-

The President is promising big announcements on housing affordability issues in Switzerland, but will it include ending the GSE conservatorships?

January 20 -

What's said in the online video, which replicates the president's voice with his permission, may be as important to lenders as how the message is delivered.

January 20 -

Treasury Secretary Scott Bessent said Tuesday morning that banks should focus on the sweeping deregulation the administration has enacted as the industry pushes back on President Trump's proposed 10% credit card interest rate cap.

January 20 -

A consumer retreat contributed to the trend, which may be getting a closer look as the Trump administration weighs a ban on institutional purchases.

January 16 -

A pair of fair housing attorneys fired by the Department of Housing and Urban Development testified the agency has stopped enforcement of those laws.

January 16 -

President Trump Tuesday told reporters he would not delay announcing his pick to fill a new vacancy on the Federal Reserve Board despite threats from Republican Senators to block any Fed nomination until a recently-disclosed Justice Department investigation into Fed Chair Jerome Powell is resolved.

January 13 -

The Bureau of Labor Statistics reported Tuesday morning that consumer prices rose 0.3% in December, with annual inflation stuck at 2.7%, lending credence to the Federal Reserve's cautious stance toward interest rates heading into 2026.

January 13 -

Financial markets took a tumble Monday morning after Federal Reserve Chair Jerome Powell announced that he was the subject of a Justice Department inquiry concerning the central bank's headquarters renovation. Lawmakers and former Fed officials decried the move as political intimidation.

January 13 -

Continuing to retreat from Biden-era rules, the Consumer Financial Protection Bureau and Department of Justice withdrew a 2023 advisory opinion that had cautioned about denying credit to immigrants.

January 12 -

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

January 12 -

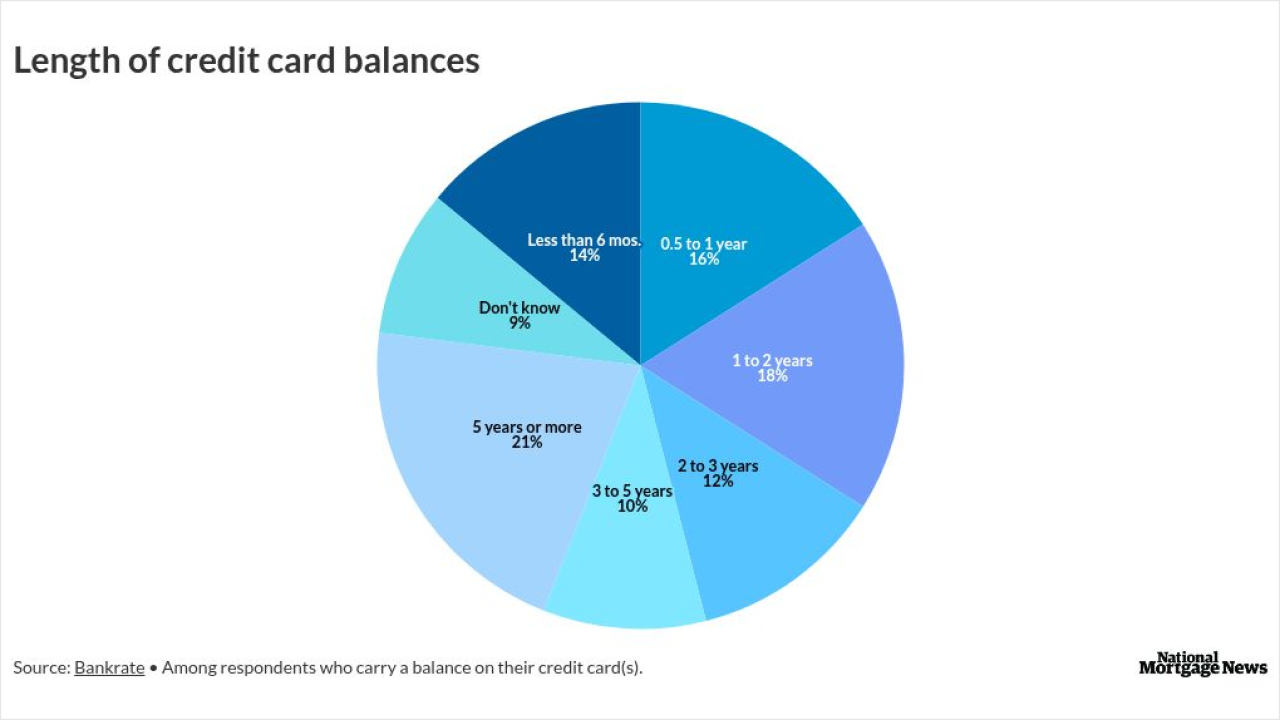

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

But a senior administration official said the DOJ, not Pulte, is behind the subpoena that relates to Powell's congressional testimony about Fed building renovations.

January 12 -

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

President Trump said he would prohibit large institutional investors from buying single-family homes. While the executive couldn't bar such investments on its own, a legislative ban could gain bipartisan support.

January 7 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

While the US military operation in Venezuela didn't hit sentiment on American financial markets, the action reminded investors how tenuous any trading thesis can be in a world undergoing geopolitical changes.

January 6 -

Federal Reserve Bank of Richmond President Tom Barkin said economic uncertainty should ease in the coming year as businesses gain confidence in sustained demand and adapt to the new policy environment.

January 6 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5