-

With today’s generation of home buyers so rooted in a digital world, how will the financial services industry need to change to meet their needs? What new consumer technology will they need to adopt to meet consumers where they are? How will those approaches differ from how things have been done historically in the industry? Join us in a discussion with Blend’s Founder, Nima Ghamsari as we chat through how banks and financial institutions need to think through these questions.

-

The inventory shortage is a likely driver of an increased willingness to consider a house where suspected paranormal activity occurred.

October 25 -

Seasonal patterns are also playing a part in the slowdown in buyer demand, the company said.

October 22 -

This increases the opportunity for the company to keep in touch with its HomeSafe and EquityAvail customers between the loan closing and when it becomes due.

October 21 -

Large companies competing to become the Amazon or Google for home lending products discuss their use of acquisitions and targeted marketing to cultivate the image of being a one-stop-shop innovator.

September 20 -

Hopes that the pandemic has been curbed have dimmed as infections and hospitalizations are on the rise again due to the introduction of the extremely dangerous Delta strain. For some companies, this has disrupted their plans to bring remote employees back to their offices or institute a "hybrid" arrangement.

-

The company's new name helps reflect the business lines it expanded into outside of fix-and-flip during the last few years.

September 1 -

Rep. Val Demings introduced legislation in Congress that automatically triggers a stop on evictions and foreclosures for homeowners with federally-backed mortgages when a disaster is declared.

August 20 -

The bank's noninterest expenses fell by 8% in the second quarter — a sign that CEO Charlie Scharf is making progress in reining in spending that had been soaring in recent years amid heightened regulatory scrutiny. He ultimately hopes to reduce gross expenditures by $8 billion annually.

July 14 -

For the first time, the FDIC, Federal Reserve and OCC have combined efforts to advise banks on risk management procedures when working with nonbank partners.

July 13 -

A new public-private network is pursuing a more comprehensive approach than other states to cultivate a strong financial technology industry by uniting banks, insurance companies, startups, government agencies, investors, universities and students.

June 9 -

2020 was a challenging year for banks. The impact of COVID on the economy as well as changes to accounting for loan loss provisions were evident in weaker financial and stock price performance in 2020 for many banks and yet CEO compensation increased. Learn from experienced executive compensation consultants about the challenges Compensation Committees faced in 2020, why pay levels increased relative to 2019, what were common COVID-related compensation changes, and what changes were made for 2021 incentive plan design.

-

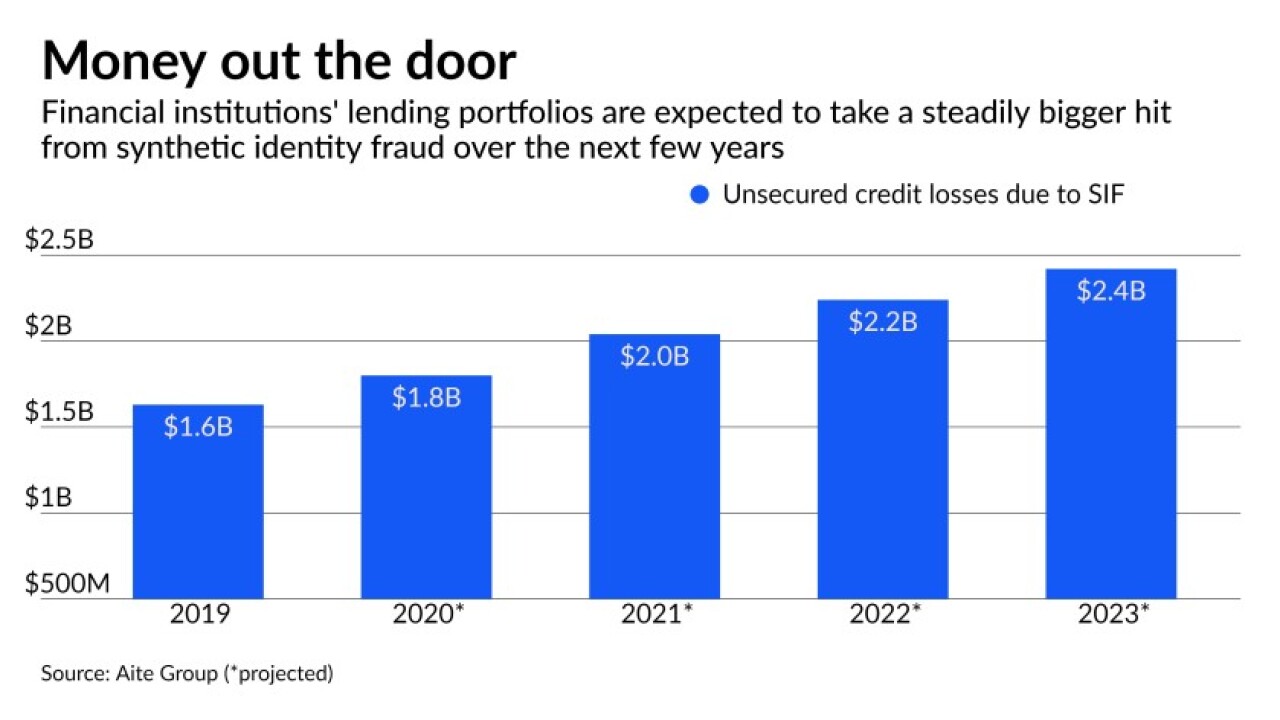

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

The move formalizes the use of the Rocket Mortgage moniker, which has been a major part of the company’s branding since 2016.

May 12 -

Juliet Weissman of New York City's Cornell Tech campus discusses the role of higher education and partnerships in luring startups and their workforces.

May 10 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

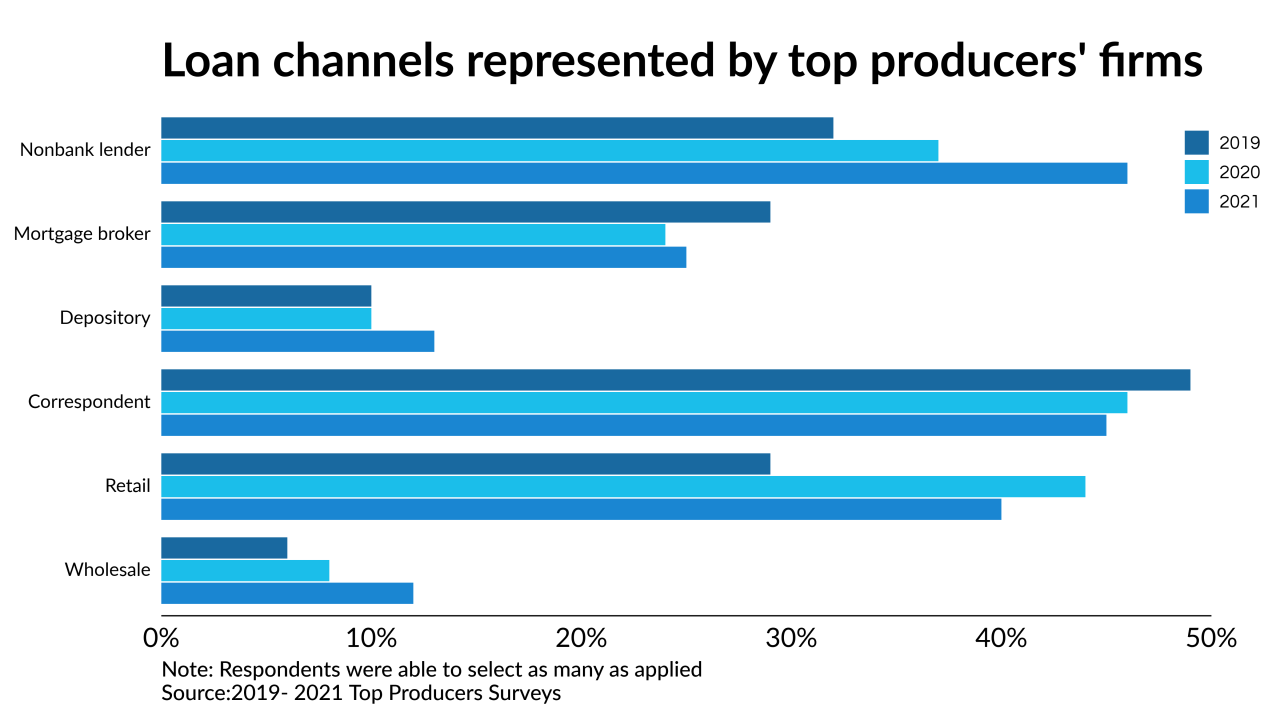

The loan officers who brought in the highest volumes last year offer their perspectives on social media, the GSEs, loan channels and more.

April 15