-

The guidance addresses confusion related to how lenders should handle situations in which borrowers have not paid for a year and need additional help due to a natural disaster.

June 11 -

Rising sea levels aren’t keeping buyers from scooping up oceanfront homes as work flexibility gives consumers wider options on where to live, according to Redfin.

June 9 -

Storm-related reconstruction costs — a large share of which may be concentrated in the New York City area — are estimated to total $1.9 trillion for water damage and $8.5 trillion for wind damage.

June 1 -

Increasingly extreme weather patterns and natural disasters weigh heavy on the majority of borrowers looking to buy a house, while half will move because of it, according to Redfin.

April 5 -

As global warming intensifies storms and flooding, formerly redlined neighborhoods with majority BIPOC occupants will likely bear the brunt of the damage risk, according to a Redfin analysis.

March 15 -

A Freddie Mac study of loans in forbearance from 2017 and 2020 found that, over both periods, borrowers had low credit scores and high debt-to-income ratios.

November 18 -

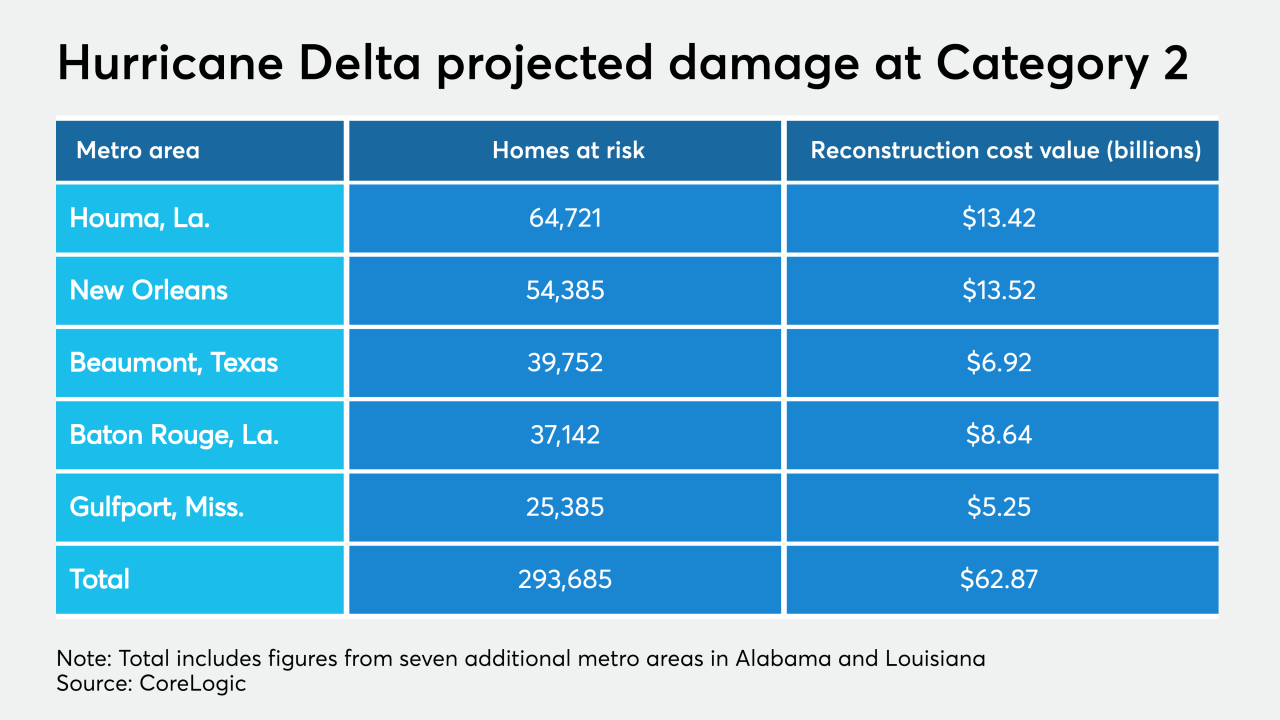

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

Despite a roller-coaster stock market, lingering pandemic and uncertainty caused by natural and made disasters, the real estate market continues to connect buyers to sellers.

September 28 -

Shannon King, a single mother, left the Bay Area a decade ago as housing costs soared, hoping to find an affordable place to live in southern Oregon.

September 21 -

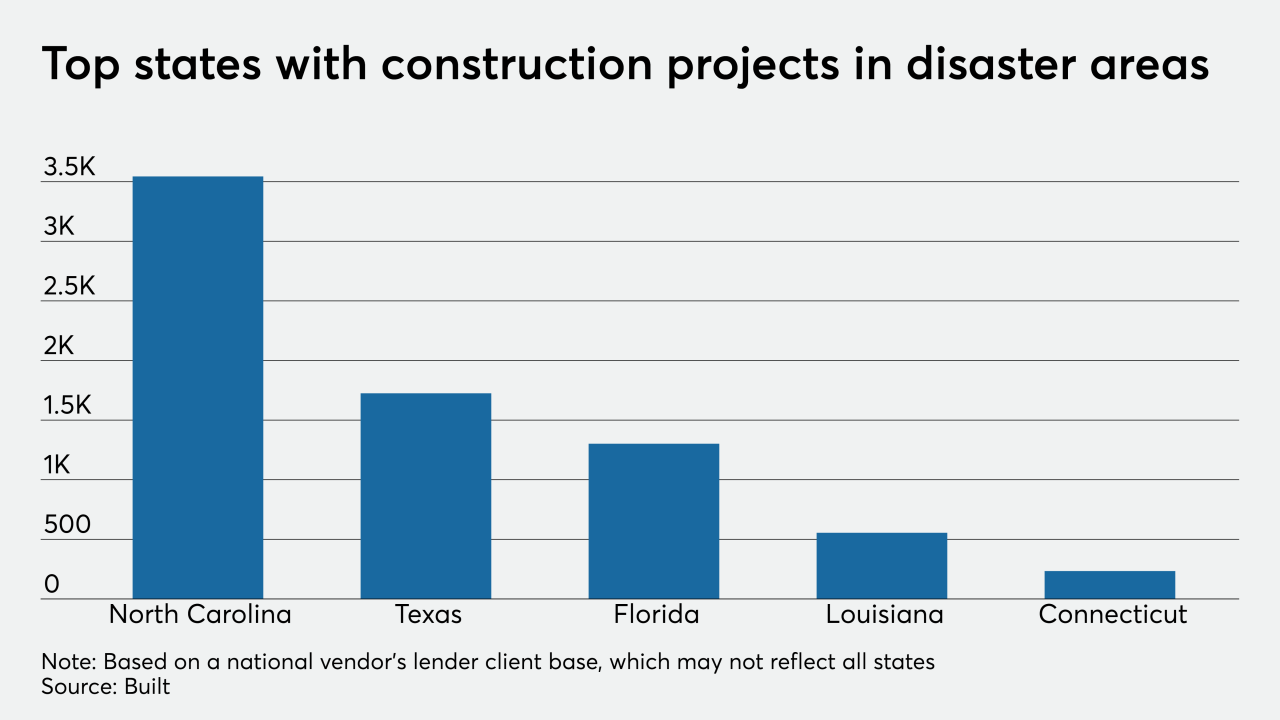

The technology company arrived at this percentage by mapping federally declared disaster areas to the projects it helps lenders manage.

September 3 -

The lightning-ignited Hennessey Fire destroyed 254 single-family homes in Napa County, Calif., making it one of the most destructive in county history, Cal Fire reported.

September 2 -

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

Developer Doug Loose says he is "living in a cloud" after recently securing financing through Frankenmuth Credit Union for a portion of his $4.2 million purchase of a damaged condominium complex in Midland, Mich.

August 10 -

Mortgage insurers had been operating under the belief that rules pertaining to natural disaster delinquencies apply with COVID-19, but now it's in writing.

July 1 -

If delinquency rates rise, all four stand-alone firms would have a capital shortfall.

June 9 -

In addition to the potential wave of mortgage defaults resulting from coronavirus-driven forbearances, hurricane season could put nearly 7.4 million homes worth $1.8 trillion at risk.

May 28 -

County homeowners may be eligible for federal assistance in the form of low-interest loans rather than grants.

May 25 -

Loans with coronavirus-related forbearance have to be reported as current to the credit bureaus but there’s a ripple effect from them that has implications for credit reports and underwriting.

May 22 -

Florida's first-ever — and short-lived — climate change czar set a clear priority for the state: Protect the real estate market.

April 27