-

Angel Oak Companies' affiliates increased their production of loans made outside the boundaries of the Qualified Mortgage definition by 90% year-over-year during the second quarter, when most lenders' volume fell.

July 23 -

Startup LoanSnap, a company funded in part by Virgin Group founder Richard Branson, has launched artificial intelligence that matches consumers with mortgages based on a complex analysis of their financial situation.

July 20 -

Mortgage rates took a small step down, decreasing for the sixth time in the eight weeks since Memorial Day, according to Freddie Mac.

July 19 -

Mortgage rates broke from their recent respite, increasing for only the second time in the past seven weeks, according to Freddie Mac.

July 12 -

Greater consumer access to credit could help mortgage bankers replenish originations eroded by higher rates, but they are reluctant to depart from the status quo to provide it.

July 11 -

Access to mortgage credit inched up in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

July 10 -

Healthier economic conditions, more effective underwriting methods and recovering hurricane-impacted states helped drive delinquency and foreclosure rates to their lowest level in over 10 years, according to CoreLogic.

July 10 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

Mortgage rates maintained their recent slide and have now declined in five of the past six weeks, according to Freddie Mac.

July 5 -

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

Mortgage rates declined over the past week as worried investors increased their purchases of 10-year Treasuries, according to Freddie Mac.

June 28 -

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

Mortgage rates slid over the past week and have now declined in three of the past four weeks, according to Freddie Mac.

June 21 -

Higher interest rates on home mortgages drove the share of loans used to purchase houses rather than refinance to new heights in May.

June 20 -

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20 -

The House Financial Services Committee approved a bill that would roll back the requirements of the TILA-RESPA integrated disclosures rule for charities like Habitat for Humanity and instead allow them to use the old good faith estimate and HUD-1 mortgage forms.

June 15 -

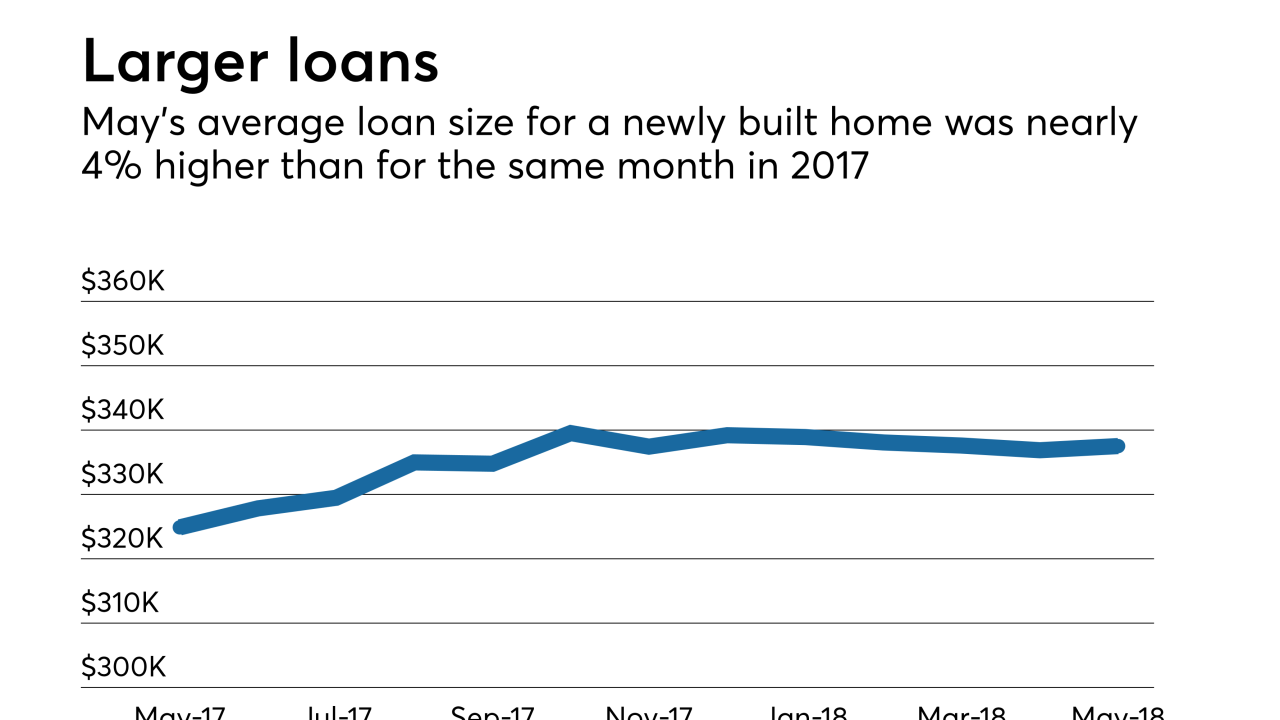

Mortgage applications for newly constructed homes declined in May as sales and supply are not keeping up with demand, the Mortgage Bankers Association said.

June 15 -

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

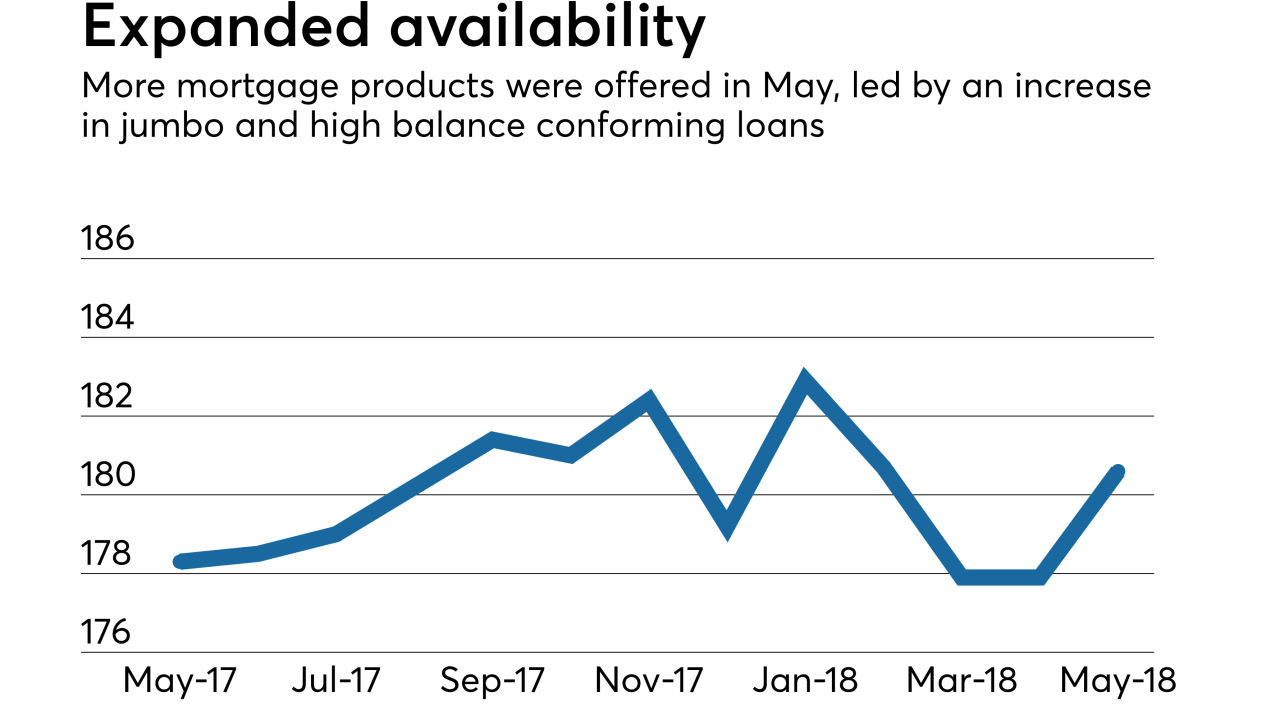

Mortgage credit availability increased in May by 1.5% as more jumbo and high-balance conforming loan products came on the market, the Mortgage Bankers Association said.

June 13 -

Genworth Financial's mortgage insurance business, which had slipped in market share, has more certainty about its future prospects after a federal government committee approved the holding company's acquisition by China Oceanwide.

June 11