-

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

Mortgage technology efforts have historically been behind the curve, but some recent responses to the coronavirus highlight instances where it rises to the occasion.

March 27 -

The government is cushioning the impact of the coronavirus on consumers, but independent mortgage bankers need funding to deal with increased levels of servicing advances because of forbearances.

March 27 Community Home Lenders of America

Community Home Lenders of America -

Independent mortgage bankers had their most profitable fourth quarter in seven years for originations, but the fallout from the coronavirus could upset the economics of the industry in the short term.

March 24 -

Refinancing activity is surging, existing borrowers are inquiring about loan modifications, loan closings are being delayed by more complex credit checks — and banks are short on people to handle it all.

March 19 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

March 9 -

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

March 6 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Franchisees of Remax Holdings' Motto Mortgage combined to originate over $1 billion in loans in the organization's third year of operations.

February 21 -

The CEO of Freedom Mortgage, Stanley Middleman, provides his take on trends affecting independent mortgage bankers as well as the residential real estate finance industry at large.

February 20 -

Unexpected rate drops and other factors drove a surprising rebound in nonbank mortgage hiring during what is usually a slow season.

February 7 -

To paint nonbanks as a source of systemic risk, particularly given the track record of commercial banks in causing the 2008 subprime mortgage fiasco, seems absurd.

February 7 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Federal Housing Finance Agency plans to increase liquidity standards for nonbank conforming loan servicers, and at the same time raise the net worth requirements for those that also perform the function for Ginnie Mae.

February 5 -

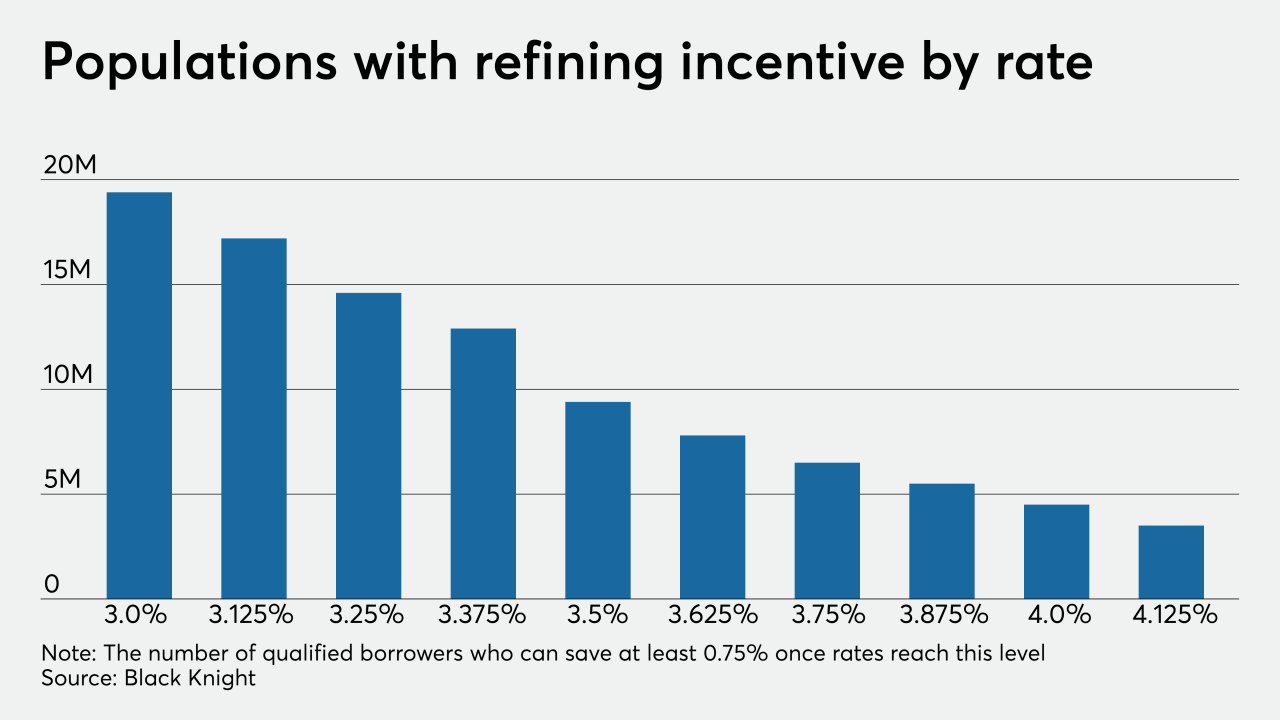

After being range-bound for several weeks, mortgage rates are fluctuating enough to spur significant changes in refi incentive, according to Black Knight.

January 29 -

The estimated number of mortgage professionals employed by nondepository institutions inched down in November 2019 following a surge in the previous month.

January 10 -

California Gov. Gavin Newsom plans to ask the legislature to revamp the current Department of Business Oversight and rename it the Department of Financial Protection and Innovation, modeled after the federal CFPB.

January 9 -

A Conference of State Bank Supervisors subsidiary settled a lawsuit with defendants who allegedly misused and reproduced copyrighted questions from a national exam mortgage loan officers take to obtain licenses.

January 8 -

The Department of Banking and Insurance in New Jersey is warning that enforcement of a 2019 residential mortgage servicer licensing law will begin in 2020.

December 31 -

Mortgage lenders are increasingly introducing new loan programs outside of typical underwriting parameters in line with indicators suggesting that the availability of credit in the housing finance market is growing.

December 10