-

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

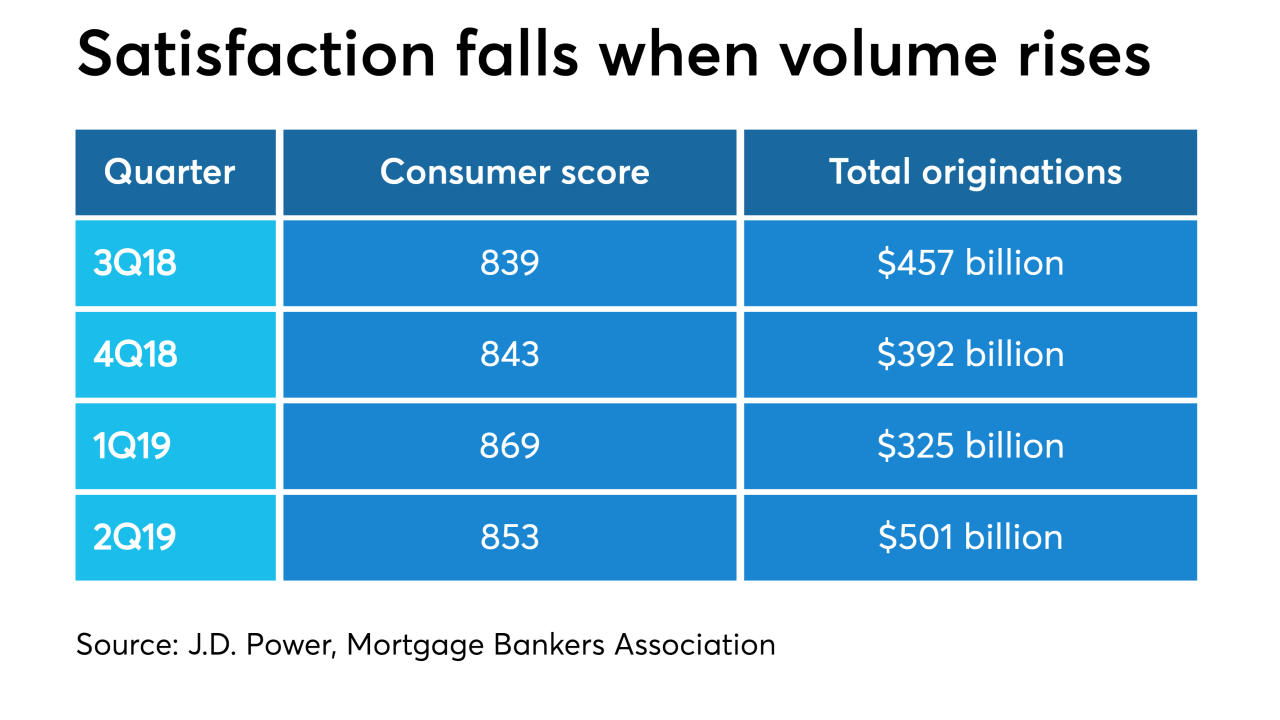

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

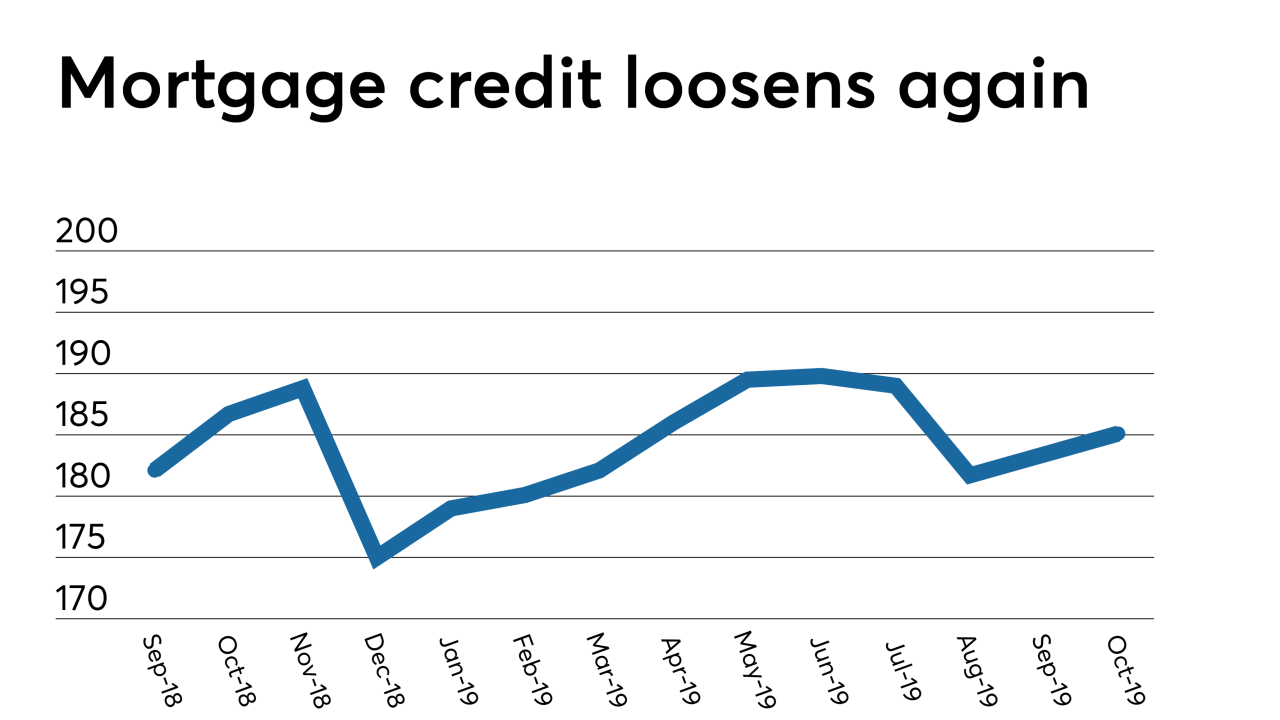

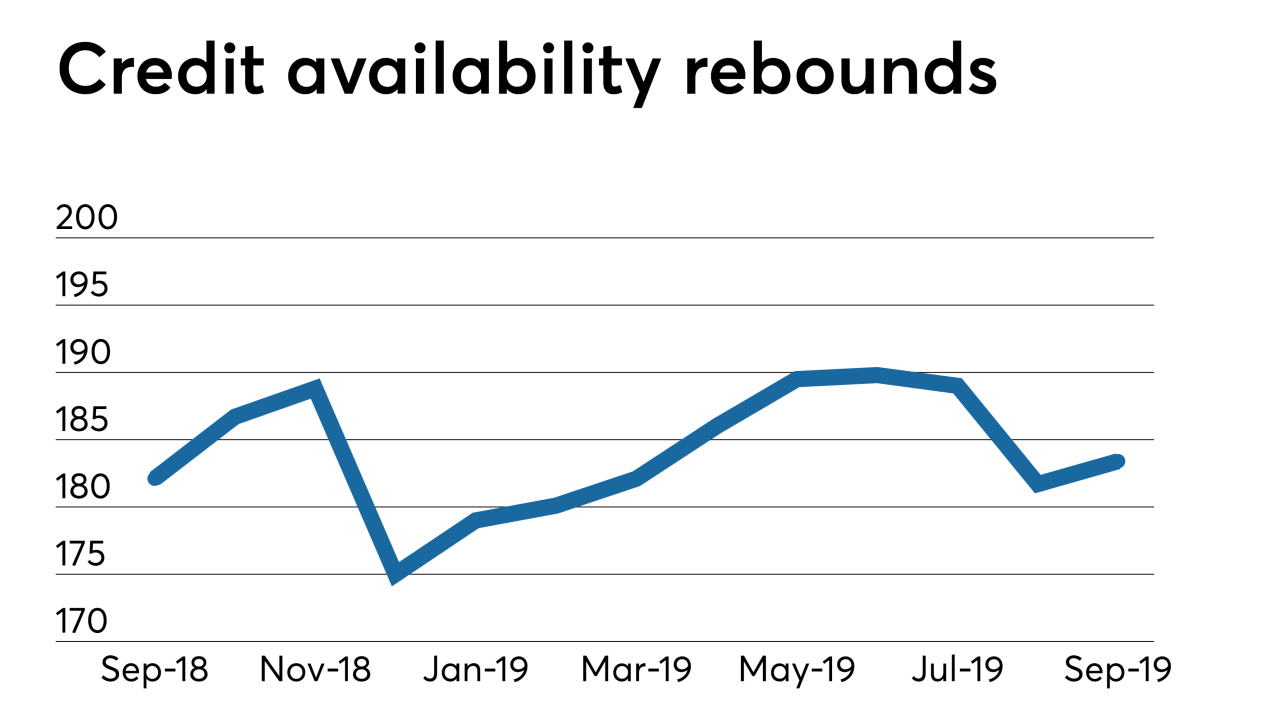

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

VantageScore totaled 12.3 billion scores across consumer credit loan categories over a 12-month period between 2018 and 2019 with minimal mortgage volume, leaving potential for a major ramp up.

October 29 -

Loan origination system provider Ellie Mae has agreed to purchase mortgage technology firm Capsilon, citing the growing appeal of artificial intelligence-driven automation and interest in becoming more active as an acquirer.

October 29 -

PointPredictive has rolled out IncomePASS, which uses machine learning technology to determine if the borrower's income as stated on the application is realistic.

October 25 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

Mortgage lenders prefer to invest in improvements to their consumer-facing technology because it offers a better return than similar spending on back-end processes, according to Fannie Mae.

October 16 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

Fannie Mae is cracking down on homebuyer education requirements, particularly for first-time homebuyers and purchasers utilizing high loan-to-value mortgages.

October 4 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

Freddie Mac is increasing the number of companies offering merged reports from the credit bureaus through integrations with its Loan Product Advisor automated underwriting system.

September 30 -

Freddie Mac's efforts to improve underwriting could include the use of a technology firm's artificial intelligence-driven consumer-risk modeling software that can expand access to credit, according to the Wall Street Journal.

September 26 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

Commercial real estate transaction volume rebounded in the second quarter from a poor first three months of 2019, although property price growth plateaued, according to Ten-X Commercial.

September 20