-

Meanwhile, nearly half of consumers are more worried about severe weather now compared to five years ago, according to Realtor.com.

September 27 -

The government-sponsored enterprise also expects purchase and refinancing volumes to drop in 2022.

September 20 -

Last month’s housing market reversed a trend in purchases, but it wasn’t enough to stop the double-digit price growth, according to Redfin.

September 16 -

The fintech projects the Series C capital will enable $10 billion in annual housing transactions through its system and expansion to half the U.S.

September 14 -

August’s increase in that loan type drove refinancings to take up a slim majority share of origination volume for the first time since February, according to Black Knight.

September 13 -

A rising — but still small — share of borrowers believe interest rates and housing price appreciation will fall in the next year, according to Fannie Mae.

September 7 -

Meanwhile, property values across the U.S. have increased for 40 quarters in a row, according to the Federal Housing Finance Agency.

August 31 -

Local mortgage lenders give their boots-on-the-ground perspectives about the ZIP codes with 2021’s shortest list-to-sale times, according to Realtor.com.

August 27 -

Record high price growth and the dearth of housing inventory left the majority of consumers anxious about the market, a survey finds.

August 23 -

Measuring factors from affordability to quality of life, local lenders give insights to the top metro areas for new buyers, according to WalletHub.

August 20 -

Purchase activity dominated the period and experienced the most growth while refinances cooled off and home equity lines of credit made a comeback, according to Attom Data Solutions.

August 19 -

Despite home supply recovering and sales slowing, properties spent the least amount of time on the market since at least 2009, according to Remax.

August 17 -

The new all-in-one brokerage aims to avoid the "one-size-fits-all approach,"Rocket Homes CEO Doug Seabolt said.

August 12 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

The company’s $204 million in net income was down from unusual highs seen recently but still historically strong thanks to the balance between its loan channels and servicing operation, representatives said.

August 6 -

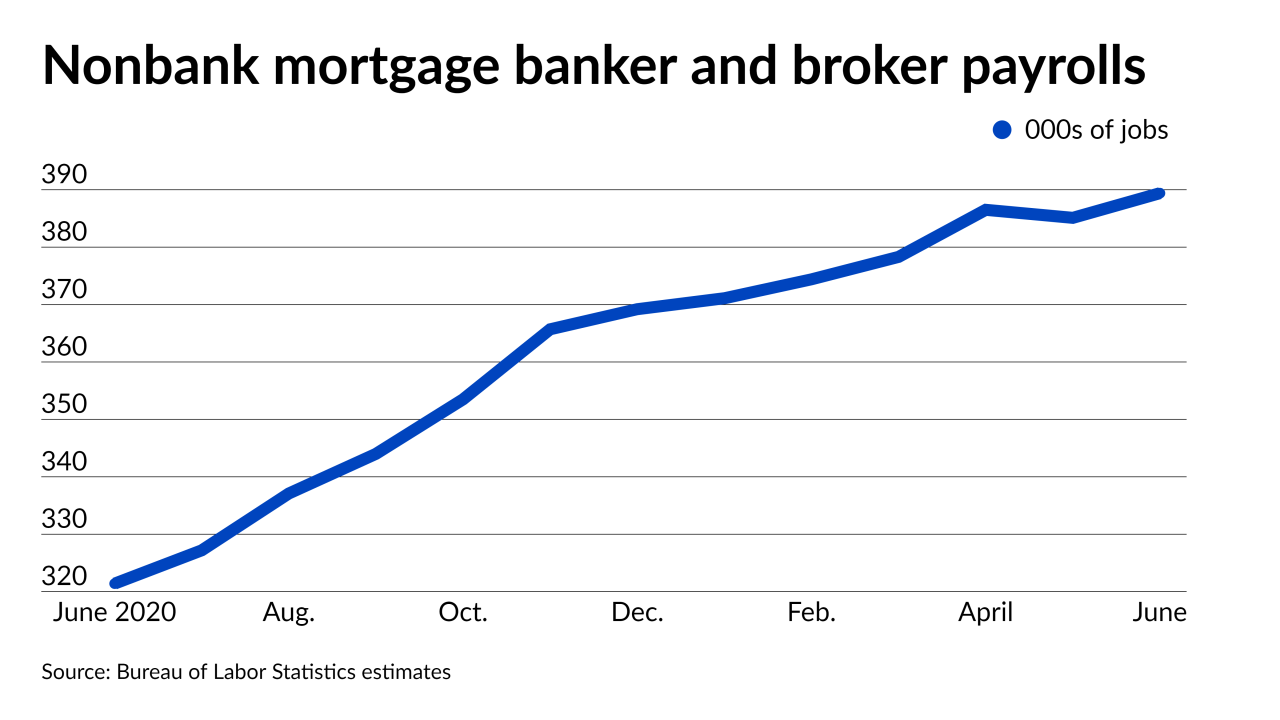

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

A ClimateCheck score measures the risk of disaster at the zip-code level over the period of a 30-year mortgage.

August 4 -

The gulf between buyer demand and the amount of listings for sale drove housing values to a six-decade peak, according to CoreLogic.

August 3 -

The company's Series A funding round, led by Sequoia Capital, added $165 million in capital, which will allow it to expand its home buying operations into more states.

July 27 -

The average mortgage borrower has gotten a hometown discount when buying a property, as the rise of remote work allowed for migration away from large metropolitan areas, according to a Redfin report.

July 26