-

The Federal Housing Administration and Ginnie Mae will use their lagging digital mortgage positions to their advantage as they put an emphasis on building their technology.

May 21 -

The market for non-qualified mortgages has been robust thus far in 2019, offering a pragmatic option for otherwise viable borrowers, as long as lenders stay vigilant about pushing the envelope too far.

May 17 -

Americans continued to take on debt in the first quarter, though new mortgage borrowing slowed to the weakest level since late 2014, according to a Federal Reserve Bank of New York report.

May 14 -

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

May 14 -

Issuance of mortgage-backed securities increased and came close to matching 2018 levels in the latest month tracked by Ginnie Mae.

May 14 -

Hurricane Michael killed seven people and caused more than $6 billion in damage in Florida in October, a toll compounded by warmer, higher seas and wetter air, the signs of climate change scientists have long warned about.

May 13 -

First-quarter operating revenue in Equifax's Mortgage Solutions unit was the lowest it's been for the fiscal period since 2016, and the company anticipates declines in this division will remain a concern.

May 13 -

Lenders and policymakers could further build on a recent surge in Asian-American homeownership if they took three steps, according to the Asian Real Estate Association of America.

May 9 -

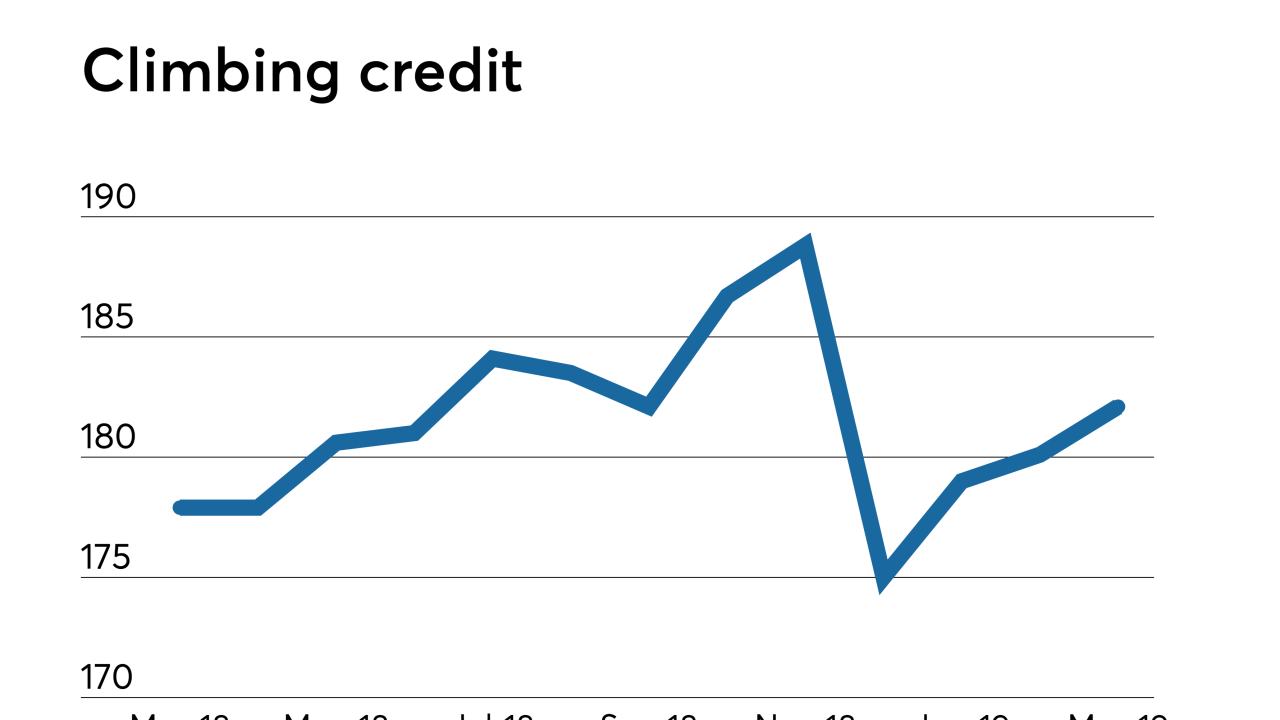

Mortgage lending credit standards loosened a bit last month as investors displayed more interest in non-qualified mortgage and nonagency jumbo loans to stay competitive, according to the Mortgage Bankers Association.

May 9 -

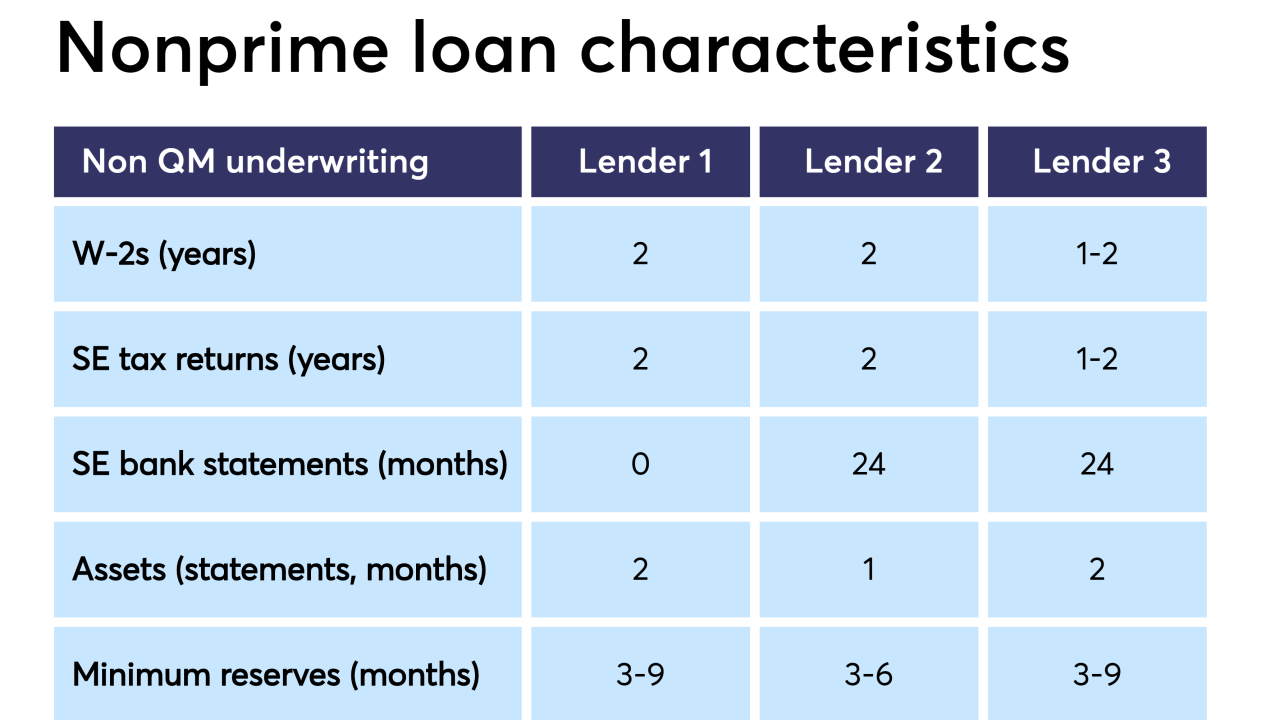

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

Artificial intelligence, automation, electronic closings; the 2019 Top Producers identified the biggest technology initiatives bending the way mortgages get done.

April 4 -

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

Mortgage borrowers don't know about the logistics of applying for a loan, which is the basis for their erroneous ideas about the process, the respondents to the 2019 Top Producers Survey said.

April 2 -

Plaza Home Mortgage's wholesale division has rolled out a one-time close, construction-to-permanent loan that meets Fannie Mae underwriting guidelines.

April 1 -

Technology, staffing, reform: Here's a look at 12 key insights from the 2019 Top Producers, from what they considered critical to success to stances they have on industry initiatives going forward.

April 1