-

A consumer retreat contributed to the trend, which may be getting a closer look as the Trump administration weighs a ban on institutional purchases.

January 16 -

Confidence among US homebuilders unexpectedly fell in January, as costly sales incentives outweighed a recent boost from lower mortgage rates and the president's housing proposals.

January 16 -

NAHB's remodeling index finished at its highest mark in a year, with the current industry outlook standing in stark contrast to homebuilder sentiment.

January 16 -

The government securitization guarantor could move forward with more big-picture initiatives as well this year now that it officially has a confirmed president.

January 15 -

Mortgage applications for new-home purchases decreased 15.2% on a seasonally adjusted basis in December, according to the Mortgage Bankers Association.

January 15 -

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

United Wholesale Mortgage sees this branding partnership as an opportunity to recruit workers in its home market in the Detroit area, CMO Sarah DeCiantis said.

January 15 -

Foreclosure filings were reported on more than 360,000 properties in the United States last year, up 14% from 2025 and 3% from 2023, according to Attom.

January 15 -

The latest Lower acquisition comes after several previous mergers with lenders as well as two last year that incorporated technology and real estate platforms.

January 14 -

The contract rate on a 30-year mortgage dropped 7 basis points to 6.18% in the week ended Jan. 9, according to Mortgage Bankers Association data released Wednesday.

January 14 -

Contract closings rose 5.1% to a 4.35 million annualized pace last month, the highest since February 2023, according to figures released Wednesday by the National Association of Realtors.

January 14 -

Over 46% of mortgage transactions examined had at least one significant wire fraud or title risk, with 3.2 findings per transaction, Fundingshield said.

January 14 -

Titl hopes to standardize and connect property records through a centralized, digitized U.S. registry, which would lead to reduced closing times and costs.

January 14 -

Total lock volume increased 2% from November and finished 30% higher than last December, according to Optimal Blue's latest Market Advantage report.

January 13 -

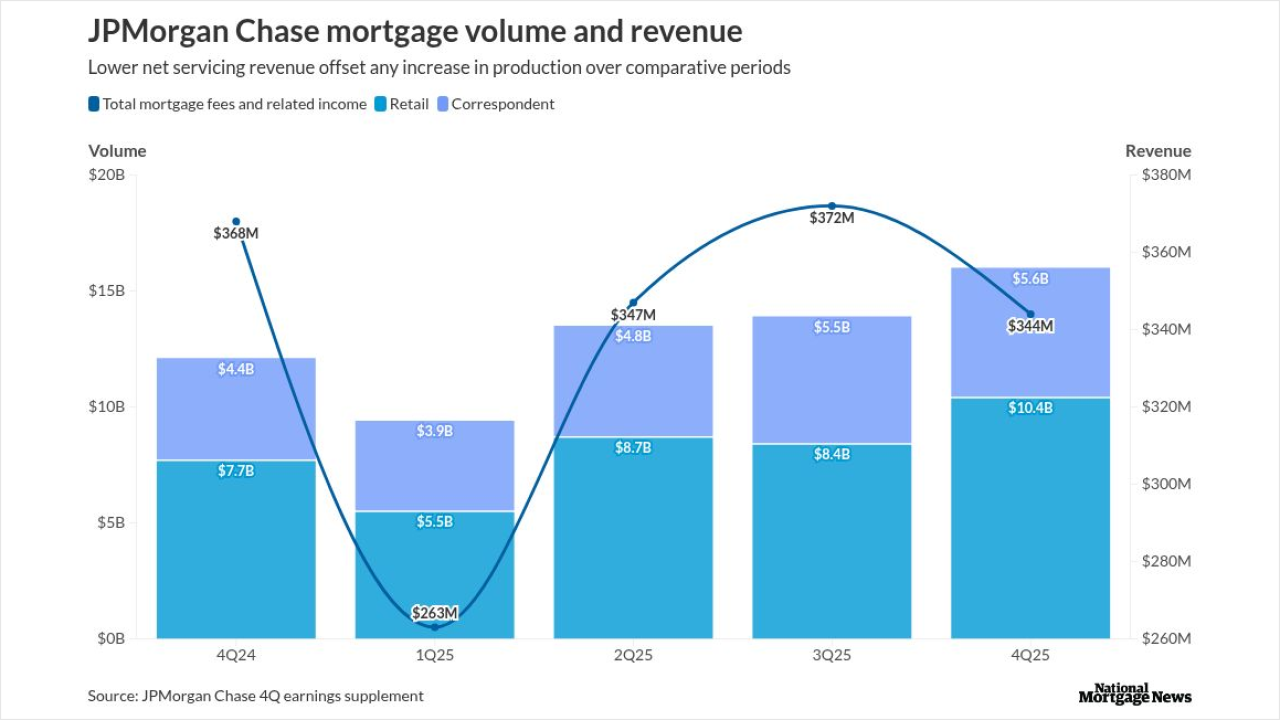

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

A Florida man's racketeering class action case accuses two mortgage employees of conspiring with a homebuilder to facilitate fraudulent construction draws.

January 13 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Sales of new homes in the US were little changed in October near the strongest pace since 2023 as builders lured anxious customers with price cuts and incentives.

January 13 -

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

January 12 -

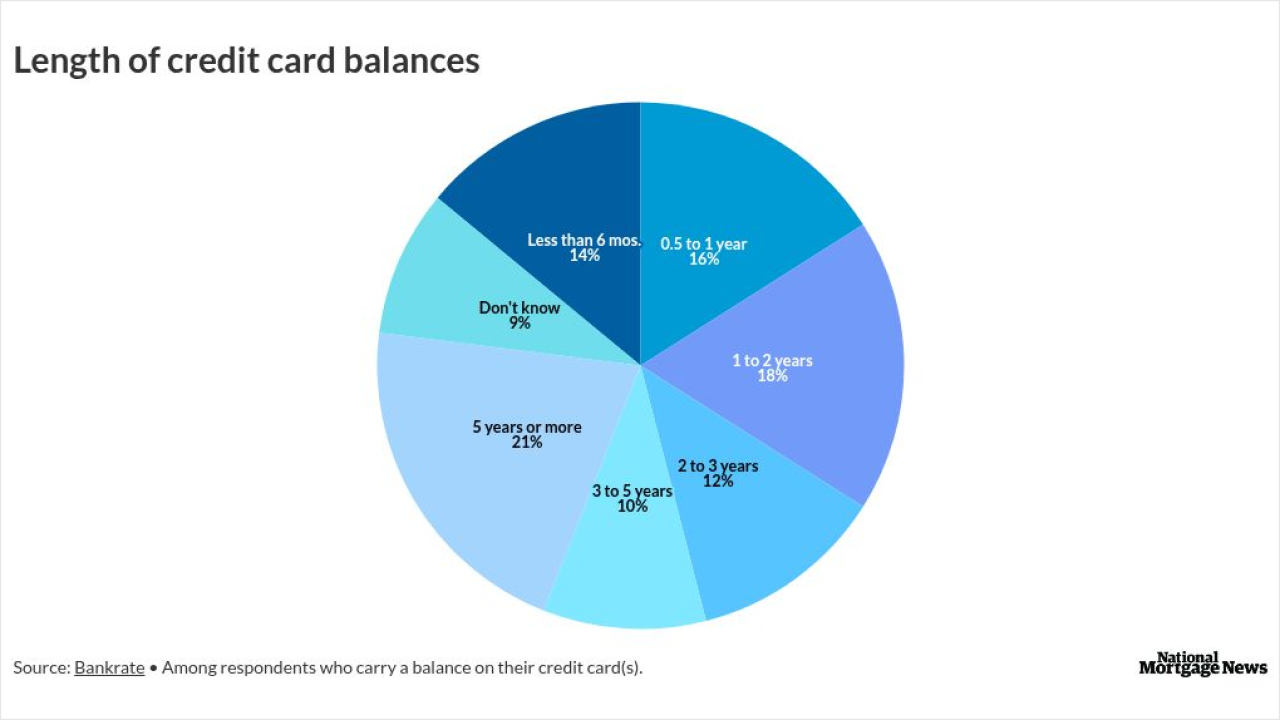

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12