-

Quontic has rolled out a streamlined non-qualified mortgage refinance product that will not require the borrower to provide verifications or documentation.

February 19 -

Finance Minister Bill Morneau is relaxing mortgage qualification rules to make it easier for homebuyers to secure financing, a move that could give Canada's real estate market another boost.

February 19 -

Debt-to-income doesn't perfectly measure a borrower's likelihood of making timely mortgage payments, but it shouldn't be replaced as the ability-to-repay rule evolves, it should be made more flexible instead.

February 5 Platinum Home Mortgage Corp.

Platinum Home Mortgage Corp. -

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 3 -

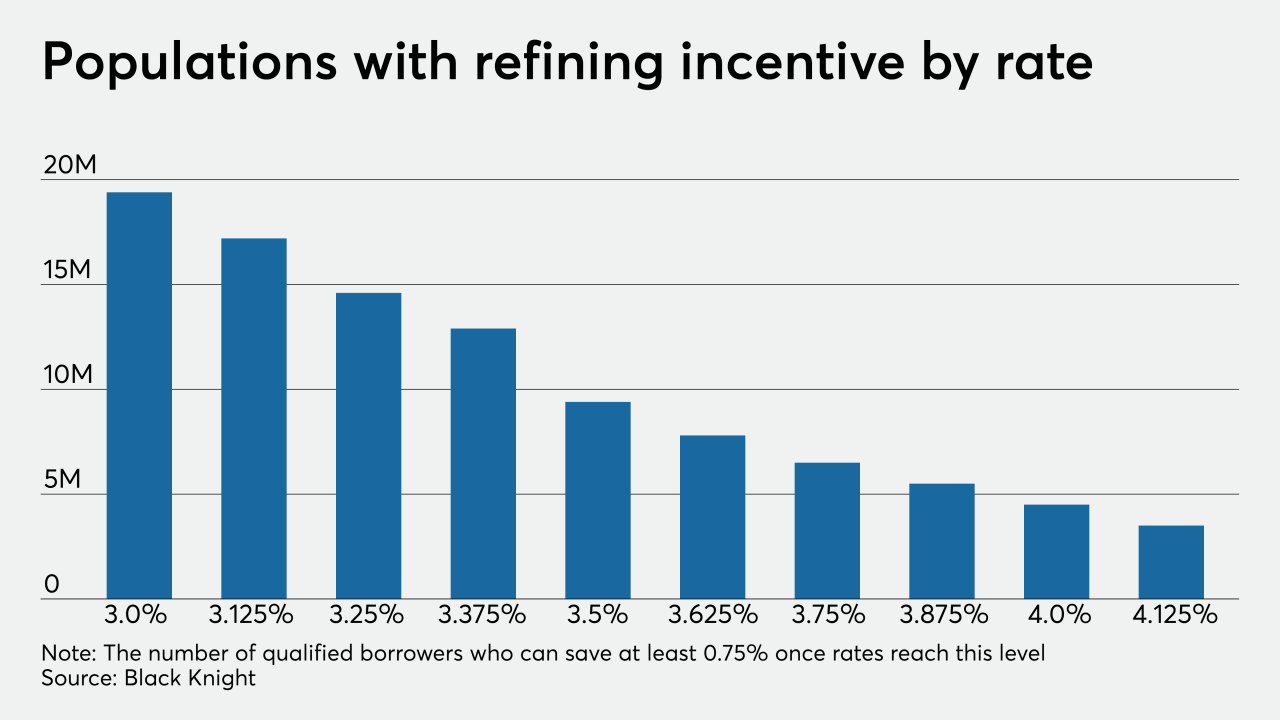

After being range-bound for several weeks, mortgage rates are fluctuating enough to spur significant changes in refi incentive, according to Black Knight.

January 29 -

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 24

-

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

JPMorgan Chase may be leading the next trend for banks seeking to shift risk away from their mortgage portfolios — if regulators give Wall Street the green light.

November 13 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

Impac Mortgage Holdings generated $1.4 million in net income during the third quarter in earnings that were favorable compared to a string of losses in the past year.

November 8 -

BSI Financial's chief executive weighs in on changes in the interest rate environment, the evolution of digital mortgage servicing and natural disasters.

October 21 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

Industry groups are calling on the consumer bureau to eliminate the debt-to-income limit for “qualified mortgages” and provide a short-term extension of special treatment for Fannie- and Freddie-backed loans.

September 24 -

The recapitalization of Fannie Mae and Freddie Mac prior to the 2020 election is unlikely even if the net worth sweep ends, according to a Keefe, Bruyette & Woods report.

September 23 -

Though advocates and industry are rarely aligned, they are starting to coalesce around a plan that would call for the elimination of the CFPB’s 43% debt-to-income limit as part of its qualified mortgage rule.

August 27 -

Angel Oak is now offering mortgage brokers and correspondent loan sellers a prequalification tool to determine borrower eligibility for non-qualified mortgages.

August 14