-

Compared with the second quarter, the title insurer had 154,000 more orders opened and earned $89 per residential file.

November 5 -

The ballot measure, which would allow local jurisdictions to expand rent control, had concerned mortgage companies who worried the law would result in a patchwork of different policies that could complicate underwriting and discourage lending.

November 4 -

The price for the commercial valuation and budgeting technology company was not disclosed.

November 4 -

The technology rolled out by the Department of Housing and Urban Development aims to provide lenders with immediate and expanded responses related to Federal Housing Administration insurance eligibility.

November 2 -

Two investors pushing CoreLogic Inc. to explore a sale won partial support from a prominent shareholder advisory firm, which urged shareholders to support three of the dissident group’s nominees for the board.

November 2 -

This deal comes a little more than two months after CIS combined with Avantus.

October 28 -

The company said it is "engaging with third parties" that are reportedly willing to pay at least $14 per share more than Senator Investment and Cannae Holdings.

October 28 -

The war of words between Senator Investments, Cannae Holdings and CoreLogic continues in the run-up to the Nov. 17 special shareholders meeting.

October 23 -

The agency confirmed that loans backed by Fannie Mae and Freddie Mac can continue avoiding debt-to-income limits as the bureau completes a revamp of the Qualified Mortgage standard.

October 20 -

While using the 30-day SOFR as its index, Freddie Mac structured the deal so it could shift to a one-month term if and when that rate is approved.

October 19 -

For many borrowers who might have qualified for conventional financing before the pandemic, non-QM loans are the only path forward toward homeownership.

October 16 Luxury Mortgage

Luxury Mortgage -

The pandemic has exacerbated delays and inefficiencies in loan manufacturing, while adding to security risks.

October 14 Kofax

Kofax -

Record-low interest rates, high origination volumes and social distancing created a perfect storm for mortgage fintechs like SnapDocs and LoanSnap to score a cash infusion.

October 13 -

The agency had raised concerns in the Obama administration about kickbacks in the marketing pacts between mortgage lenders and other providers, but the agency's recent guidance says the deals are legally viable.

October 9 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

The government-sponsored enterprises set a Sept. 30 deadline for sellers to accept applications for Libor adjustable-rate mortgages.

October 8 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

When the economy inevitably slides, leaders with a culture based on the mantra, "Treat people like family, and the money will take care of itself," won't need a miracle to survive.

October 6 Incenter

Incenter -

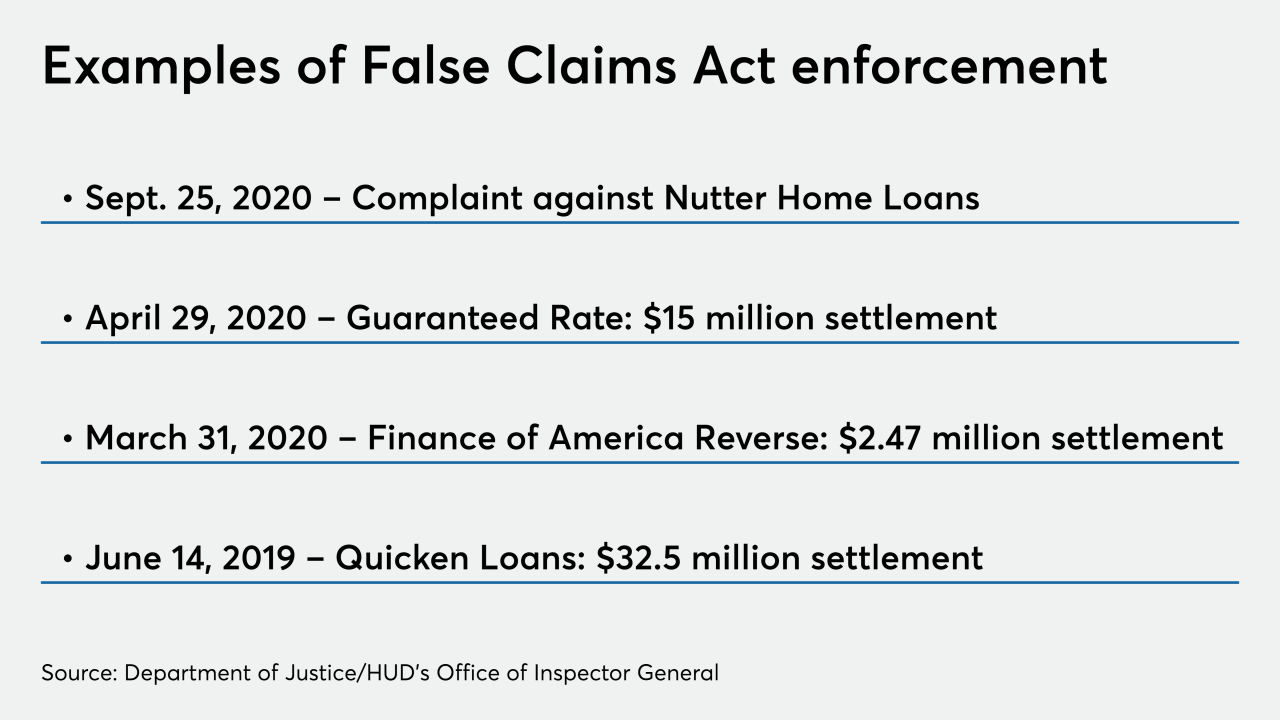

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

The donation will go through the Association of Independent Mortgage Experts in an effort to expand and diversify opportunities in the industry.

September 25