-

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

Mortgage application activity increased 3.8% from one week earlier, with refinance volume for Federal Housing Administration-insured loans taking the spotlight, the Mortgage Bankers Association said.

December 11 -

The prequalification letter is a great way to move borrowers from casual tire kickers to committed applicants, but advances in digital verification will soon make it obsolete.

December 10 Blend

Blend -

The housing market is likely changing to predominantly repeat purchasers, even as growth in the first-timer buyer segment continued in the third quarter, a study from Genworth found.

December 10 -

Colorado Springs-area homebuyers continued to find slim pickings last month, as the supply of local properties available for purchase remained at historically low levels.

December 9 -

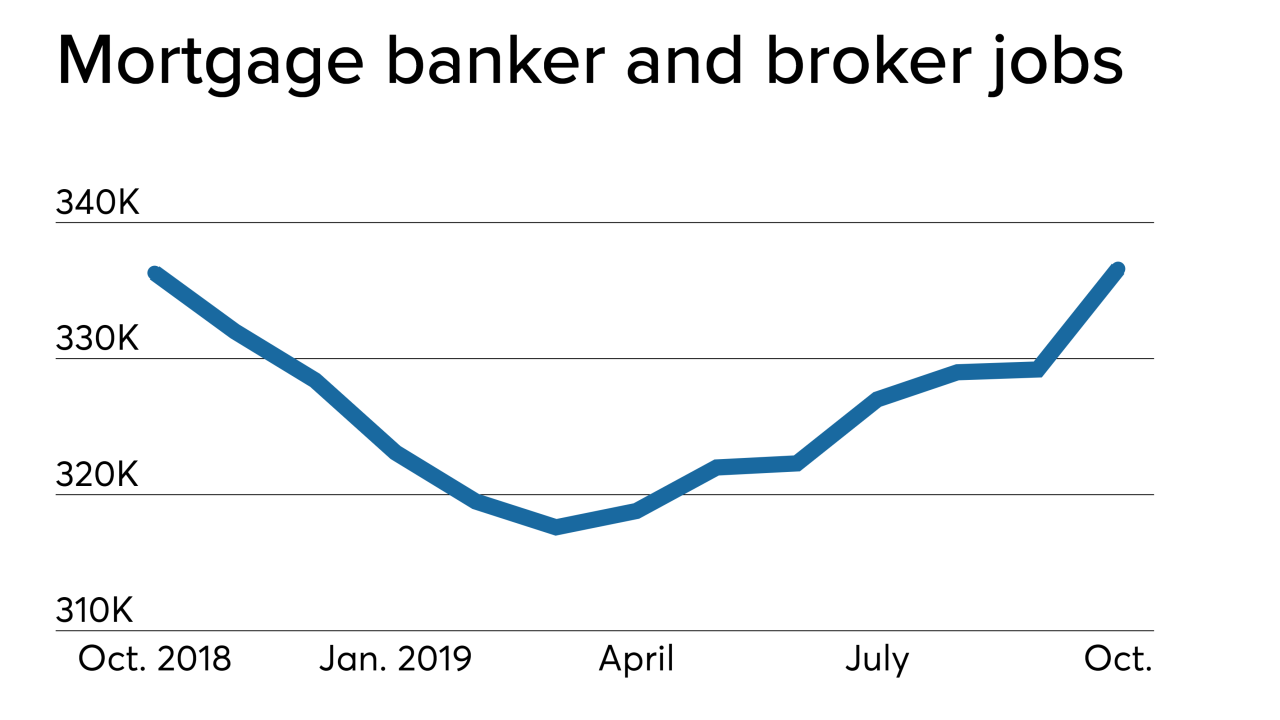

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

Mortgage-bond investors will need to absorb about 26% more agency MBS supply in 2020 as both home sales and prices continue to climb, according to the average estimate of six of Wall Street's biggest dealers.

December 5 -

Connecticut single-family home sale prices in October reached their highest level in 12 years for the month, a bit of welcome news in a housing market that is looking for a boost in a decade-plus recovery.

December 5 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

The vision underpinning the American dream — of fresh-faced young people buying a first home with a white-picket fence — hasn't held up well.

December 4 -

If Denver-area buyers were expecting a bounty of homes to choose from this holiday season, they are going to be sorely disappointed. Sellers are playing the grinch as 2019 draws to a close.

December 4 -

Purchase mortgage application activity is at its highest level since this summer on a seasonally adjusted basis, and should remain strong in December, according to the Mortgage Bankers Association.

December 4 -

The Huntsville, Ala., housing market continues strong with more homes sold in the third quarter of this year than the average for the same period throughout the decade.

December 4 -

Australia's property frenzy is back in full swing, with home prices surging the most in 16 years in November.

December 3 -

October's deceleration in housing values could be followed by acceleration in 2020, but a growing subset of millennials nevertheless plan to become homeowners in the new year, according to CoreLogic.

December 3 -

While the median price of sold homes increased again this year, the number of sales to date in Central Massachusetts is so far below the rate from last year.

December 3 -

Northeast Ohio home sales for the year are on track to outpace 2018 levels, and local real estate experts don't foresee any signs of a major slowdown in the coming months.

December 3 -

Loan defect risk in purchase applications stopped falling and plateaued in October, according to First American Financial Corp.

December 2 -

U.K. house prices increased at their fastest pace in more than a year this month, according to Nationwide Building Society.

December 2 -

Home sales entered the fourth quarter stronger than last year here, up nearly 5%, and the median price was also surging, ending October at $179,000, according to the Oklahoma City Metro Association of Realtors.

December 2