-

Growth in loans with higher debt-to-income ratios is reviving focus on a regulatory exemption for Fannie Mae, Freddie Mac and other federal agencies that back mortgages.

November 3 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

Cannabis businesses are legal in 29 states, but compliance questions on the federal level are keeping mortgage lenders from making loans to the industry's workers.

October 23 -

The Consumer Financial Protection Bureau set its 2018 thresholds for high-cost mortgages regulated under the Home Ownership and Equity Protection Act.

August 31 -

American International Group is accessing the securitized market through a Credit Suisse deal backed by loans that were generally originated less than a year after TRID.

June 21 -

The Treasury plan includes a slew of items that don’t require Congress to act, and appear feasible in the short term. Here's a guide to what changes could be made.

June 13 -

The House passed a bill that assigns Qualified Mortgage status to loans that banks hold in portfolio.

June 9 -

JPMorgan Chase is marketing another offering of bonds backed by a mix of conforming and jumbo residential mortgages, according to Moody's Investors Service.

May 19 -

Nexera Holding, which has operated as an online lender under the name Newfi, is applying that branding to the company as a whole.

May 15 -

While consumers pay for mortgage insurance policies, carriers like Arch MI are forging new relationships with real estate agents and strengthening lender partnerships to reach the growing segment of millennial and low-to-moderate-income homebuyers.

May 9 -

Risk management concerns were responsible for a five-percentage-point reduction in bank non-qualified mortgage lending last year.

March 31 -

Home affordability is near lows last seen post-crisis but there is hope wage growth that is outpacing home prices in many counties could reverse or slow the trend.

March 30 -

Banks are stepping up their efforts to win a key exception to the Consumer Financial Protection Bureau's "Qualified Mortgage" rule.

March 13 -

New Residential Investment Corp. is readying an offering of bonds backed by both reperforming and nonperforming mortgages.

March 2 -

Redwood Trust is back with its second offering of residential mortgage bonds in less than a month, according to Kroll Bond Rating Agency.

February 2 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

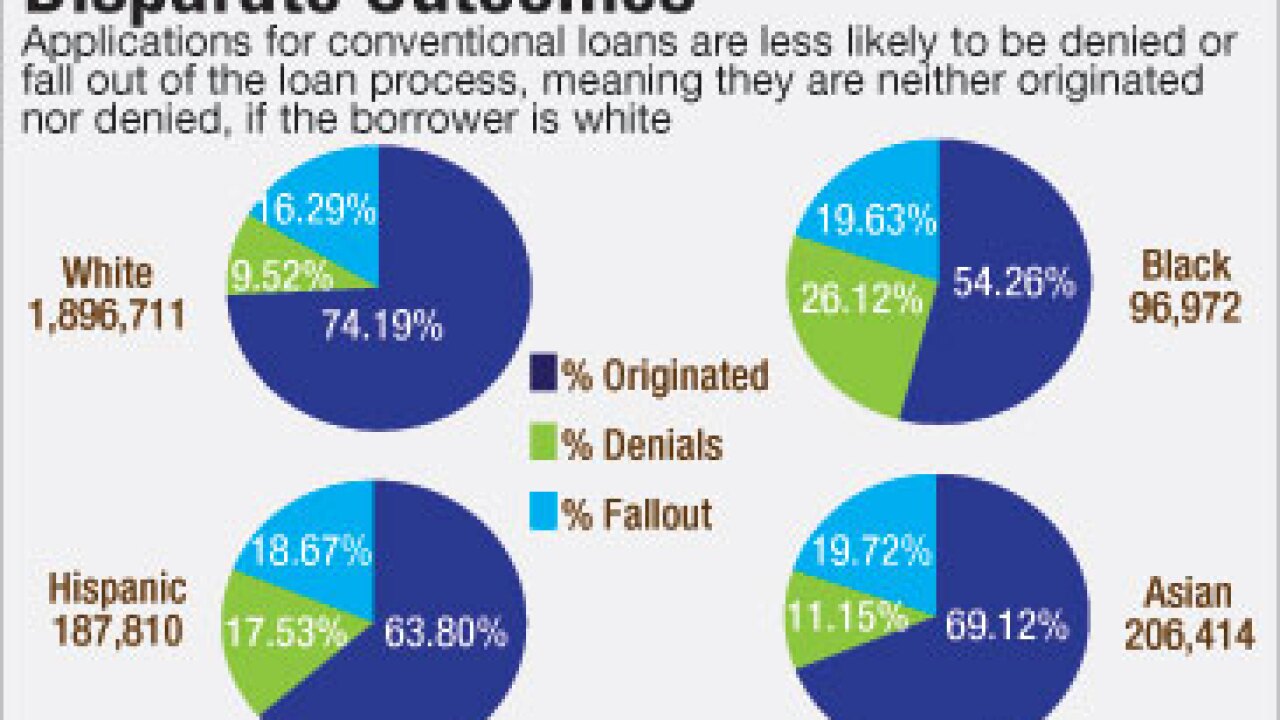

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Rising interest rates typically squelch demand for refinancing, leaving lenders to compete for homebuyers' business. But plain-vanilla purchase loans aren't the only saleable products in this rising-rate environment. Here are five other products likely to find demand.

December 27 -

Industry forecasts for 2017 mortgage volume assumed a continuation of current housing and economic policies under a Hillary Clinton administration. But with Donald Trump's win, analysts are sorting out what, if any, adjustments are needed to those projections.

November 11 -

Mortgage brokers were among the companies that received the regulator's warning letters, but brokers are not required to report HMDA data leading many to suspect mini-correspondents, which straddle the line between broker and lender, were the recipients.

October 28