-

Mortgage and real estate professionals need to do a better job of educating consumers and themselves about the growing vulnerability to wire fraud schemes during the home buying process.

July 3 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

Mortgage application fraud risk declined for the second consecutive month in May as housing market dynamics shifted towards the buyers, First American said.

June 28 -

Making low-balance loans with poor economies of scale is tough in a market with slim margins, but it could have its rewards.

June 27 -

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a Moody's report said.

June 24 -

Real value comes from the wholesaler using a hands-on approach to ensure that a mortgage broker's customers are treated to the best experience for the life of the loan.

June 21 Home Point Financial

Home Point Financial -

Freddie Mac fulfilled its promise to offer a single mortgage that finances the home purchase price and improvements completed after closing.

June 20 -

Quicken Loans claimed victory in its dispute with the Department of Housing and Urban Development over the False Claims Act, only paying the agency for losses incurred and interest.

June 14 -

Guild Mortgage is targeting Airbnb hosts with its new refinance program, allowing them to use short-term rental income to qualify for a new loan on their owner-occupied primary residence.

June 14 -

Ally wants to increase productivity and improve the use of analytics to build on customer relationships.

June 13 -

As purchase applications stall in the heart of home buying season despite mortgage rates nearing two-year lows, lenders continued to loosen credit standards in May, according to the Mortgage Bankers Association.

June 11 -

Cutting the title insurance decision to nearly instantaneous will be the norm in the next 12 to 24 months, according to WFG Lender Services.

June 6 -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

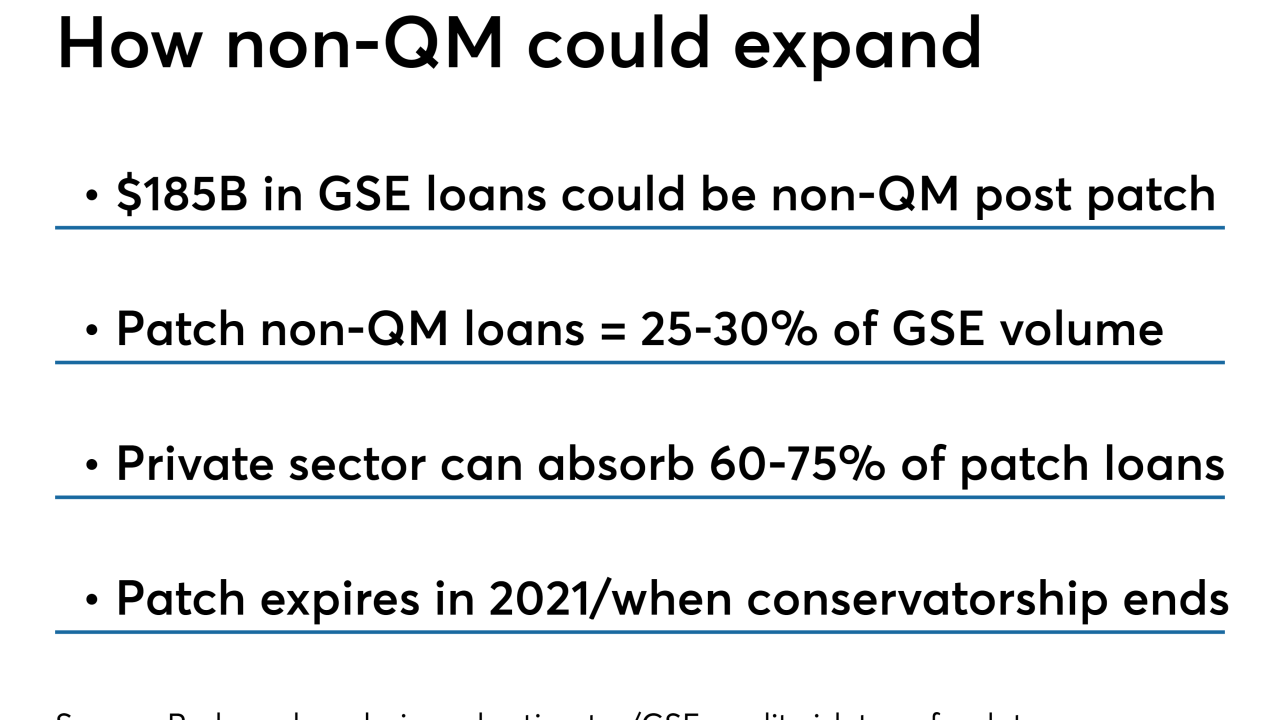

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

Mortgage application fraud risk declined for the first time since last summer because the home sales market became less competitive with an easing of the inventory shortage, First American said.

May 31 -

Investors shouldn't overreact to the first-quarter shift in private mortgage insurer market share, said the CEO of the company that benefited most from the change.

May 31 -

Freddie Mac uncovered a growing number of fraudulent school records and work histories in California, where Fannie Mae also has noted increasing instances of falsified employment information.

May 29 -

Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

May 28 -

Four real estate professionals could face up to 30 years in prison and hefty fines after being indicted on charges related to allegedly defrauding Fannie Mae, Freddie Mac and multifamily lenders.

May 23 -

One year into her tenure as SunTrust Banks' mortgage transformation officer, Sherry Graziano has put into motion several initiatives that are redefining the role of loan officers at the Atlanta-headquartered company.

May 22