-

As purchase applications stall in the heart of home buying season despite mortgage rates nearing two-year lows, lenders continued to loosen credit standards in May, according to the Mortgage Bankers Association.

June 11 -

Cutting the title insurance decision to nearly instantaneous will be the norm in the next 12 to 24 months, according to WFG Lender Services.

June 6 -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

Mortgage application fraud risk declined for the first time since last summer because the home sales market became less competitive with an easing of the inventory shortage, First American said.

May 31 -

Investors shouldn't overreact to the first-quarter shift in private mortgage insurer market share, said the CEO of the company that benefited most from the change.

May 31 -

Freddie Mac uncovered a growing number of fraudulent school records and work histories in California, where Fannie Mae also has noted increasing instances of falsified employment information.

May 29 -

Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

May 28 -

Four real estate professionals could face up to 30 years in prison and hefty fines after being indicted on charges related to allegedly defrauding Fannie Mae, Freddie Mac and multifamily lenders.

May 23 -

One year into her tenure as SunTrust Banks' mortgage transformation officer, Sherry Graziano has put into motion several initiatives that are redefining the role of loan officers at the Atlanta-headquartered company.

May 22 -

The Federal Housing Administration and Ginnie Mae will use their lagging digital mortgage positions to their advantage as they put an emphasis on building their technology.

May 21 -

The market for non-qualified mortgages has been robust thus far in 2019, offering a pragmatic option for otherwise viable borrowers, as long as lenders stay vigilant about pushing the envelope too far.

May 17 -

Americans continued to take on debt in the first quarter, though new mortgage borrowing slowed to the weakest level since late 2014, according to a Federal Reserve Bank of New York report.

May 14 -

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

May 14 -

Issuance of mortgage-backed securities increased and came close to matching 2018 levels in the latest month tracked by Ginnie Mae.

May 14 -

Hurricane Michael killed seven people and caused more than $6 billion in damage in Florida in October, a toll compounded by warmer, higher seas and wetter air, the signs of climate change scientists have long warned about.

May 13 -

First-quarter operating revenue in Equifax's Mortgage Solutions unit was the lowest it's been for the fiscal period since 2016, and the company anticipates declines in this division will remain a concern.

May 13 -

Lenders and policymakers could further build on a recent surge in Asian-American homeownership if they took three steps, according to the Asian Real Estate Association of America.

May 9 -

Mortgage lending credit standards loosened a bit last month as investors displayed more interest in non-qualified mortgage and nonagency jumbo loans to stay competitive, according to the Mortgage Bankers Association.

May 9 -

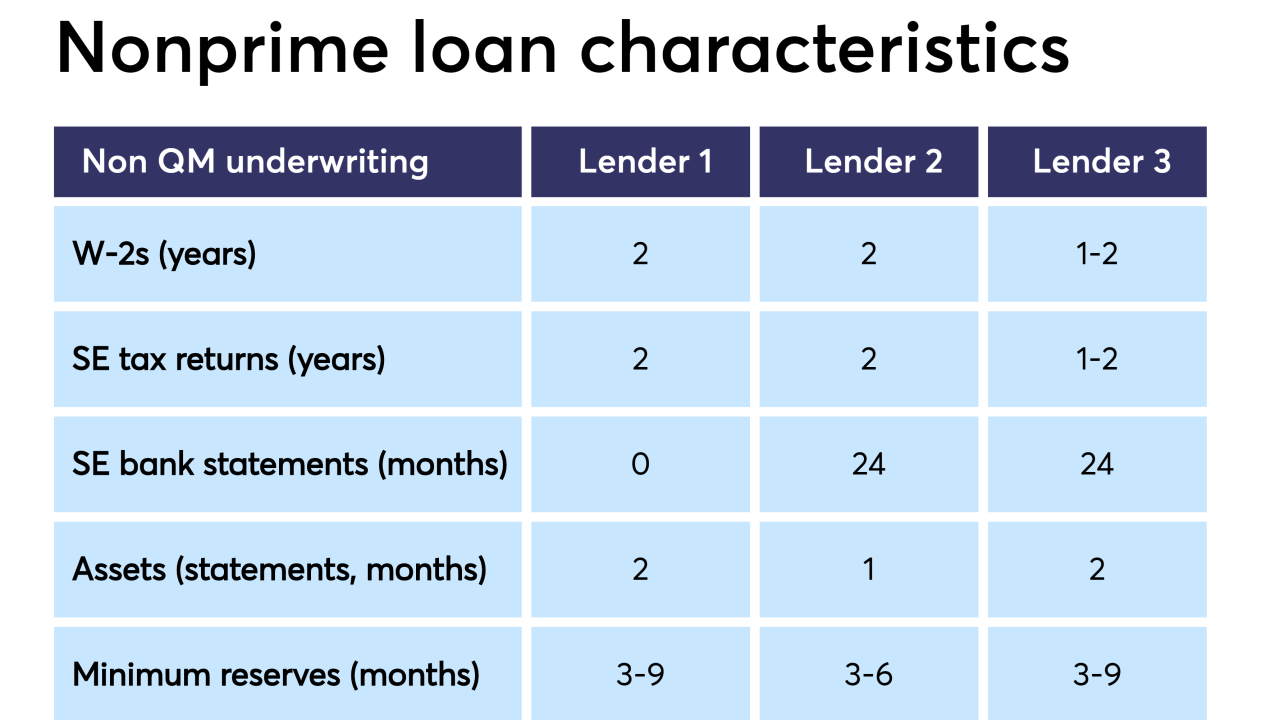

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6