-

About half of the multifamily housing units built nationally that use the federal 4% Low Income Housing Tax Credit are financed with tax-exempt PABs.

June 5 - LIBOR

Commercial and multifamily mortgage lenders need to figure out their plan for replacing the London interbank offered rate index potentially expiring at the end of 2021.

June 4 -

The exurbs were the only area that posted annual growth in new single-family home permits in the first quarter, highlighting an ongoing affordability battle for homebuyers and builders looking for land, according to the NAHB.

May 28 -

Activist investor Blue Lion, which has been waging a campaign for changes at HomeStreet Bank, is pressing the Seattle-based company to consider selling its Fannie Mae multifamily mortgage operations.

May 24 -

Kushner Cos., the real estate firm owned by the family of President Donald Trump's son-in-law Jared Kushner, has received about $800 million in federally backed debt to buy apartments in Maryland and Virginia.

May 24 -

Four real estate professionals could face up to 30 years in prison and hefty fines after being indicted on charges related to allegedly defrauding Fannie Mae, Freddie Mac and multifamily lenders.

May 23 -

Issuance of mortgage-backed securities increased and came close to matching 2018 levels in the latest month tracked by Ginnie Mae.

May 14 -

Housing advocates and Democratic lawmakers want to create more protections for tenants of rent-controlled apartments, but they are facing stiff opposition from property owners and the banks that lend to them.

May 10 -

With as many as 2,155 apartment units either proposed or under construction in Santa Fe, observers have different views on what role these large projects will play in Santa Fe's housing crisis.

April 24 -

Sheldon Oak Central, a Connecticut affordable housing developer, is at risk of losing half a million dollars in federal subsidies if it can't come up with cash to rehab one of its aging properties.

April 15 -

A strong real estate market is helping drive up residential property values across Scott County, Iowa, as many homeowners are seeing in assessment notices from the assessor's office.

April 12 -

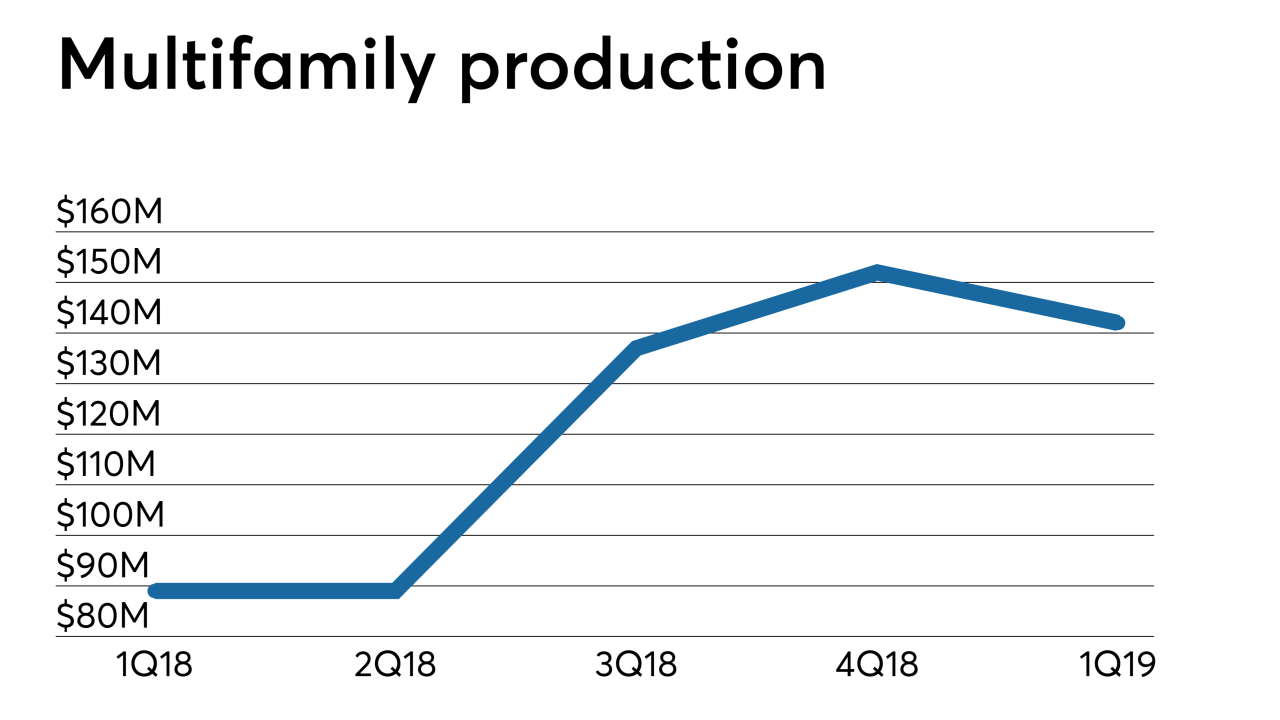

Multifamily and commercial lenders had another banner year in 2018, when closed-loan originations rose 8% to a high of $574 billion.

April 11 -

Homebuilders in the Twin Cities metro had their sleepiest March in four years with single-family and multifamily construction falling sharply.

April 3 -

An emerging gap between the government-sponsored enterprises on a Federal Housing Finance Agency scorecard item is prompting Fannie Mae to diversify its multifamily credit risk transfer efforts.

March 29 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27 -

A $54-million project to build upscale condominiums at the edge of downtown Detroit has been canceled, unable to get financing, and the Plan B is to put a hotel there.

March 25 -

With a second defendant pleading guilty to conspiracy, it was learned that a Watertown, N.Y., apartment complex is among dozens of rental properties in that state and several others that allegedly received $500 million in fraudulent bank loans.

March 25 -

Commercial and multifamily lending lags the technology available in the residential market. A look at how one expert thinks the gap could be closed.

March 22 -

Lennar, the region's largest home builder has acquired a huge piece of land alongside Interstate 15 in the San Diego community of Rancho Peñasquitos and is preparing to build 324 single- and multi-family homes for middle-class families.

March 22 -

Rhode Island's housing market cooled a bit in February, as the median sales price remain unchanged from the same month a year ago, but the number of sales fell, and houses lingered on the market a week longer before selling.

March 22