-

Risk management concerns were responsible for a five-percentage-point reduction in bank non-qualified mortgage lending last year.

March 31 -

Home affordability is near lows last seen post-crisis but there is hope wage growth that is outpacing home prices in many counties could reverse or slow the trend.

March 30 -

Banks are stepping up their efforts to win a key exception to the Consumer Financial Protection Bureau's "Qualified Mortgage" rule.

March 13 -

New Residential Investment Corp. is readying an offering of bonds backed by both reperforming and nonperforming mortgages.

March 2 -

Redwood Trust is back with its second offering of residential mortgage bonds in less than a month, according to Kroll Bond Rating Agency.

February 2 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Rising interest rates typically squelch demand for refinancing, leaving lenders to compete for homebuyers' business. But plain-vanilla purchase loans aren't the only saleable products in this rising-rate environment. Here are five other products likely to find demand.

December 27 -

Industry forecasts for 2017 mortgage volume assumed a continuation of current housing and economic policies under a Hillary Clinton administration. But with Donald Trump's win, analysts are sorting out what, if any, adjustments are needed to those projections.

November 11 -

Mortgage brokers were among the companies that received the regulator's warning letters, but brokers are not required to report HMDA data leading many to suspect mini-correspondents, which straddle the line between broker and lender, were the recipients.

October 28 -

Lenders asking whether bank loans are safe are missing the point and should instead be more concerned with the standard they apply when underwriting them.

October 19 Offit | Kurman

Offit | Kurman -

Upcoming look-backs of key Dodd-Frank provisions like the Qualified Mortgage rule are unlikely to result in new regulatory changes. But any effort to revisit already-implemented rules should give cause for concern, legal experts warn.

October 18 -

To successfully respond to the most pressing challenges facing the mortgage industry right now, lenders and servicers must navigate issues of competition, governance, affordability and margins.

October 18 -

In some housing markets, the right combination of wages, home prices and rental market conditions makes owning a home a virtual no-brainer. Here's a look at the top markets with the largest affordability spread between owning and renting.

September 28 -

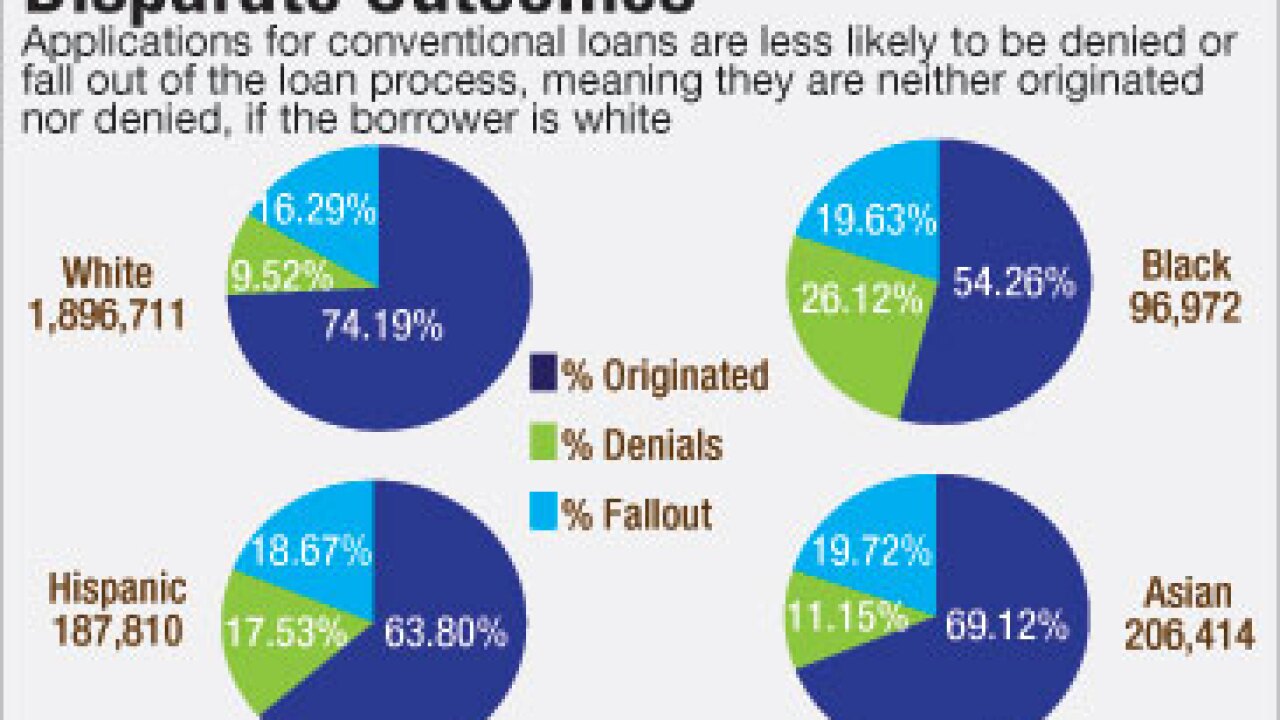

The mortgage industry is failing communities of color by not providing adequate access to conventional loan products, calling into question the future of the housing market and the nation's ability to turn the tide of rising wealth inequality.

September 22 Center for Responsible Lending

Center for Responsible Lending -

House Democrats made an unusual move this week to avoid offering amendments or engaging in debate over a massive financial reform bill. Here's why.

September 15 -

Many lenders are still reluctant to give mortgages to borrowers with less-than-pristine credit, yet such loans are far more likely than prime jumbo loans to be bundled into collateral bonds. Sreeni Prabhu of Angel Oak Capital credits banks' behavior and higher interest rates for that reality.

August 29 -

Angel Oak Capital's second securitization of nonprime residential mortgages brought its funding costs down significantly, helped by the addition of some new investors.

August 24 -

JPMorgan is taking a riskier route for its second jumbo mortgage loan securitization of 2016.

August 15 -

President Obama called for Fannie Mae and Freddie Mac to be eliminated, but Democratic policymakers attending the convention here appear resigned to the fact that Congress is unable to act on housing finance reform.

July 28