of reports that can give lenders immediate representation and warranty relief on certain data, diversifying beyond an exclusive partnership with Equifax in one category.

October 23 -

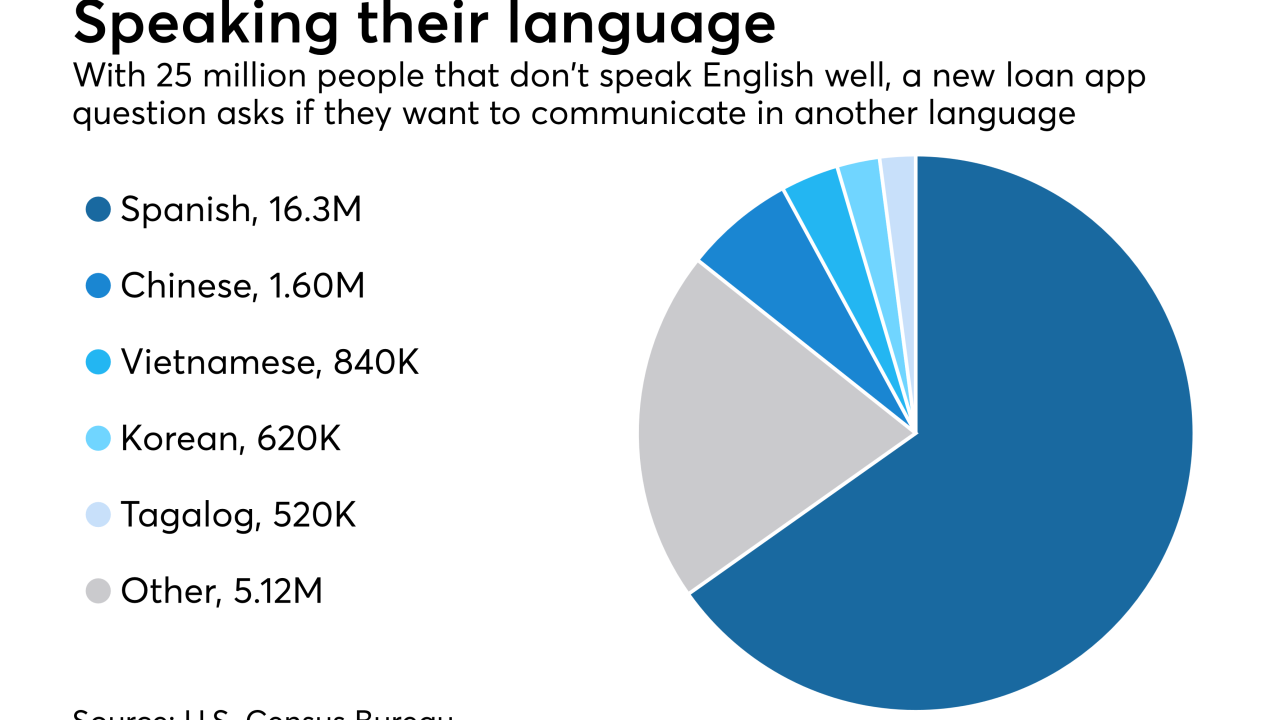

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

Equifax continues work to add new security features and restore full access to The Work Number following a report highlighting potential security vulnerabilities in a browser-based portal of its employment verification service.

October 20 -

Mortgage rates ticked down for the first time in two weeks as the 10-year Treasury yield fell to its lowest point in October, according to Freddie Mac.

October 19 -

The way lenders need to submit payment information on certain student loans in order to calculate a borrower's monthly debt-to-income ratio is changing at Freddie Mac.

October 19 -

Mortgage applications increased 3.6% from one week earlier even though rates remained mostly flat during the period, according to the Mortgage Bankers Association.

October 18 -

MGIC Investment Corp.'s third-quarter net income of $120 million was more than double the $56.6 million for the same period last year as its losses incurred fell by over 50%.

October 18 -

Government-sponsored enterprises Fannie Mae and Freddie Mac's guarantee fee pricing last year kept the playing field fairly level for different-sized lenders.

October 17 -

Mortgage defaults keep rising and are getting much nearer to where they were in 2016 as damage from natural disasters continues to add to slight upward pressure on credit.

October 17 -

The latest version of Ellie Mae's Encompass loan origination system includes new features for Home Mortgage Disclosure Act compliance and digital mortgages.

October 16 -

Recently exposed security vulnerabilities in an Equifax tool used extensively in the mortgage industry are raising new questions about the reliability and veracity of the beleaguered credit bureau's employment verification service.

October 13 -

Mortgage rates posted their biggest week-over-week increase since July and the 10-year Treasury yield also rose, according to Freddie Mac.

October 12