-

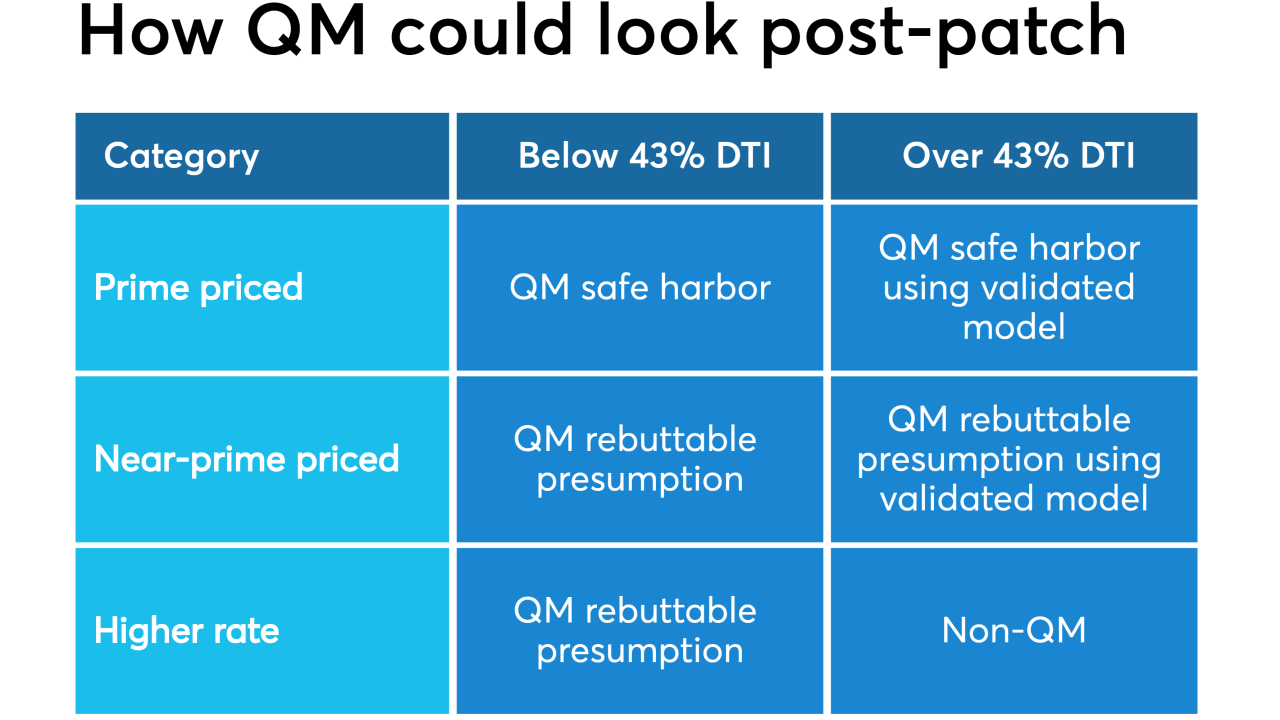

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

Alternative investment manager Pretium plans to buy Deephaven, a residential mortgage-backed securities issuer that operates outside the qualified mortgage market, from Varde Partners.

June 18 -

Guild Mortgage is targeting Airbnb hosts with its new refinance program, allowing them to use short-term rental income to qualify for a new loan on their owner-occupied primary residence.

June 14 -

A long list of "preparatory steps" means that any potential Fannie Mae and Freddie Mac initial public offerings are at least three to four years away, according to Raymond James.

June 6 -

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

May 28 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The market for non-qualified mortgages has been robust thus far in 2019, offering a pragmatic option for otherwise viable borrowers, as long as lenders stay vigilant about pushing the envelope too far.

May 17 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

The transaction represents one of the biggest mortgage-backed bond offerings of large-balance home loans this year — behind only Wells first prime jumbo RMBS in January.

May 8 -

A GSE exemption in the bureau’s “qualified mortgage” rule is set to sunset in 2021, and regulators should not try to extend it as some experts have suggested.

May 8 American Enterprise Institute

American Enterprise Institute -

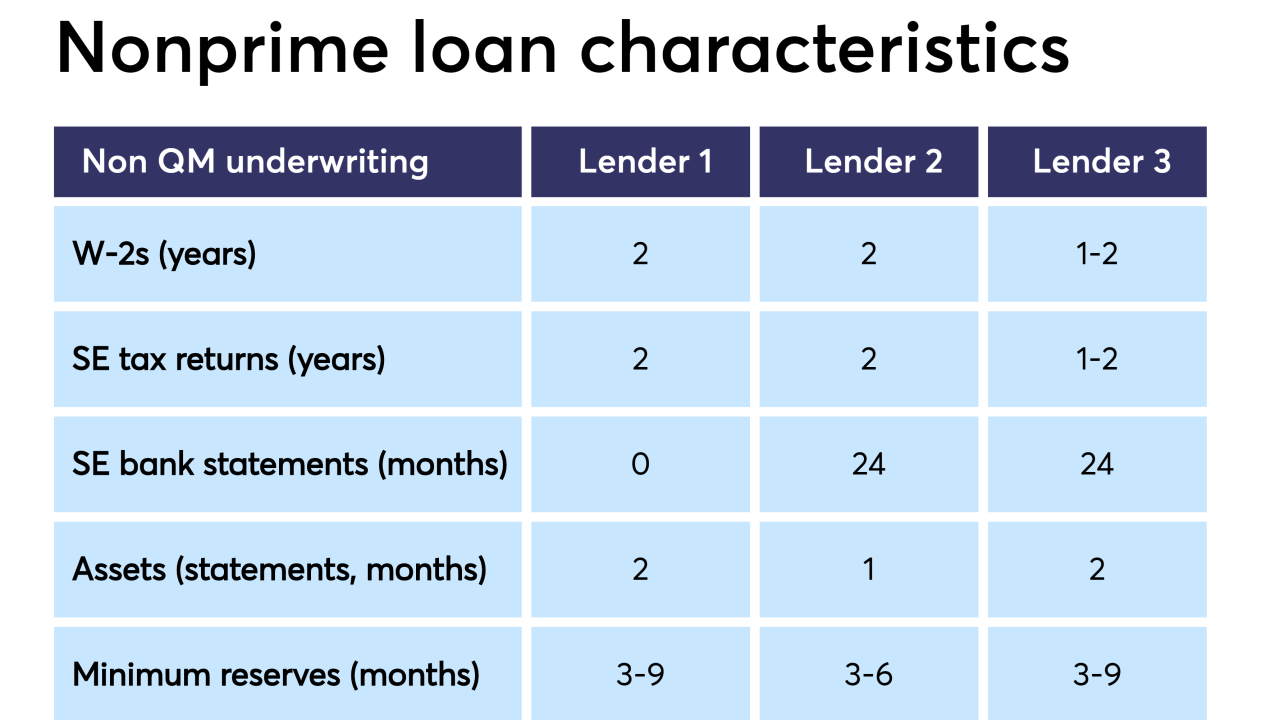

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

New FHFA Director Mark Calabria isn't just charting a future for Fannie Mae and Freddie Mac, but also fixing problems resulting from the "qualified mortgage" exemption for the GSEs and taking a "deep dive" into problems in the mortgage servicing market.

April 25 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

Impac Mortgage Holdings saw its shift to predominantly originate non-qualified mortgage loans reduce its fourth-quarter GAAP net loss along with increasing its gain-on-sale margins.

March 15 -

Absent some policy change, nearly a third of the loans backed by Fannie Mae and Freddie Mac could be in violation of the Consumer Financial Protection Bureau's Qualified Mortgage rule in two years.

February 4 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28