-

The share of mortgage refinance applications dropped below 50% for the first time since the start of September, as interest rates rose to a six-week high.

October 11 -

Slightly looser underwriting outside the government sector is primarily responsible for the latest increase in credit availability.

October 10 -

Lenders could be responsible for water quality issues affecting borrowers and properties if the Federal Housing Administration follows through with its response to an inspector general's report.

October 6 -

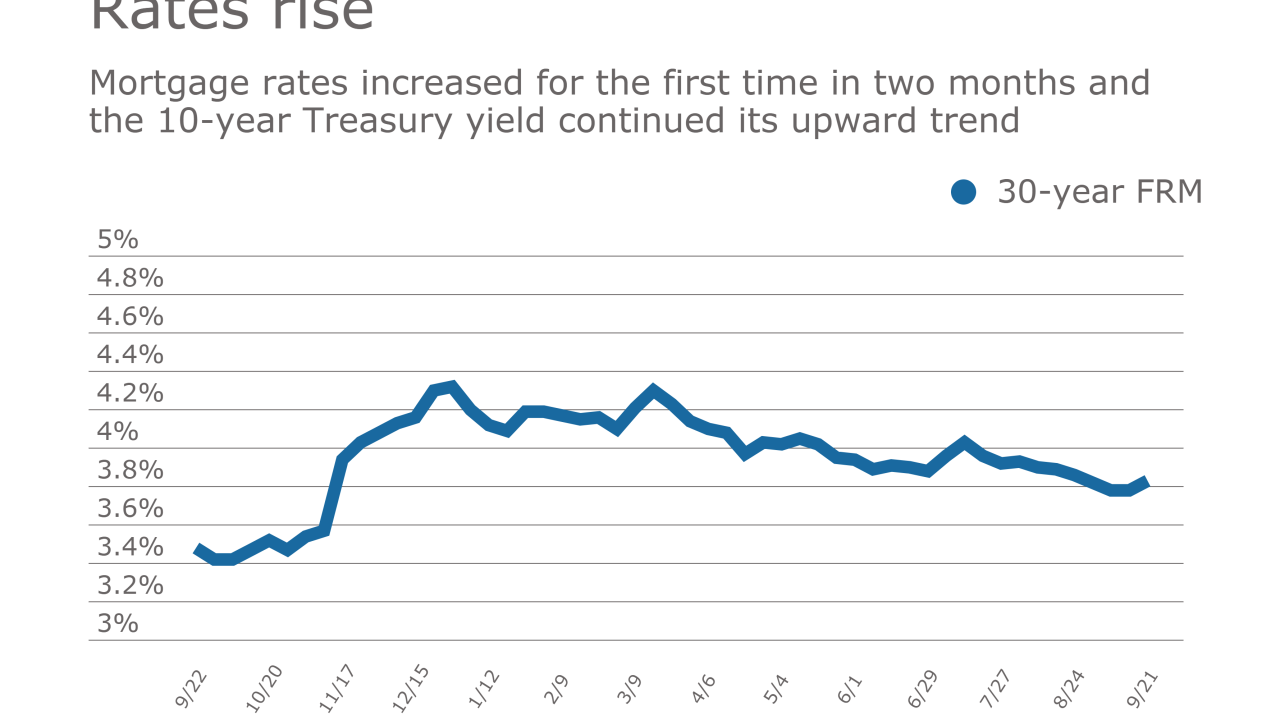

Mortgage rates ticked up to their highest mark in six weeks, reflecting the 20-basis-point rise in the 10-year Treasury yield during September, according to Freddie Mac.

October 5 -

A decline in refinancing applications offset the gain in purchase activity, leading to an overall drop in application activity of 0.4% from one week earlier.

October 4 -

CMG Financial is trying out a platform that gives borrowers the ability to raise funds for down payments in conjunction with Fannie Mae loans.

October 3 -

Competition in other areas of consumer lending has driven both VantageScore and FICO to build credit scoring models that are more accurate and more consumer-friendly. Permitting that competition in the mortgage market can increase certainty for lenders and transparency for investors.

October 2 VantageScore Solutions

VantageScore Solutions -

The Federal Housing Administration is extending processing hours for reverse mortgages this weekend to accommodate a rush to get loans approved ahead of rule changes coming Oct. 2.

September 29 -

Mortgage lenders took on more risk in the second quarter as the share of loans to real estate investors and condominium owners increased, according to CoreLogic.

September 29 -

Mortgage rates remained unchanged from last week even through the 10-year Treasury yield first moved lower then spiked up during the period, according to Freddie Mac.

September 28 -

Reverse mortgage lenders are stretched thin to the point of having to turn borrowers away as seniors rush to get ahead of Home Equity Conversion Mortgage changes that will raise fees and lower loan limits.

September 27 -

While millennials were the largest group of home buyers in the past 12 months, many had problems with affordability and the down payment.

September 27 -

Mortgage application activity decreased 0.5% from one week earlier as a decline in refinance volume was only partially offset by an increase in purchases.

September 27 -

Consumers across all generations, from millennials to baby boomers, want more online and digital communication with their mortgage lender, according to a survey from Velocify.

September 26 -

Borrower and mortgage eligibility problems, a sign of the shift to a purchase market, were the leading cause of critical defects found following post-closing reviews, according to Aces Risk Management.

September 25 -

Mortgage rates increased for the first time in seven weeks, while the 10-year Treasury yield continued its upward trend, according to Freddie Mac.

September 21 -

A Consumer Financial Protection Bureau proposal would limit how much Home Mortgage Disclosure Act data is released to the public in an effort to protect consumer privacy.

September 20 -

Mortgage application activity decreased from one week earlier due to normal seasonal trends, according to the Mortgage Bankers Association.

September 20 -

Default rates for first-lien mortgages rose slightly higher in August and remain lower year-over-year, but recent hurricanes could intensify loan performance concerns.

September 20 -

Digital mortgages transform the customer experience with slick user interfaces and data integrations that streamline the process of getting a borrower hooked up with a lender. Now it's time to disrupt the rest of the process.

September 20