-

Walter Investment Management Corp. is in danger of having its stock delisted from the New York Stock Exchange as its average market capitalization remains below required minimums.

August 17 -

Critics of recent False Claims Act enforcement argue the Justice Department is too heavy-handed toward lenders and servicers. But in an industry reputed for shoddy processes during the crisis, perhaps stringent oversight is warranted.

August 11 National Mortgage News

National Mortgage News -

PHH Corp. will pay the Justice Department $75 million to settle a False Claims Act investigation of its underwriting practices on government-insured mortgages and loans sold to Fannie Mae and Freddie Mac.

August 8 -

The year opened with hopes that regulatory and enforcement pressures would abate for the mortgage industry. The reality has turned out quite differently.

August 7 -

The nonbank mortgage sector had its largest one-month employment gain in a year, as independent mortgage bankers and brokers enjoyed stronger-than-expected originations during the second quarter.

August 4 -

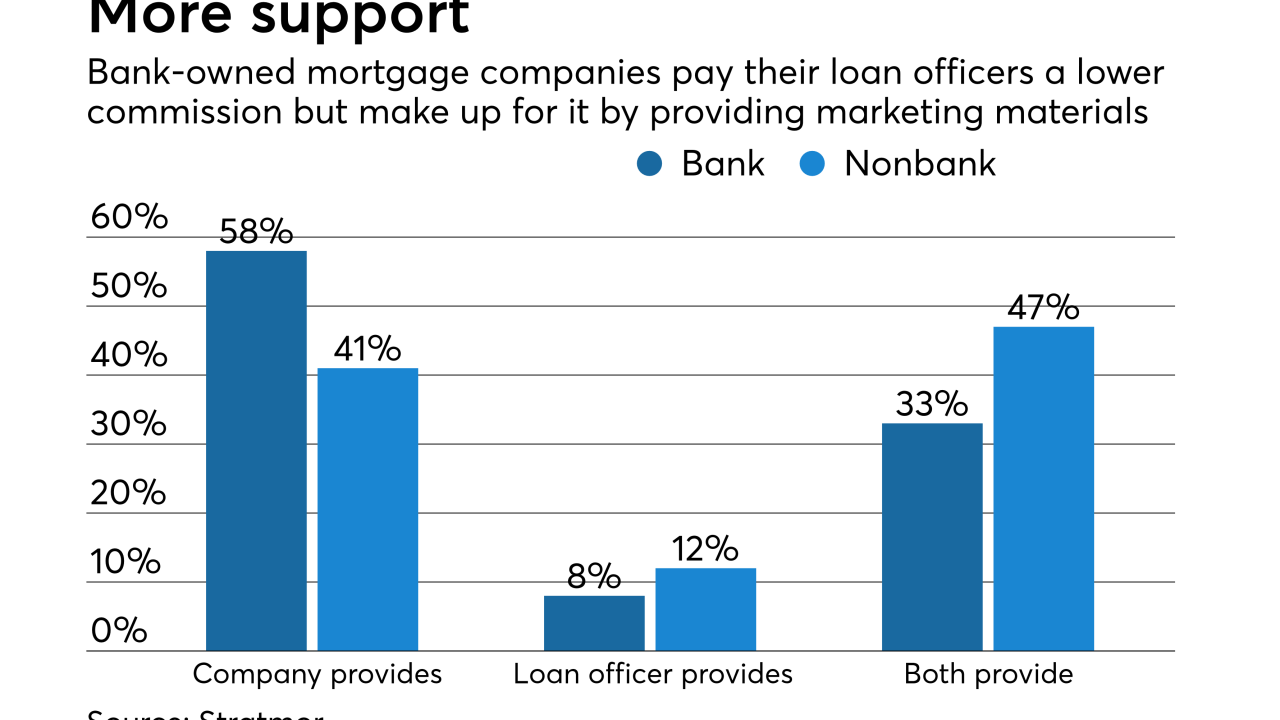

Banks pay their loan officers less than independent mortgage bankers do, but the level of sales support provided negates the difference, a study from Stratmor Group said.

July 28 -

Former Ginnie Mae President Ted Tozer is joining the board of directors at PennyMac Financial Services starting Aug. 1.

July 19 -

It's not only regulation that is hurting profitability, but also banks' failure to adapt to the internet age, according to a recent study.

July 12 -

Employment among nonbank lenders and mortgage brokers grew in May, marking the third straight month of employment gains at a time when housing inventory is tight, refinancing has slowed and home prices are rising.

July 7 -

From the largest banks to the smallest independents, policymakers want to hear the mortgage industry speak with one voice in the critical efforts to reform the government-sponsored enterprises.

June 29 Cunningham & Co.

Cunningham & Co. -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

New entrants in mortgage servicing are rethinking how business is done, creating more division between holders of mortgage servicing rights and the entities that actually manage loans.

June 13 -

Employment in the mortgage sector increased for the second consecutive month in April as the spring home purchase season began.

June 2 -

Maine's residential mortgage lending industry bears little resemblance to its prerecession version as changing conditions have shuffled the deck of top lenders and created new choices for borrowers.

May 23 -

Employment in the mortgage sector rose for the first time in three months in March, driven by an increase in loan broker hires.

May 5 -

The onslaught of regulatory actions against Ocwen may open the door for Nationstar to pick up a massive subservicing portfolio from the beleaguered servicer.

April 27 -

Congressional action to reform housing finance is ultimately needed, but we must confront the risk of continued drift and inaction if Congress is unable to act.

April 26 Community Home Lenders of America

Community Home Lenders of America -

Per-loan profits for nonbank lenders increased over 13% in 2016 from the previous year, driven by higher loan balances and increased revenue.

April 13 -

Employment in the nondepository mortgage banker and broker sector fell for the second consecutive month in February, a possible sign of growing concern about shrinking demand for mortgages.

April 7 -

From loan product mix to compensation plans, here's a look at the top factors that make or break independent mortgage banker acquisition deals.

April 3