-

The purchase mortgage share increased 15 percentage points in the first five months of 2017 to 68% of all closed loans in May, according to Ellie Mae.

June 21 -

Mortgage application activity increased slightly from one week earlier, according to the Mortgage Bankers Association.

June 21 -

Traditional partnerships with lenders have been eroded by compliance strains and new incentives to control more of the homebuying transaction.

June 21 -

Defaults on first-lien mortgages fell 5 basis points in May from the previous month, dropping to their lowest level in a year, according to the S&P/Experian Consumer Credit Default Index.

June 20 -

Federal Reserve Vice Chairman Stanley Fischer said a long period of low interest rates may have contributed to "high and rising" home prices in several countries, cautioning against forgetting the lessons of the 2007-09 housing crisis.

June 20 -

The young adult homeownership rate should increase by 1.5 percentage points over the next two decades as education attainment among racial and ethnic minorities continues to rise.

June 20 -

With refinancing coming in a little stronger than expected and underwriting loosening, Fannie Mae has slightly increased its forecast for total volume in 2017.

June 19 -

Mortgage rates increased for the first time in over a month, but the increase might be short-lived, according to Freddie Mac.

June 15 -

The move follows mounting criticism that many homeowners using property assessments to finance energy efficiency upgrades can neither understand, nor afford, the terms of deals.

June 15 -

Wintrust Mortgage has committed to funding $40 million in below-market fixed interest-rate loans in the Chicago area through a partnership with Habitat for Humanity.

June 14 -

Mortgage applications increased 2.8% from one week earlier as refinancings hit their highest level since November, according to the Mortgage Bankers Association.

June 14 -

Houston-area homebuyers snapped up a record number of houses in May and drove the region's median sales price to unprecedented levels.

June 14 -

The gap between what homeowners believe their home is worth and what the actual value widened for the sixth consecutive month in May, according to Quicken Loans.

June 14 -

Home sales and prices in the Baltimore area continued to climb in May, as buyers vied for properties in a market with historically low inventory.

June 13 -

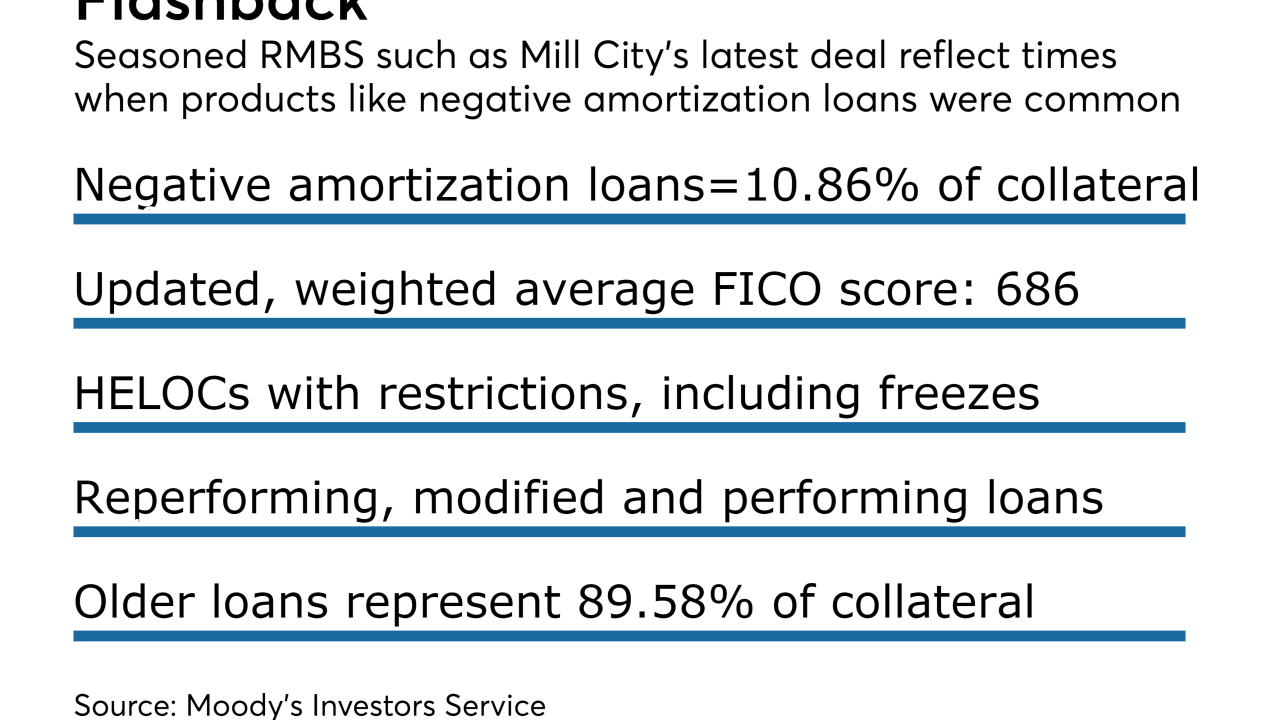

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

American International Group will receive $590 million in gross proceeds from the sale of Arch Capital Group stock it received in the United Guaranty Corp. transaction.

June 12 -

Median prices for single-family houses and condominiums on Maui increased by double-digit percentages in May as low inventory prompted buyers to snap up properties at a rapid pace.

June 12 -

Mortgage credit availability declined in May as lenders reduced the number of government-guaranteed products they market by nearly 2%.

June 9 -

The number of first-time single-family homebuyers has hit a peak not seen since 2005 and is expected to spur the origination of more mortgages with higher loan-to-value ratios.

June 8 -

Mortgage rates dropped for the fourth consecutive week and hit their lowest level in nearly seven months, according to Freddie Mac.

June 8