-

Rohit Chopra, the director of the Consumer Financial Protection Bureau, has cautioned banks, credit unions and fintechs about fair-lending violations that may stem from reliance on artificial intelligence. His comments threaten to discourage financial firms from using the technology to crunch nontraditional data about borrowers, experts say.

February 1 -

The co-founder of Arch Capital Solutions reviews the changes made to reporting disclosures on mortgages for condominiums and units located in HOAs that were part of a response to the tragic condo collapse in Surfside, Florida.

January 28 Arch Capital Solutions

Arch Capital Solutions -

The CEO of the Lincoln Family of Companies brand details its expansion strategy, which is unique for the settlement services business.

January 28 -

The mortgage broker business was never a driving force for the Chicago-based firm's purchase of Stearns Lending, so dropping it wasn't totally unexpected.

January 14 -

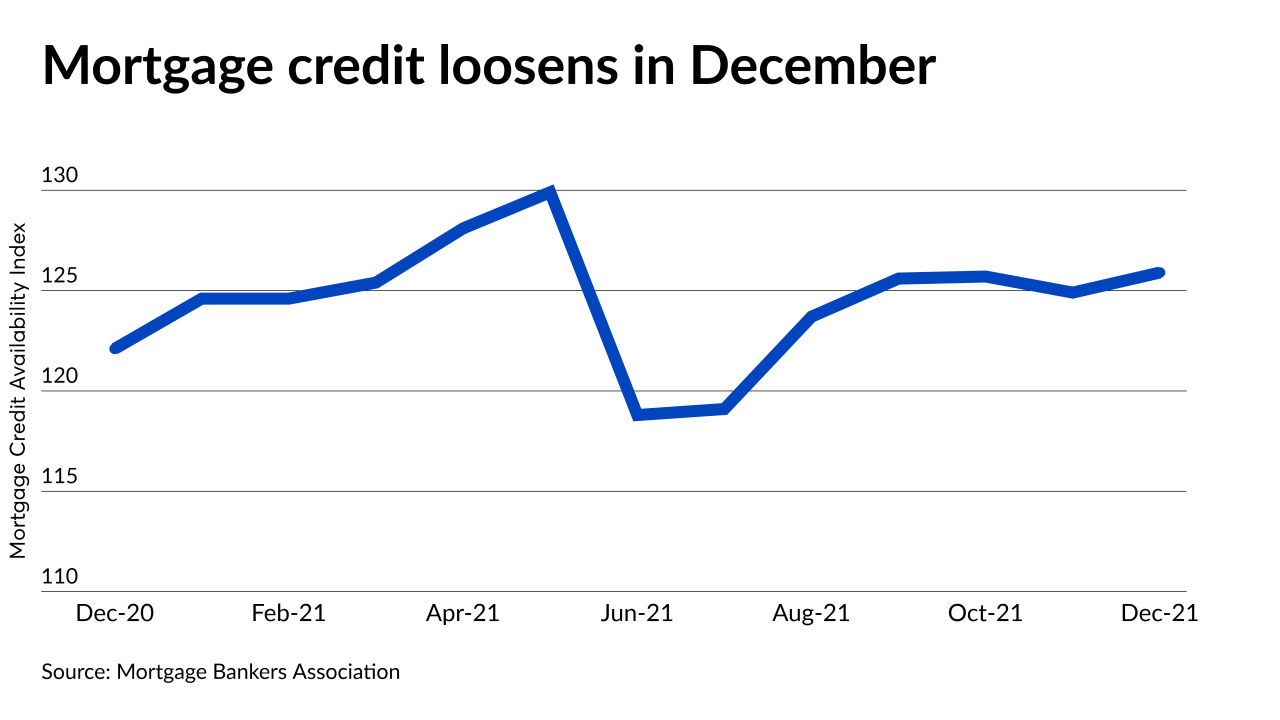

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11 -

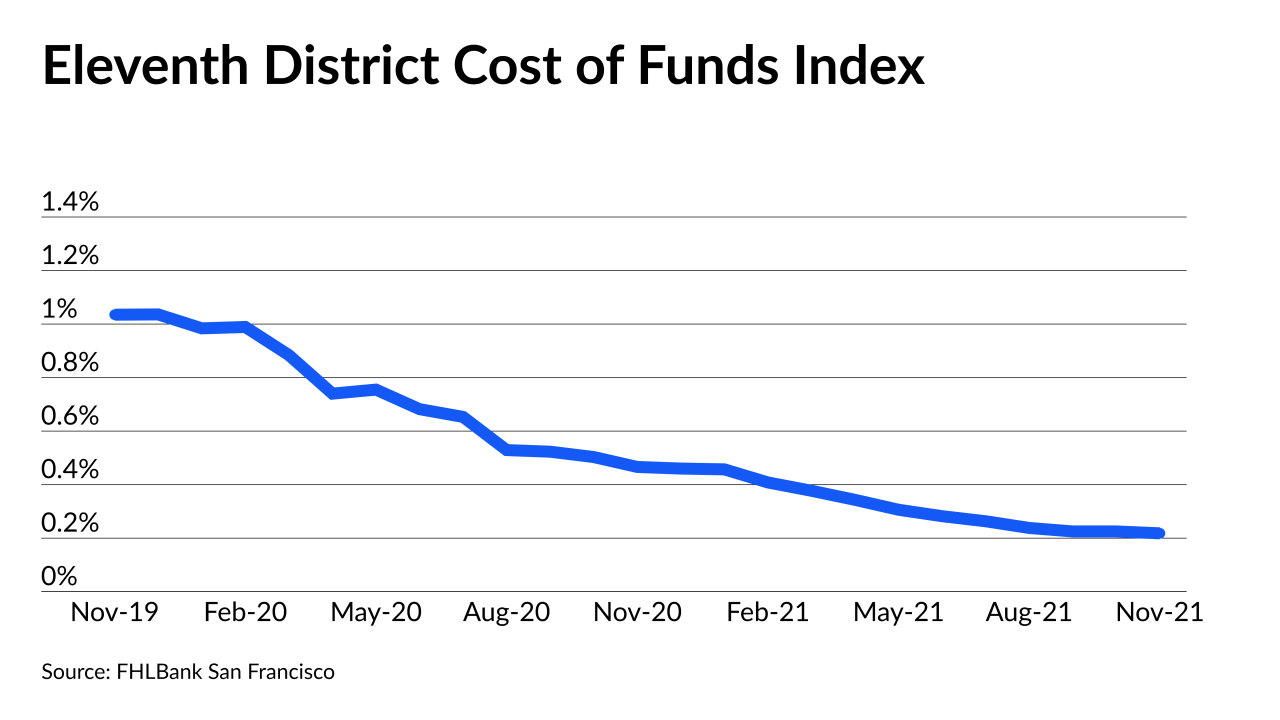

The metric’s imminent end after more than 40 years means servicers need to put replacement plans in motion if they haven’t already.

January 3 -

But low mortgage rates and higher wages are allowing borrowers to meet conforming loan underwriting terms — at least for now.

December 30 -

-

Error findings related to income and employment reached a high point since Aces Quality Management started its report in 2016.

December 14 -

Activity is down 20% from one year ago, driven by a 65% falloff in rate and term refinancings, Black Knight said.

December 13 -

While qualifying got a little tougher for entry-level buyers with lower incomes in November, some other prospective borrowers had an easier time of it.

December 10 -

This group of homeowners has greater financial obligations than any generation before them and largely aren’t aware of how they can make use of their home as an asset, a survey from Hometap found.

December 8 -

Borrowers who make at least a 10.01% down payment will not be required to obtain this form of credit enhancement, as these loans are not being sold to Fannie or Freddie.

November 17 -

The deal between the two fintechs aims to cut mortgage decisioning times for lenders and expand access to financing for consumers.

November 16 -

Even though one aspect of these lending standards is becoming more flexible, some say they still don’t always meet the needs of borrowers like delivery workers employed on a contract basis.

November 12 -

But overall, customers are less satisfied with their origination experience compared with the 2020 survey, according to J.D. Power.

November 11 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Values are predicted to increase by just a fraction of the rate they had in 2020, CoreLogic said.

November 2 -

The financial services technology provider will leverage multiple data sources to verify borrower salaries at a “flip of a switch.”

October 20 -

Gain on sale has dipped 130 basis points per loan since the third quarter last year, but over the same period, per loan expense is up by $1,216.

October 19