-

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

The second half of 2019 is a prudent time to examine the CRE market in the context of an inevitable slowdown, taking into account how the current landscape is impacting lending practices.

August 29 EDR Insight

EDR Insight -

The race to optimize mobile capabilities for consumers is far outstripping efforts to improve the back-office experience. That imbalance carries substantial risks.

August 28 -

Lower interest rates that have the power to reduce house payments are triggering a surge in mortgage refinancing activity and giving real estate agents hope that more affordable rates can lift area home sales that are barely lagging behind 2018.

August 26 -

Mortgage companies will be charged fees to upgrade an Internal Revenue Service system they use, but will benefit from the improvement as well.

August 22 -

The Mortgage Industry Standards Maintenance Organization is working with stakeholders to come up with a common means of handling new tax transcript authorization requirements in the Taxpayers First Act.

August 19 -

The Federal Housing Administration updated its lender certification proposal originally issued this past May, as it looks to ease industry concerns on False Claims Act enforcement.

August 15 -

The Department of Housing and Urban Development will remove some barriers to government-insured condominium lending next month, including a post-crisis measure housing industry groups have long complained about.

August 14 -

Angel Oak is now offering mortgage brokers and correspondent loan sellers a prequalification tool to determine borrower eligibility for non-qualified mortgages.

August 14 -

The Federal Housing Finance Agency has repeatedly reconsidered whether to add a language question to the GSEs' loan application, but its new director's latest call may finally resolve the question.

August 9 -

HSBC anticipates its mortgage underwriting volume ramping up significantly after recent initiatives to provide loan officers with more tools and time to address the complex needs of affluent customers, often from overseas.

August 8 -

More applications for non-QM loans might close if lenders and originators beefed up efforts to address missing or outdated information, according to Computershare.

August 8 -

Jumbo loan product availability continued climbing and reached an all-time high in July, but it wasn't enough to stop overall credit standards from tightening, according to the Mortgage Bankers Association.

August 8 -

Essent Group continued to benefit from the volatility in private mortgage insurers' market share, remaining in second place among the six active underwriters at the end of the recent quarter.

August 2 -

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

Loan officers' jobs are harder than they need to be because of back-end system inefficiencies, and it adds cost to the process.

July 31 cloudvirga

cloudvirga -

Equitable Group Inc. and Home Capital Group Inc. are reaping a windfall from Canada's tighter mortgage regulations.

July 31 -

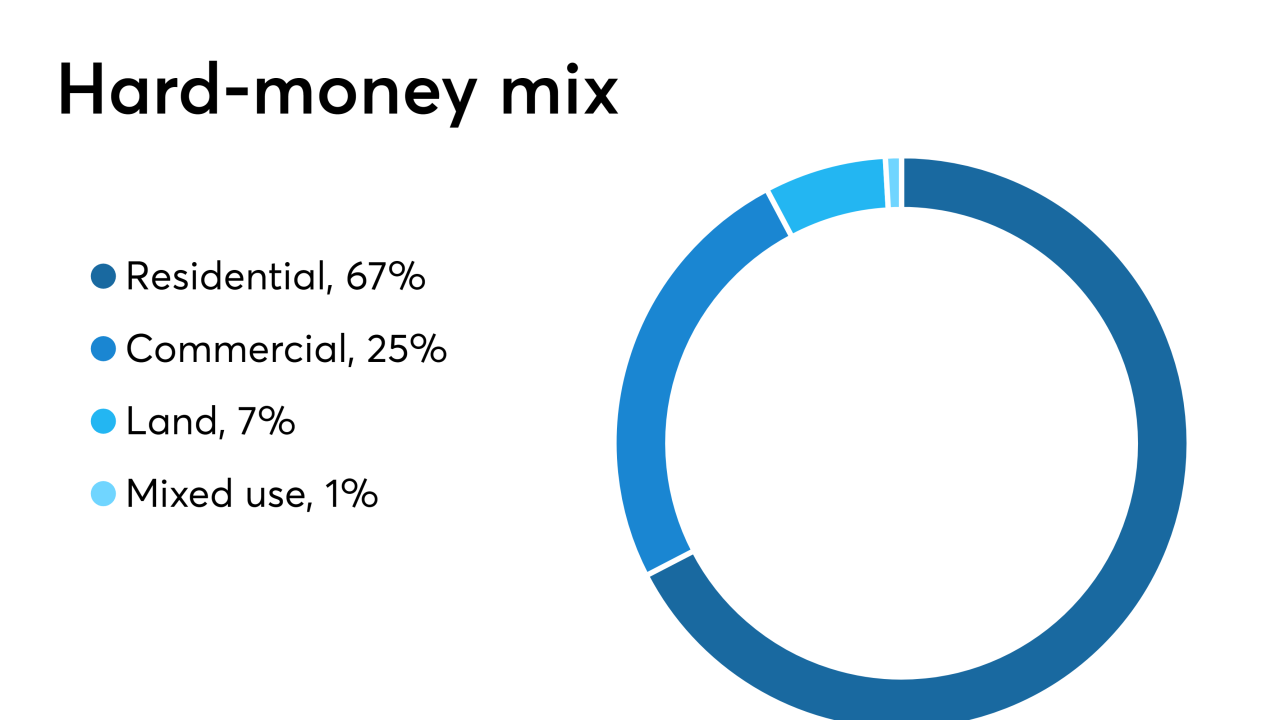

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

Waterstone Mortgage is now qualifying borrowers without a traditional credit history for both its conventional and government mortgage programs.

July 24