-

A mortgage fraud scheme involving fake employment records, initially thought to be contained to Southern California, is occurring statewide, Fannie Mae said in a new fraud alert.

August 9 -

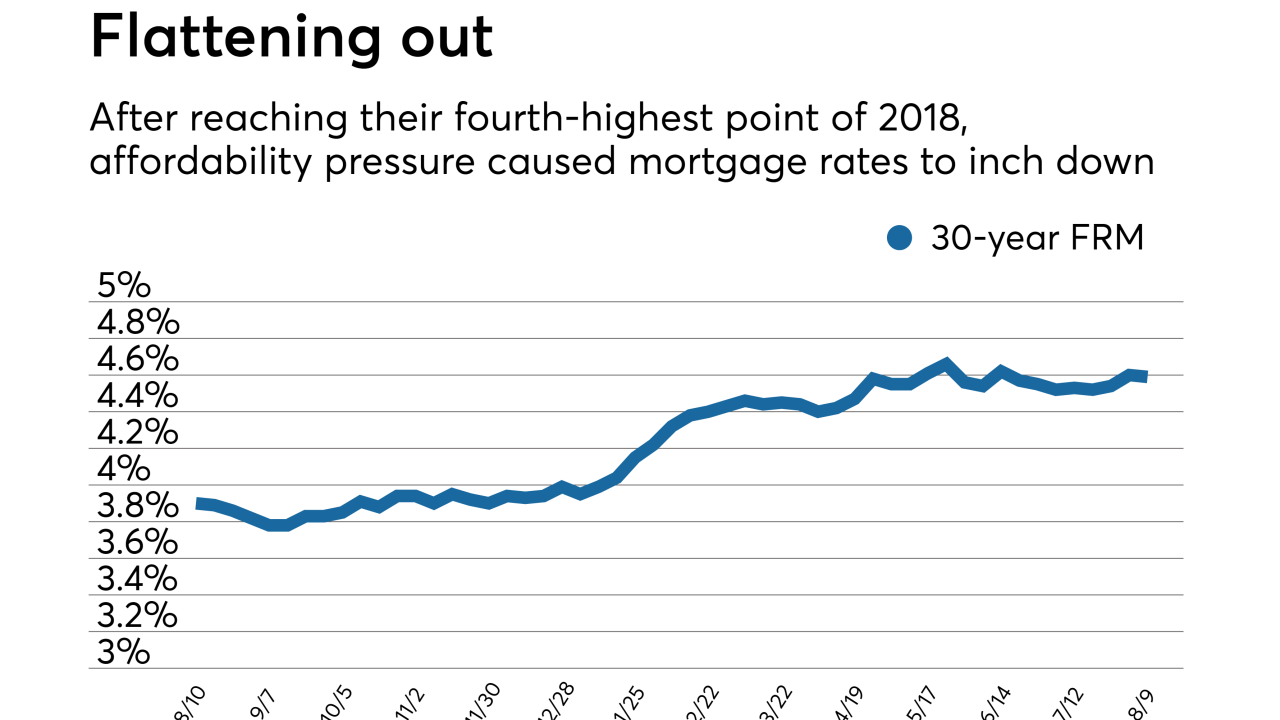

Mortgage rates took a small step back due to affordability pressure after climbing for the past two weeks, according to Freddie Mac.

August 9 -

Mortgage credit accessibility kept climbing in July, mostly thanks to an expansion of jumbo loan products offered, pushing that index to its historical high point, according to the Mortgage Bankers Association.

August 7 -

Wells Fargo estimates that in 400 instances, borrowers later went through foreclosure who were improperly denied or not offered a mortgage modification.

August 6 -

Revisions to the TILA/RESPA integrated disclosure that go into effect this fall drove the changes Ellie Mae made in its latest update to the Encompass loan origination system.

August 6 -

Social media is a main avenue for mortgage lenders to reach the next generation of homebuyers. New American is trying to make their own lenders experts in the space.

August 3 -

Mortgage rates rose to their highest level in seven weeks and fourth-highest of 2018, thanks to strong economic trends, according to Freddie Mac.

August 2 -

Freddie Mac produced modest second-quarter results, reflecting a stabilizing business that CEO Donald Layton compared to a utility company.

July 31 -

Loan defect risk rose in only three states and a handful of metropolitan regions in June thanks to the continuing spread of digital mortgage initiatives that improve data quality.

July 31 -

Ellie Mae saw a 20% year-over-year increase in second-quarter revenue with more loans closed using Encompass, but net income fell nearly 50% on an accounting change and acquisition costs.

July 26 -

Angel Oak Companies' affiliates increased their production of loans made outside the boundaries of the Qualified Mortgage definition by 90% year-over-year during the second quarter, when most lenders' volume fell.

July 23 -

Startup LoanSnap, a company funded in part by Virgin Group founder Richard Branson, has launched artificial intelligence that matches consumers with mortgages based on a complex analysis of their financial situation.

July 20 -

Mortgage rates took a small step down, decreasing for the sixth time in the eight weeks since Memorial Day, according to Freddie Mac.

July 19 -

Mortgage rates broke from their recent respite, increasing for only the second time in the past seven weeks, according to Freddie Mac.

July 12 -

Greater consumer access to credit could help mortgage bankers replenish originations eroded by higher rates, but they are reluctant to depart from the status quo to provide it.

July 11 -

Access to mortgage credit inched up in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

July 10 -

Healthier economic conditions, more effective underwriting methods and recovering hurricane-impacted states helped drive delinquency and foreclosure rates to their lowest level in over 10 years, according to CoreLogic.

July 10 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

Mortgage rates maintained their recent slide and have now declined in five of the past six weeks, according to Freddie Mac.

July 5 -

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3