-

Reverse mortgage lenders are stretched thin to the point of having to turn borrowers away as seniors rush to get ahead of Home Equity Conversion Mortgage changes that will raise fees and lower loan limits.

September 27 -

While millennials were the largest group of home buyers in the past 12 months, many had problems with affordability and the down payment.

September 27 -

Mortgage application activity decreased 0.5% from one week earlier as a decline in refinance volume was only partially offset by an increase in purchases.

September 27 -

Consumers across all generations, from millennials to baby boomers, want more online and digital communication with their mortgage lender, according to a survey from Velocify.

September 26 -

Borrower and mortgage eligibility problems, a sign of the shift to a purchase market, were the leading cause of critical defects found following post-closing reviews, according to Aces Risk Management.

September 25 -

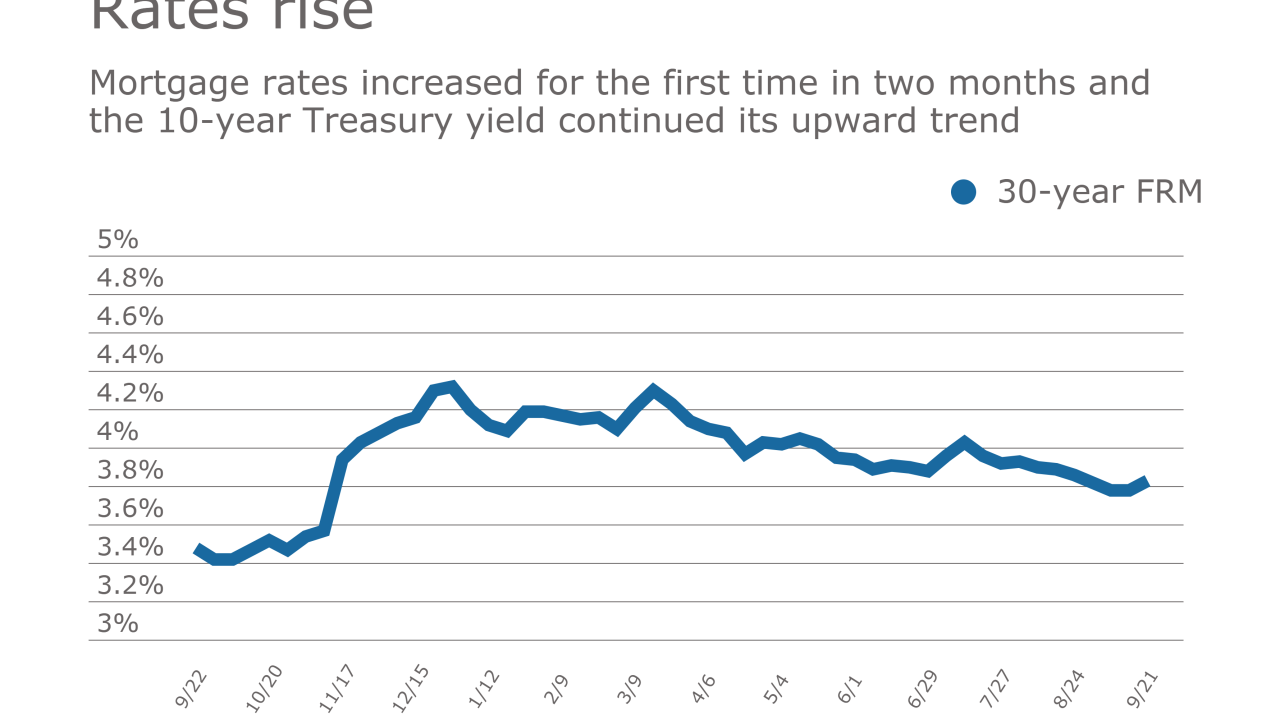

Mortgage rates increased for the first time in seven weeks, while the 10-year Treasury yield continued its upward trend, according to Freddie Mac.

September 21 -

A Consumer Financial Protection Bureau proposal would limit how much Home Mortgage Disclosure Act data is released to the public in an effort to protect consumer privacy.

September 20 -

Mortgage application activity decreased from one week earlier due to normal seasonal trends, according to the Mortgage Bankers Association.

September 20 -

Default rates for first-lien mortgages rose slightly higher in August and remain lower year-over-year, but recent hurricanes could intensify loan performance concerns.

September 20 -

Digital mortgages transform the customer experience with slick user interfaces and data integrations that streamline the process of getting a borrower hooked up with a lender. Now it's time to disrupt the rest of the process.

September 20 -

For the digital mortgage to reach its full potential, lenders and technology developers still have to solve for the disconnect between the front-end application process and the underwriting work required before a loan closes.

September 20 -

Technology isn't a magic bullet for success, and just doing mortgages digitally doesn't change how the business fundamentally works.

September 20 Roostify

Roostify -

Many lenders are focusing too much time on user experience and overlooking the frustratingly inefficient mortgage process happening behind their pretty loan applications.

September 20 cloudvirga

cloudvirga -

As lenders embrace the automated processes and data integrations of digital mortgages, they must also rethink their approach to quality control.

September 20 TRK Connection

TRK Connection -

The shift to a purchase market and an increase in wholesale mortgage originations contributed to a nearly 17% year-over-year rise in fraud risk during the second quarter, according to CoreLogic.

September 19 -

-

Efforts to persuade regulators to allow Fannie Mae and Freddie Mac to use alternative credit scores would stifle competition between the credit bureaus and FICO and do little to expand access to credit, according to industry analyst Chris Whalen.

September 18 -

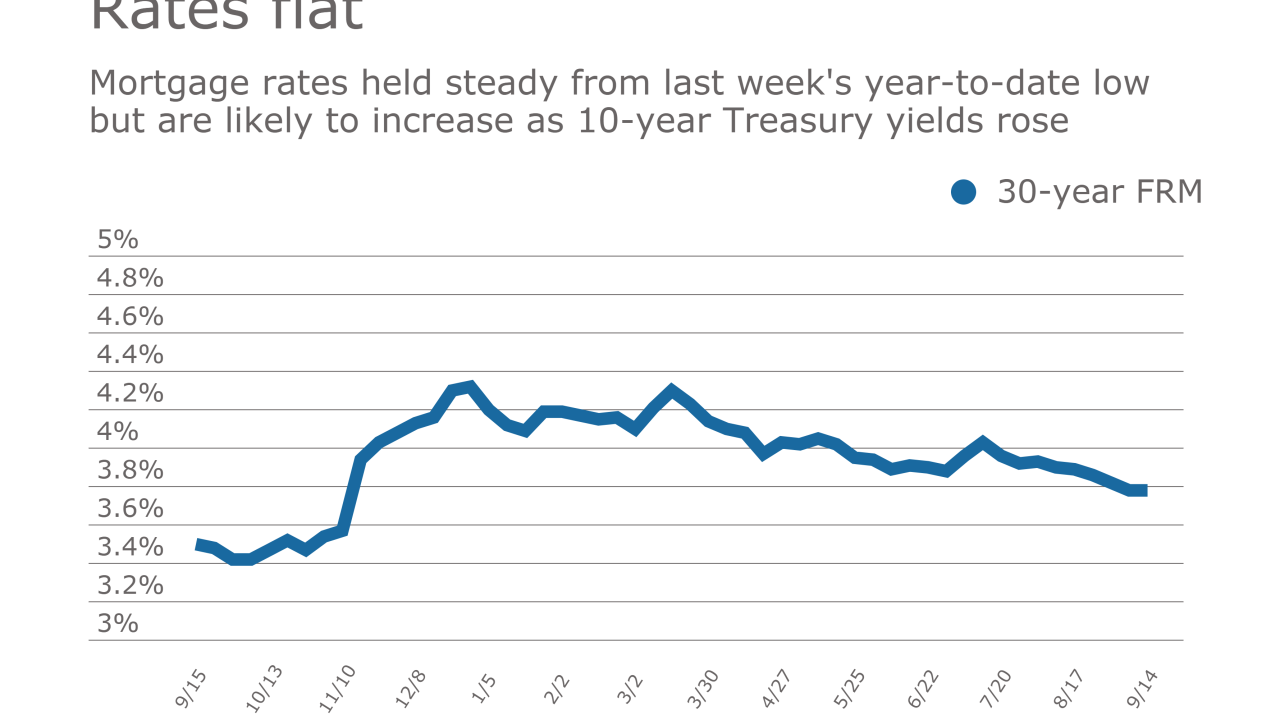

Mortgage rates remained unchanged from last week's year-to-date low but going forward they are likely to increase as 10-year Treasury yields rose.

September 14 -

A decade after the financial crisis and housing collapse, more consumers seem in the mood to buy a new home before they sell their existing home.

September 13 -

As mortgage rates dropped to new lows for the year, loan application volume increased from one week earlier, according to the Mortgage Bankers Association.

September 13