-

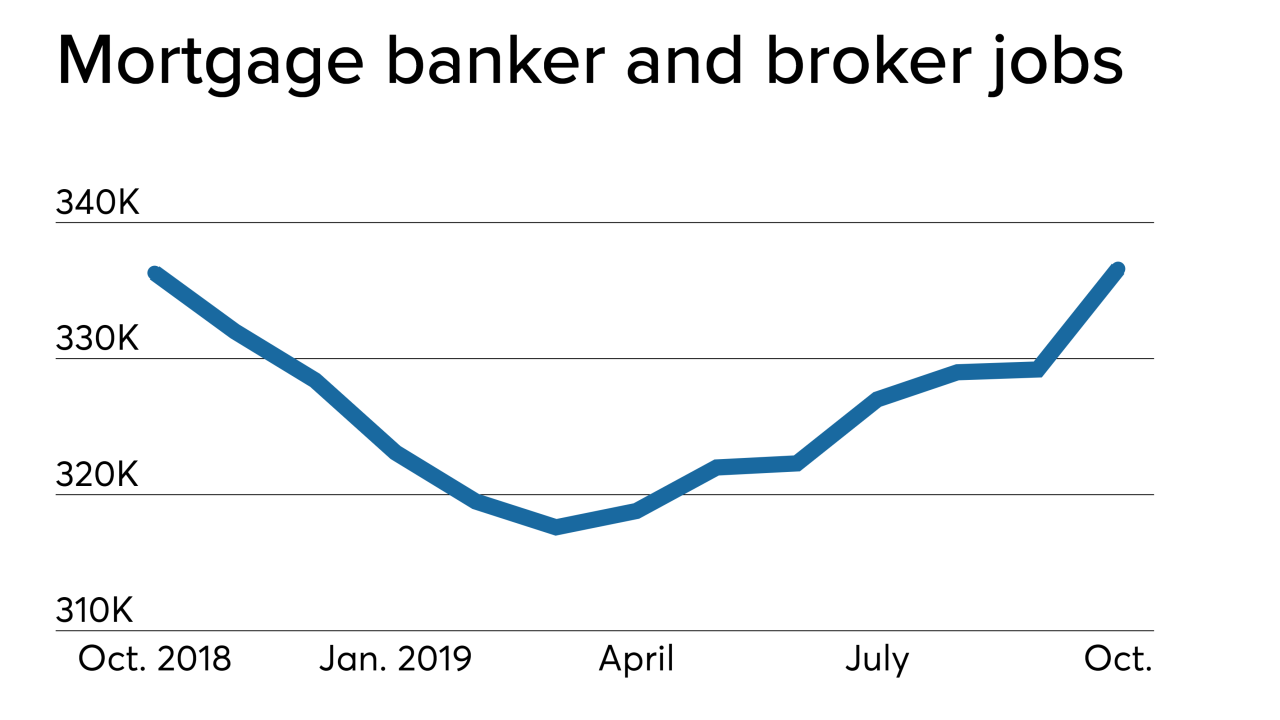

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 5 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 4 -

In a recent interview, Plaza Home Mortgage CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

The nonbank share of large mortgage servicing is growing, but smaller players tend to be depositories, the Consumer Financial Protection Bureau found in a new report aimed at examining regulatory impacts.

November 22 -

1st Alliance Lending is officially closing, but its CEO still plans to fight Connecticut's allegations that it used unlicensed personnel to take mortgage loan applications.

November 18 -

The 2015 decision posed new legal challenges for institutions trying to sell loans to third parties, but the federal regulatory agency proposed steps Monday for banks and debt parties to evade state interest rate caps.

November 18 -

The Consumer Financial Protection Bureau issued new rules governing mortgage lenders' screening and training of loan originators with temporary authority.

November 15 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

NewDay USA, a lender specializing in loans to veterans and military service members, is addressing rate-driven increases in refinancing by hiring more than 100 workers who are new to the business.

October 7 -

Employment estimates for nonbank mortgage companies rose to a 2019 high as lower rates spurred consumer demand in August, but higher rates in September could mean future numbers will be weaker.

October 4 -

Ginnie Mae's stress testing model was based on large issuers, and does not appear to adequately reflect important qualitative differences between larger and smaller issuers.

October 1 Hallmark Home Mortgage

Hallmark Home Mortgage -

A mortgage company's dispute with Connecticut over what tasks a licensed loan officer needs to handle points to a potential compliance concern for direct and digital lenders seeking to maximize efficiencies.

September 24 -

The Federal Housing Finance Agency is ending a Freddie Mac pilot that posed a competitive threat to the private market for mortgage servicing rights financing.

September 19 -

Nonbank mortgage companies added 4,600 employees to their payrolls in July and may add more to address continuing rate-driven increases in loan volume.

September 6 -

Syracuse Securities Inc., a family-run lender and servicer in New York, is planning to wind down and transfer its outstanding pipeline to Premium Mortgage Corp.

September 4 -

Independent mortgage bankers reported their highest average profit per loan originated in almost three years, benefiting from a large drop in production expenses, the Mortgage Bankers Association said.

August 29 -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

Wide short-term swings in interest rates — and loan prepayments — that we've all witnessed have serious secondary effects on consumers, lenders, investors and also policymakers.

August 19 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

1st Alliance has ceased lending activities following the loss of bonding in Connecticut, plus financial concerns it links to a state regulatory dispute, but it may later seek to recapitalize.

August 16