-

The California Consumer Privacy Act is here, but many mortgage lenders still don't know what that means for them.

February 4 Jornaya

Jornaya -

Mortgage refinancings made up slightly under one-third of MGIC Investment Corp.'s new insurance written during the fourth quarter, contributing a significant percentage of its business.

February 4 -

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 3 -

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 3 -

The prevention of wire fraud and cybercrime being perpetrated against the mortgage business is the latest passion for Regina Lowrie, longtime industry executive and the first woman to head up the Mortgage Bankers Association.

February 3 -

After maintaining a $250,000 exemption threshold for real estate appraisals for nearly 20 years, the National Credit Union Administration is set to raise that limit to $400,000.

January 31 -

Rooted in increased regulations and general customer backlash, there is a growing emphasis on collecting consent and ensuring privacy of customer data, especially following enactment of the California Consumer Privacy Act.

January 28 PossibleNOW

PossibleNOW -

FICO plans to release a new suite of scores that could reduce defaults on newly originated mortgages by 17%, but home lenders may not use it unless the government-sponsored enterprises do.

January 23 -

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

The Federal Housing Finance Agency is considering bringing back the idea of imposing stricter criteria for purchasing mortgages in areas where residential Property Assessed Clean Energy financing is available.

January 21 -

Mortgage lenders' uptake of innovations in artificial intelligence, big data and other technologies has been relatively slow. It's an approach that may not be tenable in 2020.

January 16 -

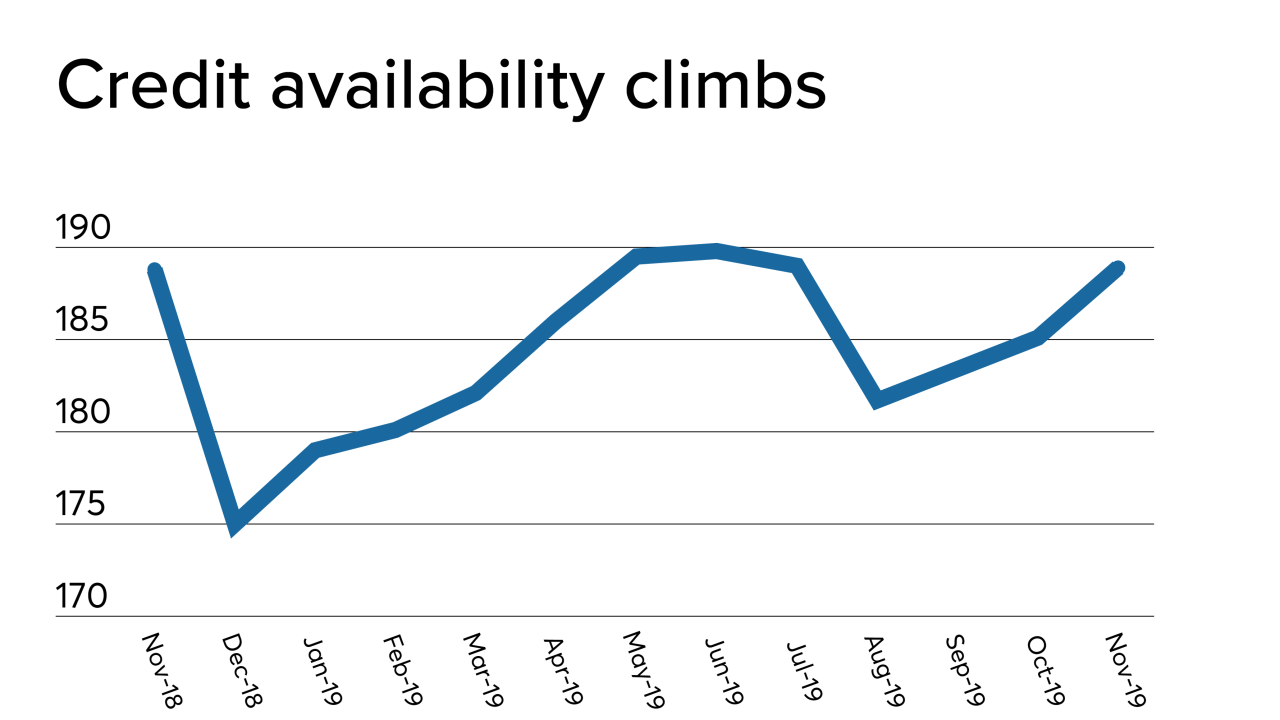

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

ClosingCorp, a San Diego-based provider of closing cost data, has purchased the WESTvm mortgage loan order management technology from West, an affiliate of Williston Financial Group.

January 8 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 3 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

The percentage of homes started last year and built within an association rose 2 percentage points to 63%, according to the National Association of Home Builders.

December 27 -

The critical defect rate for closed mortgage loans continued its decline in the second quarter, as lenders benefited from increased loan volume and profitability, an Aces Risk Management study found.

December 19 -

Mortgage lenders are increasingly introducing new loan programs outside of typical underwriting parameters in line with indicators suggesting that the availability of credit in the housing finance market is growing.

December 10 -

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

The housing market has changed dramatically since 2002 but the current appraisal limit has not. It's time for NCUA to catch up.

November 25